Bitcoin Price Forecast: BTC struggles to fly despite clear skies up to $19,280

- Bitcoin price shows a double-top formation that could enable a bearish divergence soon.

- On-chain metrics suggest no resistance for BTC up to $19,280.

- A four-hour candlestick close below $15,894 will invalidate the bullish thesis.

Bitcoin price is struggling to overcome a small hurdle after a fresh start to the week. A closer look reveals that BTC could easily trigger a rally but is unable to do so despite a lack of resistance to the upside.

Bitcoin price in a pickle

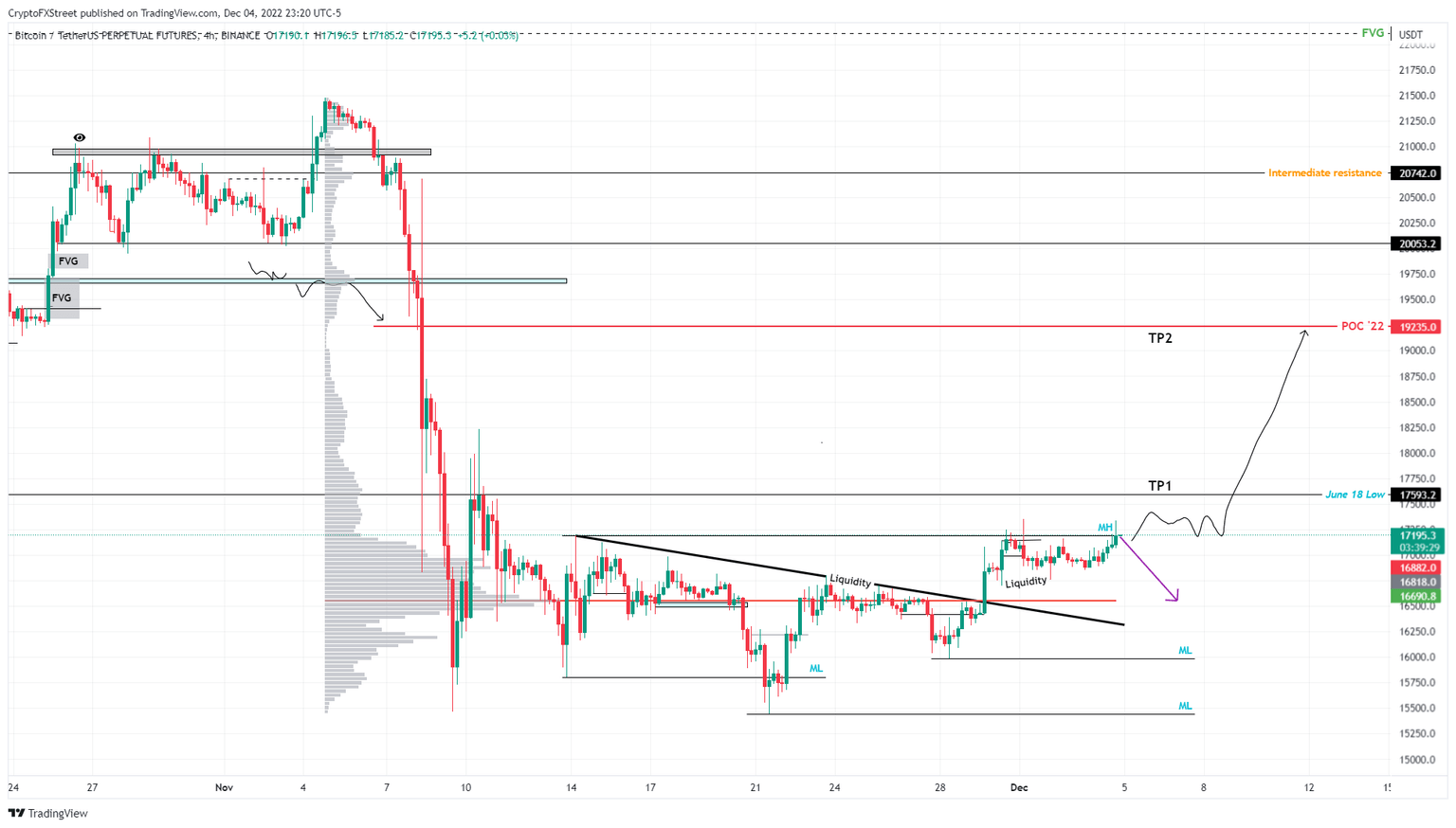

Bitcoin price reveals a noticeable struggle at the November 14 high of $17,188. Although this level was swept on December 1 and earlier today, the immediate reaction suggests that sellers remain active in this region.

