Bitcoin price hits $32K but derivatives metrics still show signs of weakness

Bitcoin price rallied 8.5% to recover the $32,000 level, but derivatives data shows pro traders still feel apprehensive.

There's no doubt that the last couple of months have been bearish for Bitcoin (BTC), but throughout this entire period, derivatives indicators have been relatively neutral. This could be because cryptocurrencies have a strong track record of volatility, and even 55% corrections from all-time highs are expected.

After two months of struggling to sustain the $30,000 support and finally losing it on July 20, the futures premium and options skew turned bearish. Even PlanB's stock-to-flow valuation model was not expecting prices below $30,000 for the current month. The model uses the stock-to-flow ratio, which is defined by the current number of Bitcoin in circulation and the yearly issuance of newly mined Bitcoin.

On-chain data is positive, but derivatives indicators are not

On-chain analytics show that the monthly average of 36,000 BTC withdrawn from exchanges is usually interpreted as accumulation. However, this superficial analysis fails to acknowledge the increased use of tokenized Bitcoin in decentralized finance (DeFi) applications.

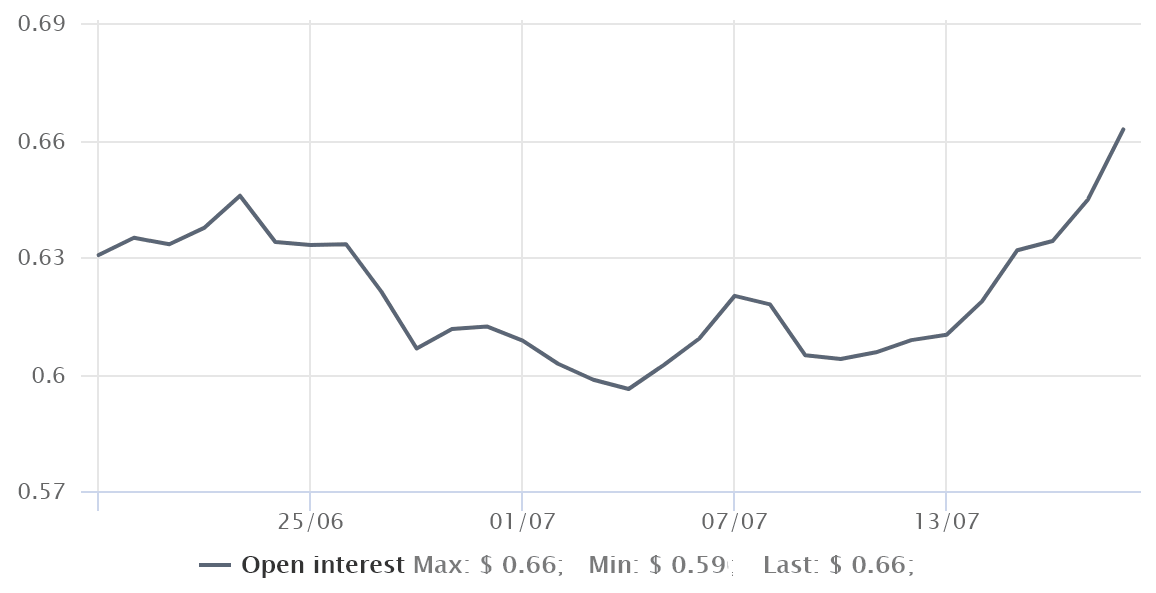

RenBTC and Wrapped BTC aggregate supply. Source: Cointrader.pro

The chart above shows that 40,660 BTC have been added to Wrapped Bitcoin (WBTC) and RenBTC (RENBTC) over the past three months. This number does not consider deposits at BlockFi, Nexo, Len and the multiple services that provide yield on user's cryptocurrency deposits.

Removing Bitcoin previously deposited on exchanges could be a sign that traders' intent to sell in the short term is reduced. Still, at the same time, it might also represent investors seeking higher returns in other avenues. In short, these coins might have been sitting on exchanges as collateral or as a long-term holding.

