Bitcoin struggles below $50,000 amid rising Israel-Iran tensions and declining US economic activity

- Bitcoin price declines as US economic activity slows down.

- Genesis moves $1.5 billion in Bitcoin and Ethereum for creditors' repayments.

- Israel-Iran tensions rise, causing a decline in BTC.

- On-chain data shows no signs of a buy-the-dips scenario, 267,842 traders were liquidated for $1.02 billion.

Bitcoin's (BTC) price shows weakness on Monday, trading 12% lower at $50,898 at the time of writing, amid a slowdown in US employment as shown in the Nonfarm Payrolls (NFP) report for July published on Friday and rising Israel-Iran tensions. The situation was further impacted by bankrupt crypto lender Genesis moving $1.5 billion in Bitcoin and Ethereum for creditors’ repayments, with no signs of a buy-the-dip scenario from traders, who faced $1.02 billion in liquidations. This confluence of factors has led to a significant downturn in global markets, with Bitcoin prices dropping below $50,000 at the start of the week.

Daily digest market movers: Bitcoin drops as US economy slows down

- Recent US economic reports reveal rising unemployment and reduced business investments. July's unemployment rate surged to 4.3%, and Bitcoin's price has since crashed below $50,000, reflecting a broader downturn in the crypto market.

- In the ongoing Gaza conflict, the brink of a potential "World War 3 teaser" has emerged due to rising tensions between Israel and Iran, sparked by the assassination of Hamas leader Ismail Haniyeh in Tehran. This escalation has led to a significant downturn in global markets, with Bitcoin prices plummeting below $50,000 on Monday.

BREAKING: Israel is preparing for a multi-day attack by Iran and Hezbollah - NBC pic.twitter.com/RFrgmVmd7k