If this trend continues, allowing four-hour candlestick closes to form a local top here, a bearish divergence would develop. This technical formation happens when Bitcoin price produces a higher high while the momentum indicator, the Relative Strength Index, sets up a lower high.

This non-conformity is indicative of a price appreciation without a strong foundation and often leads to a reversal in the uptrend. While this development might seem bearish in the short term, a retracement to $16,704 will allow sidelined buyers to accumulate BTC at a discount.

A resurgence of buying pressure at this level could trigger Bitcoin price to kick-start the next rally to retest important hurdles at $17,593 and $19,235. The latter level is called Point of Control (POC), which is the highest traded level in 2022 and is likely to provide a massive dose of selling pressure. Hence, this barrier is a good level to book profits.

BTC/USDT 4-hour chart

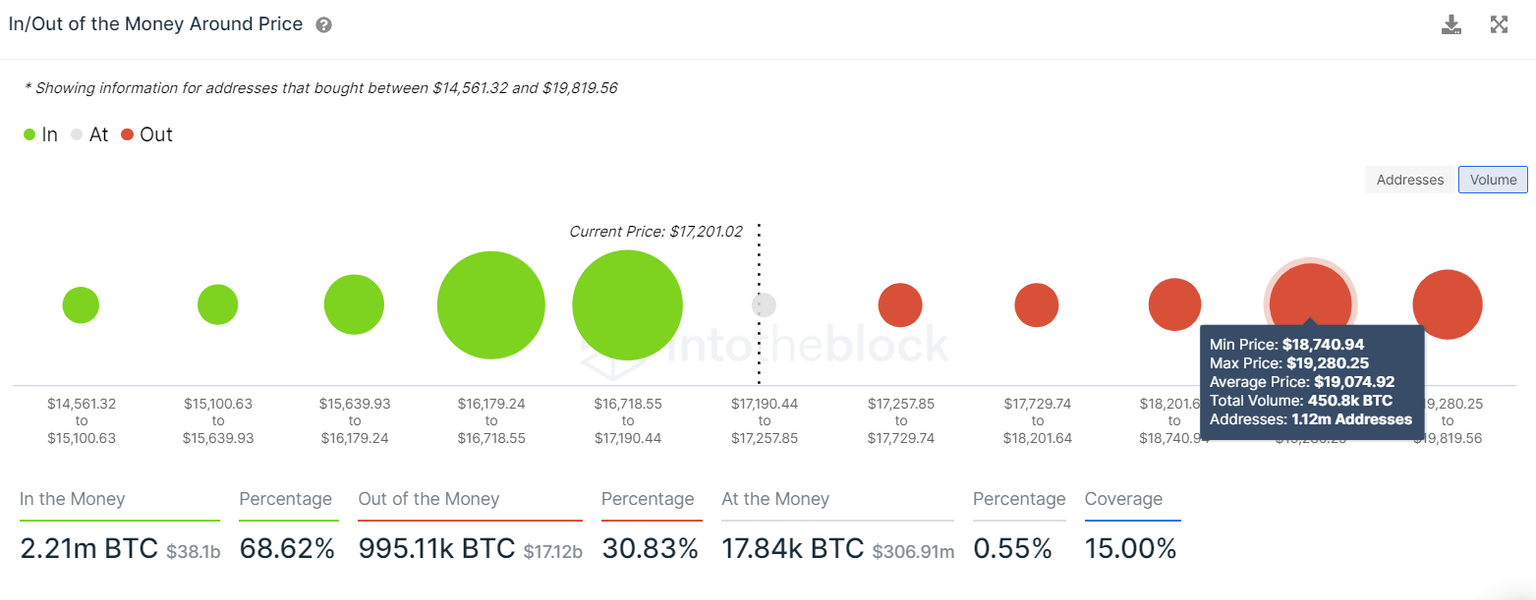

Supporting this run-up in Bitcoin price is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model. This index shows that the only formidable resistance level extends from $18,740 to $19,280. Here, roughly 1.12 million addresses that purchased 450,800 BTC are “Out of the Money.”

Interestingly, this level coincides with the POC discussed from a technical perspective, making it a good level to book profits.

BTC IOMAP

While the outlook for Bitcoin price is definitely bullish, investors should note that a retracement that extends beyond the $16,500 level is a sign of weakness. A four-hour candlestick close below $15,894 will create a lower low and invalidate the bullish thesis for BTC.

Such a development could see Bitcoin price pull back to the November 21 low of $15,443.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.