Bitcoin Price Forecast: BTC steadies near $103,000, risks deeper fall

- Bitcoin price steadies above $103,000 on Thursday after rebounding from a key support level the previous day.

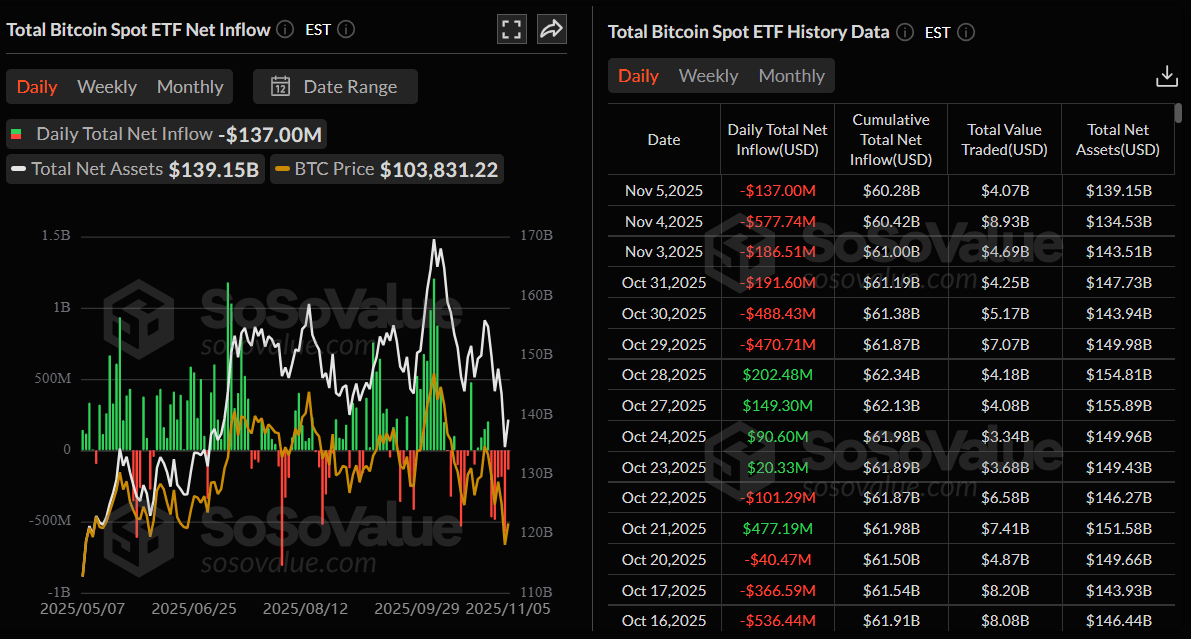

- Institutional demand continues to weaken with spot ETFs recording $137 million outflows on Wednesday, extending their streak since October 29.

- On-chain data highlights that BTC could correct deeper if the $100,000 psychological mark fails to hold as support.

Bitcoin (BTC) price remains steady around $103,000 at the time of writing on Thursday after rebounding from key support in the previous day. Despite the short-term recovery, concerns persist over weakening institutional demand, as spot Bitcoin Exchange Traded Funds (ETFs) recorded $137 million in outflows on Wednesday, extending their losses since October 29. Additionally, on-chain data indicates that BTC could face deeper downside pressure if the $100,000 psychological level fails to hold as support.

Weakening institutional demand for Bitcoin

Institutional demand for Bitcoin has continued to weaken so far this week. SoSoValue data shows that spot Bitcoin ETFs recorded an outflow of $137 million on Wednesday, following the largest single-day withdrawal since early August on Tuesday. The persistent outflow streak since October 29 indicates fading institutional confidence, which, if it continues, could deepen BTC’s price correction.