As previously mentioned, derivatives indicators flipping negative should hold more weight than assumptions on the bullish or bearish interpretation of on-chain data. In an initial analysis, analysts should review the futures contracts premium, which is also known as the basis.

This indicator allows investors to understand how bullish or bearish professional traders are because it measures the difference between monthly futures contracts and the current spot market price.

A neutral basis rate should be between 7% to 15% annualized. This price difference is caused by sellers demanding more money to postpone settlement, a situation known as contango.

However, when this premium fades or turns negative, this is a very bearish scenario known as backwardation. July 20 was the first time that the indicator sustained a negative 2.5% level for longer than twelve hours.

At the moment, professional traders are likely leaning bearish after Bitcoin lost the critical $30,000 support, but further confirmation can be gained from looking at options markets.

Pro traders are seeking protective put options

Unlike futures contracts, there are two different instruments in options. Call options provide the buyer with upside price protection, and the put option is a right to sell Bitcoin at a fixed price in the future. Put options are generally used in neutral-to-bearish strategies.

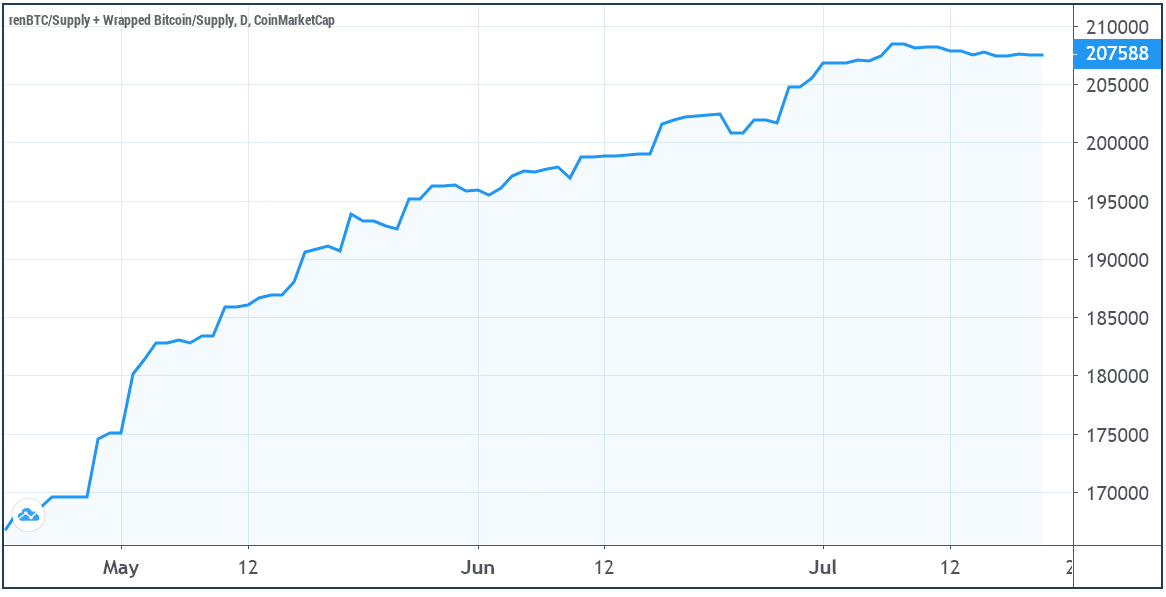

Bitcoin options put-to-call ratio. Source: Cryptorank.io

Whenever the put-to-call ratio increases, it means the open interest on these neutral-to-bearish contracts is growing, and it is usually interpreted as a negative signal. The most recent data at 0.66 still favors the call options, but these instruments gradually lose ground.

Currently, there's enough evidence of bearishness in the futures and options markets, and this hasn't been the case over the past two months. This suggests that even pro traders lack confidence after the $30,000 support failed to hold in the past 48-hours.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.

-637625035275938821.webp&w=1536&q=95)