Bitcoin Price Forecast: BTC/USD consolidates above $12,300, receives praise from former Prudential Securities exec – Confluence Detector

- George Ball, the chairman of Sanders Morris Harris, praised BTC in a recent interview.

- He said that Bitcoin is both a long-term safe haven and short-term speculative asset.

- Ball believes cryptocurrencies “can’t be undermined by the government.”

- The daily confluence detector shows a clear path to $13,000.

George Ball, the chairman of Sanders Morris Harris and a former chief executive of Prudential Securities, said that Bitcoin is a “safe haven” for investors and traders looking for an alternative investment. In a recent interview with Reuters, Ball noted that he was previously a “Bitcoin opponent.” However, with governments participating in the financial markets and stimulating them, he has realized the value of cryptocurrencies such as Bitcoin.

I’ve never said it before, but I’ve always been a blockchain and Bitcoin opponent but if you look now, the government can’t stimulate the markets forever. The liquidity flood will end and sooner or later the government’s got to start paying for some of this stimulus, for some of the deficits, for some of the well-deserved, very smart subsidies that it is providing to people.

According to Ball, the critical question is how the government plans to pay back the borrowed money.

Are they going to raise taxes that high or if not? Are they going to print money? If they print money that debases the currency and probably even things like TIPS, you know the Treasury Inflation-Protected Securities, can be corrupted. So the very wealthy investor or trader probably turns to Bitcoin or something like it as a staple.

Ball mentioned that Bitcoin is both a long-term safe haven and a short-term speculative asset. He also believes that more people will turn to cryptocurrencies as investments after Labor Day. The reason for investors choosing digital assets as an alternative investment is because they “can’t be undermined by the government,” according to Ball.

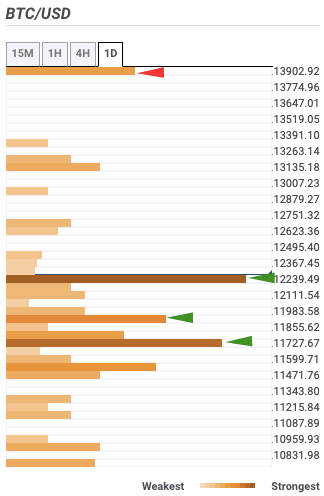

BTC/USD daily confluence detector

BTC/USD bulls continue to consolidate their prices above the $12,300-level, having taken the price up from $12,303 $12,334. The daily confluence detector gives the buyers free rein to bring the price up to the $13,000-level. There is notable resistance at $13,100, which has the Previous Year high.

On the downside, we have support levels at $12,300, $11,900 and $11,750. The $12,300-level has the one-week and one-month Pivot Point resistance-one. Up next, the $11,900-level has the one-day Pivot Point support-one, one-week Fibonacci 23.6% retracement level. Finally, the $11,750-level has the one-day Fibonacci 61.8% retracement level and one-day SMA 5.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.