— Radar (@RadarHits) August 4, 2024

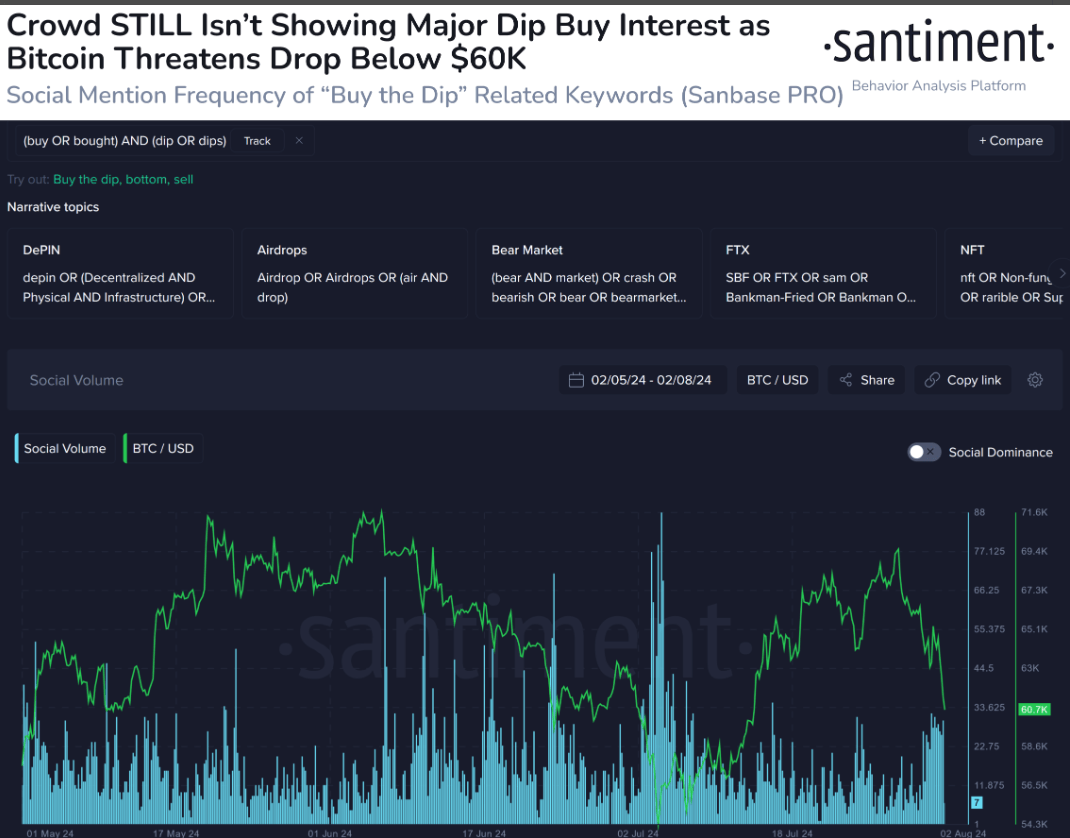

- Santiment's data indicates that the current fall in Bitcoin and Ethereum is similar to the decline in early July, but there is a noticeable lack of enthusiasm for buying the dip. Traders might start showing interest if Bitcoin approaches $50,000 or Ethereum hits $2,000, which are key psychological levels.

Bitcoin Santiment Social chart

- According to Arkham Intelligence showed on Friday, the bankrupt crypto lender Genesis transferred $1.5 billion in Bitcoin and Ethereum to repay creditors, a move likely fueling Fear, Uncertainty, and Doubt (FUD) among traders and contributing to Bitcoin's recent price decline.

BREAKING: GENESIS MOVING $1.5B BTC + ETH FOR CREDITOR REPAYMENTS

— Arkham (@ArkhamIntel) August 2, 2024

Wallets linked with Genesis Trading have moved 16.6K BTC ($1.1B) and 166.3K ETH ($521.1M) in the past hour - likely for in-kind repayments to creditors.

BTC: bc1qmetf6pu6ghr6fv92209sw5x9t5999562t8wmux

ETH:… pic.twitter.com/5Jtxqx8mxT

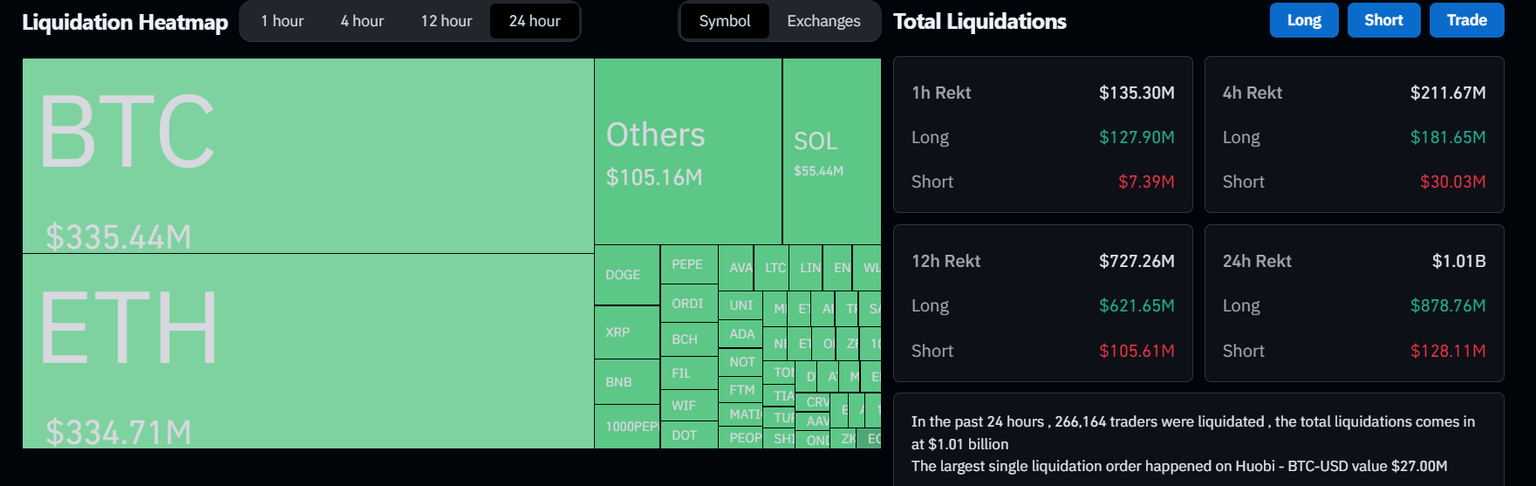

- According to the Liquidation Heatmap chart from Coinglass, in the past 24 hours, 267,842 traders were liquidated, for a total of $1.02 billion. The largest single liquidation order happened on Huobi—BTC/USD, valued at $27 million. If BTC continues to decline, more traders will be liquidated, fueling Fear, Uncertainty, and Doubt (FUD) among traders.