On-chain data warns of a deeper correction if $100,000 support breaks

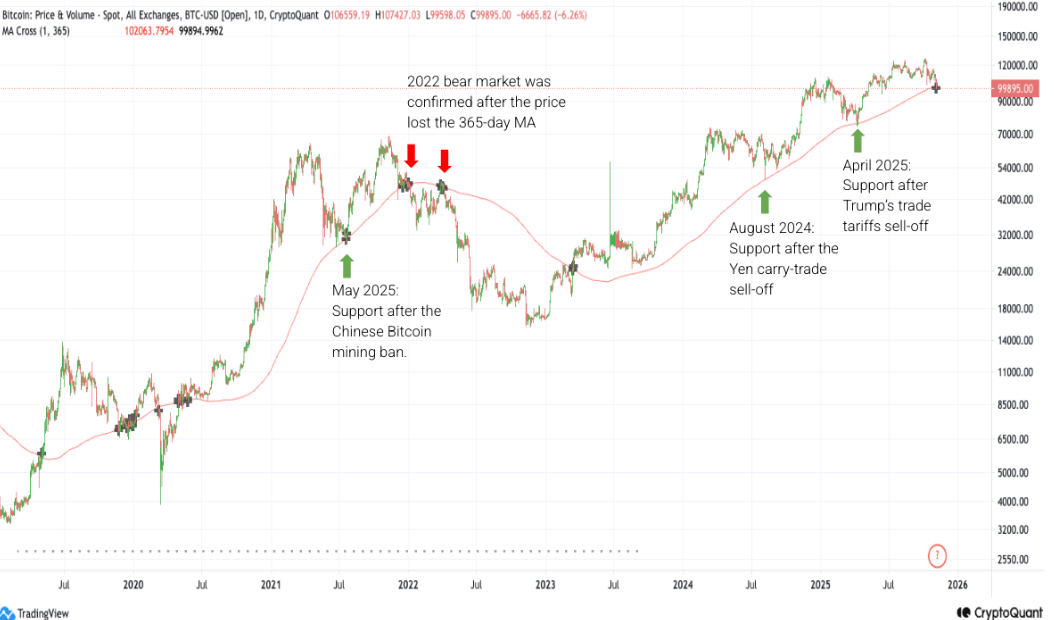

CryptoQuant’s weekly report on Wednesday highlighted that BTC’s fundamentals remain weak, with the price falling below $100,000 for the first time in months. The report added that BTC is now hovering near critical support levels, a breakdown of which could trigger a sharper market correction.

The graph below shows that Bitcoin’s price has declined below $100,000 for the first time since June 23 and is now below its 365-day Moving Average (MA) of $102,000, a key technical and psychological support level. The 365-day MA has served as the ultimate support level so far this bull cycle (green arrows) and was one of the last signals to trigger as the bear market began in December 2021 – January 2022. Failure to reclaim the 365-day MA soon could accelerate a deeper correction.

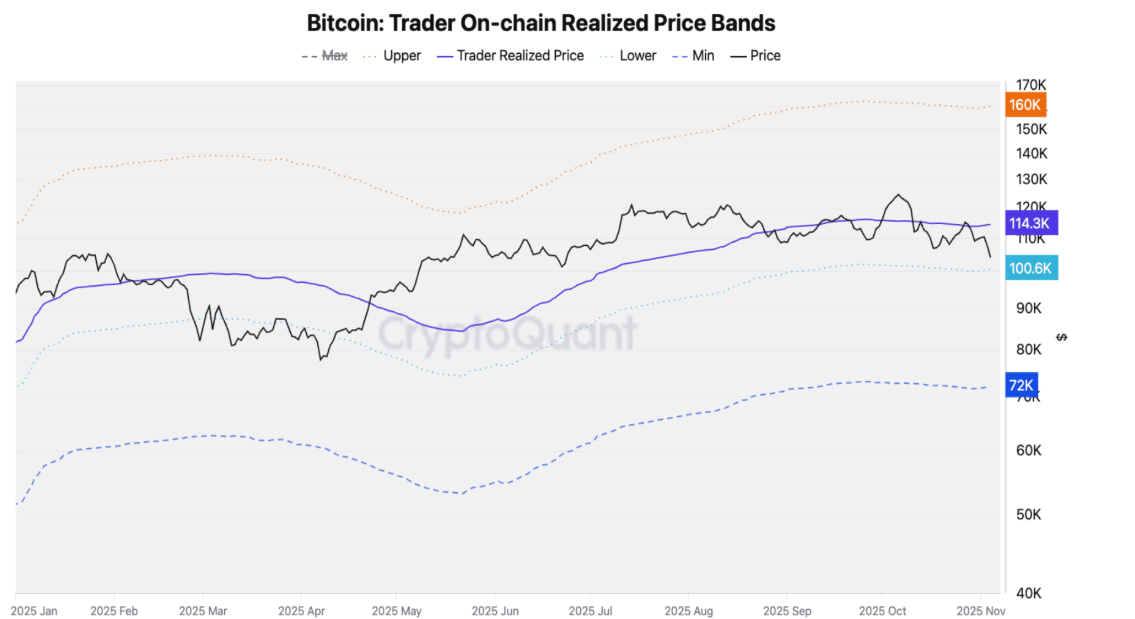

Throughout this bull cycle, the lower band ($100,000) has acted as support, as traders tend to sell and realize losses near this level, according to the Traders’ On-chain Realized Price Bands metric. However, if enough selling pressure builds, the next price support would be the Traders’ minimum price band, currently at $72,000.

