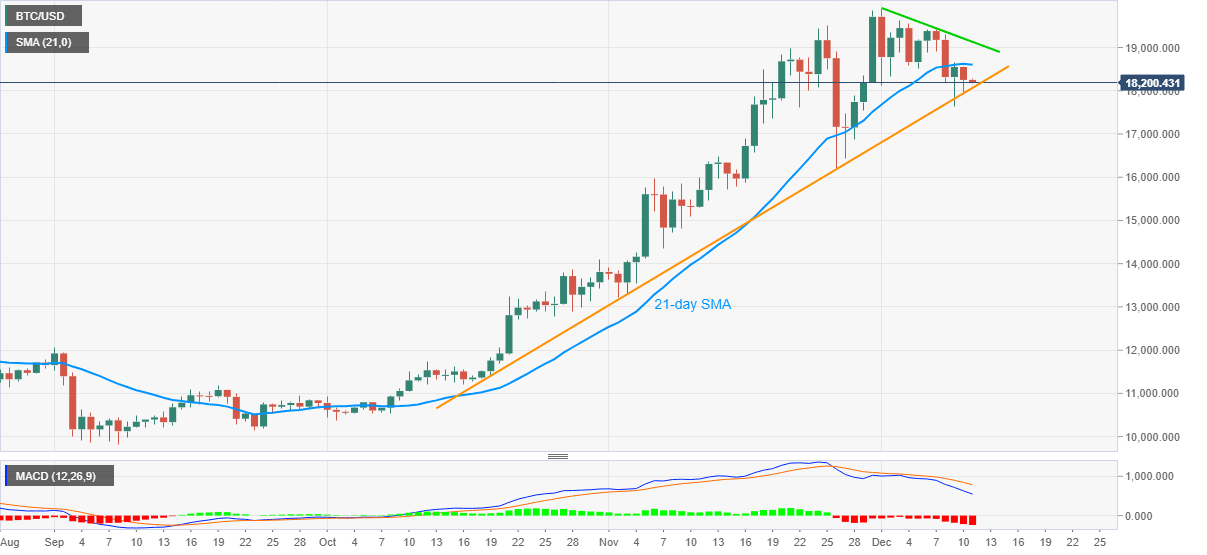

Bitcoin Price Prediction: BTC bears eye two-month-old support line amid losses below 21-day SMA

- BTC/USD stands on a slippery ground, fails to keep bounces off key support line.

- Sustained trading below 21-day SMA, bearish MACD favor sellers.

- Monthly falling trend line adds to the upside barrier.

BTC/USD holds lower ground, currently near the intraday low of 18,172, during early Friday. The crypto major marked the second failure to break an upward sloping trend line from October 09 the previous day. However, bearish MACD and extended weakness below the 21-day SMA favor the Bitcoin sellers.

Hence, further weakness towards the key support line, at 18,064 now, can’t be ruled out.

Though, any more downside past-18,064 will need validation from the 18,000 round-figures before eyeing the late-November lows around 16,210.

During the quote’s downside between 18,000 and 16,210, lows marked during November 22 and December 09, around 17,640/20, can offer breathing space to the BTC/USD bears.

Meanwhile, an upside break of 21-day SMA, currently around 18,600 will look to confront a falling trend line from December 01, at 19,131 now.

In a case where the BTC/USD bulls manage to dominate past-19,131, the monthly peak of 19,914 and the 20,000 psychological magnet will be in the spotlight.

BTC/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.