Liquidation Heatmap chart

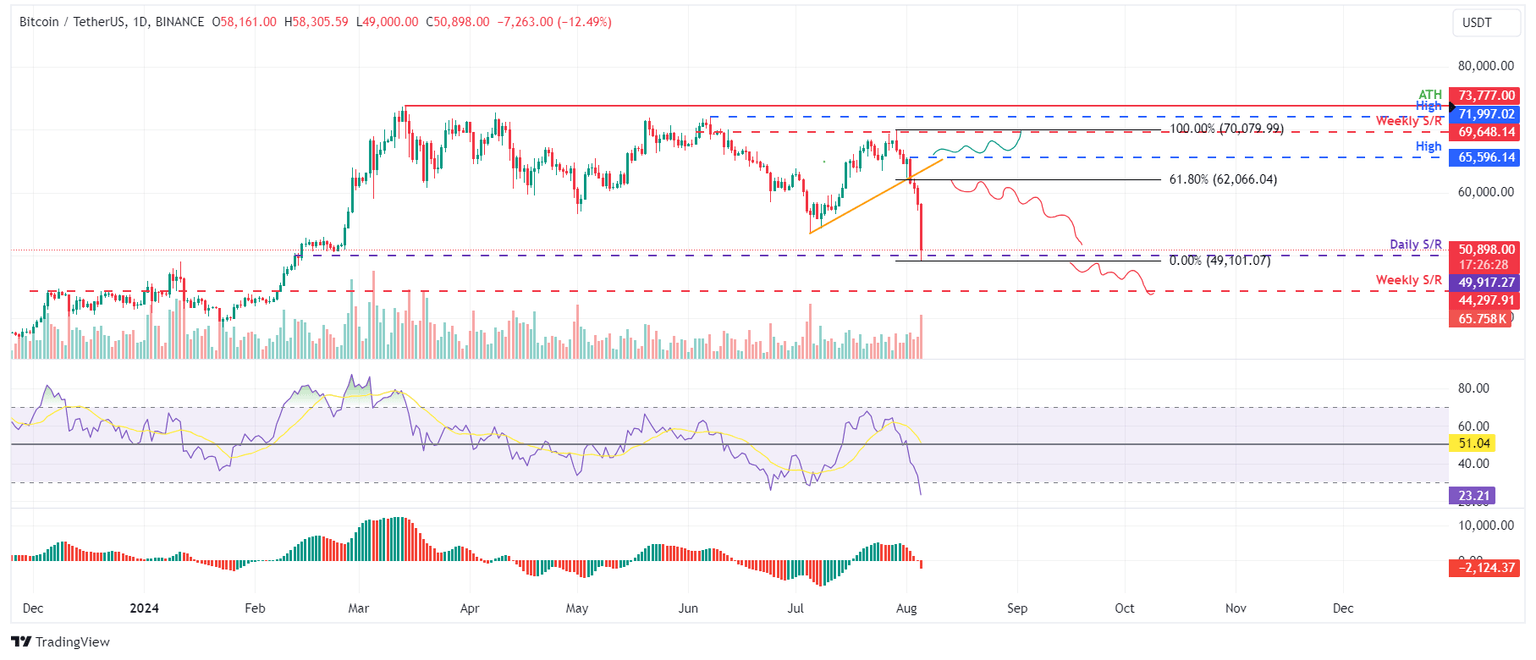

Technical analysis: BTC shows weakness as it breaks below the ascending trendline

Bitcoin's price fell below the ascending trendline (drawn by joining multiple swing lows from July 5) on Friday, leading to a 5.6% decline over the next two days. As of Monday, it is trading 12% lower at $50,898, having tested the daily support level at $49,917.

If BTC closes below the daily support at $49,917, it could continue to crash 11% and retest its weekly support at around $44,297.

The Relative Strength Index (RSI) and the Awesome Oscillator on the daily chart have dropped below their neutral levels of 50 and zero, respectively, signaling a bearish trend according to these momentum indicators.

BTC/USDT daily chart

However, a close above the August 2 high of $65,596 would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 6% rise in Bitcoin's price to retest its weekly resistance at $69,648.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.