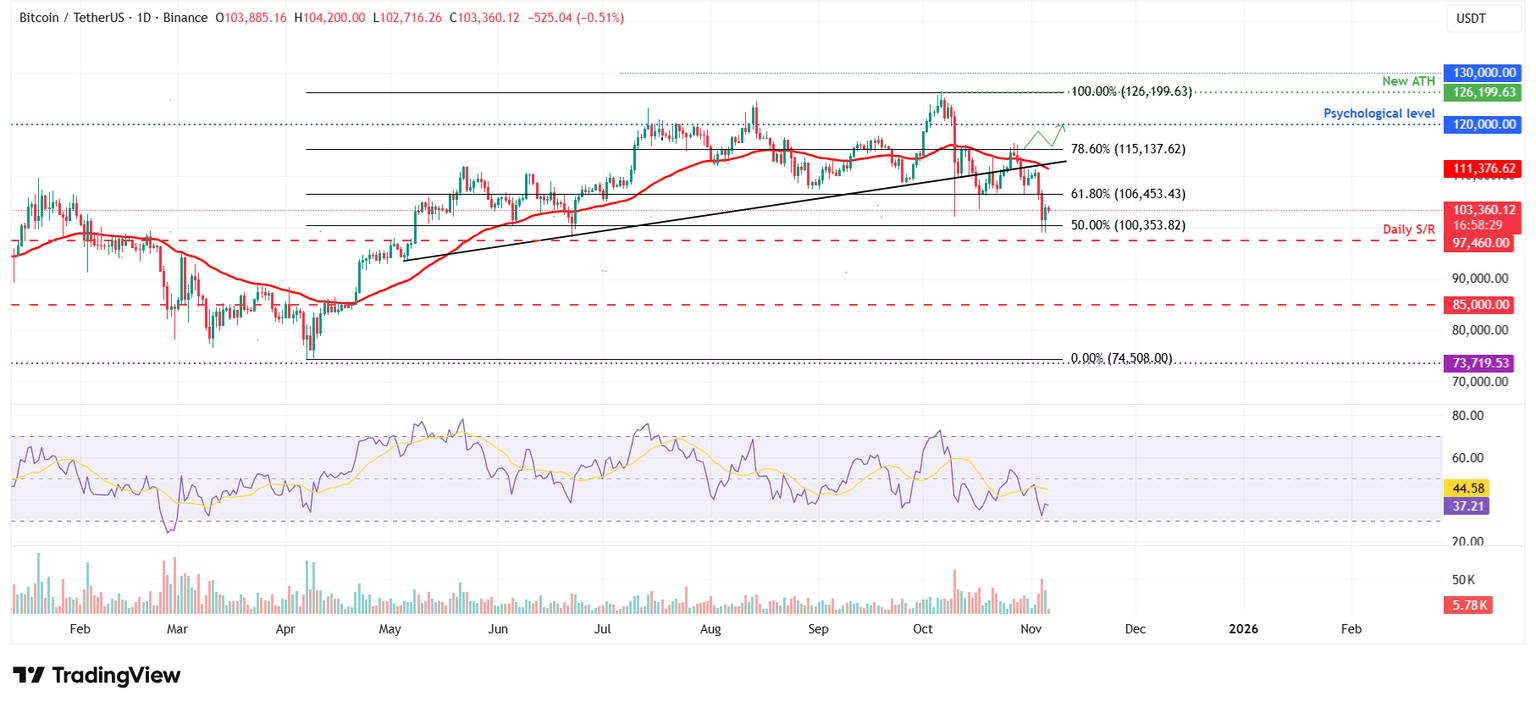

Bitcoin Price Forecast: BTC steadies after retesting key support

Bitcoin price faced rejection around its previously broken trendline on Monday and declined 8.18% until the next day, retesting the 50% retracement level at $100,353. However, on Wednesday, BTC recovered 2.35% after finding support around $100,353 level. At the time of writing on Thursday, BTC hovers at around $103,000.

If the 50% retracement level at $100,353 continues to hold as support, BTC could extend its recovery toward the next key resistance level at $106,435.

The Relative Strength Index (RSI) is 37, hovering slightly above the oversold territory, suggesting that selling momentum may be easing and that a potential short-term rebound could be on the horizon.

On the other hand, if BTC closes below the $100,353 support level, it could extend the decline toward the next daily support at $97,460.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.