Bitcoin price bounces at $36.7K as FUD over a new China crackdown fades in minutes

The best efforts of mainstream media to spark another price crash fail as BTC/USD rebounds after a mere 10% drop.

Bitcoin (BTC) saw a fresh price dip on May 21 amid reports that China had reiterated its pledge to crack down on mining and trading.

BTC/USD 1-minute candle chart (Bitstamp). Source: TradingView

China and Bitcoin: Old news

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD shed 10% in minutes on Friday as mainstream media turned up the volume on familiar bad news.

The pair had recently regained $42,000 after a record-breaking recovery from a $30,000 dip on Wednesday, with the latest concerns erasing some of its progress.

These focused on a Chinese government statement that revealed plans to "crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risk."

As Cointelegraph reported, China had already reiterated its plans to control cryptocurrency activities within its jurisdiction, but media sources had taken comments from officials as a threat to the industry. With no official changes in policy coming on Friday either, commentators were likewise quick to lay the blame on those spreading bad publicity.

Research had previously shown that the Bitcoin network is resilient to changes in conditions, with a loss of mining power in one location soon compensated elsewhere.

In a separate development, regulators in Hong Kong were planning to ban retail trading of cryptocurrency — with an exception for millionaires.

At press time, Bitcoin was already rebounding from local lows of $36,680.

Market resilience solidifies

More broadly, the impact of negative news had slowed following the $30,000 dip, potentially due to the market now being cleansed of overleveraged traders.

A tweet from Tesla CEO Elon Musk further criticizing its energy consumption on Thursday had likewise failed to cause the same shock as the first last week.

"Bitcoin hashing (aka mining) energy usage is starting to exceed that of medium-sized countries. Almost impossible for small hashers to succeed without those massive economies of scale," he had claimed.

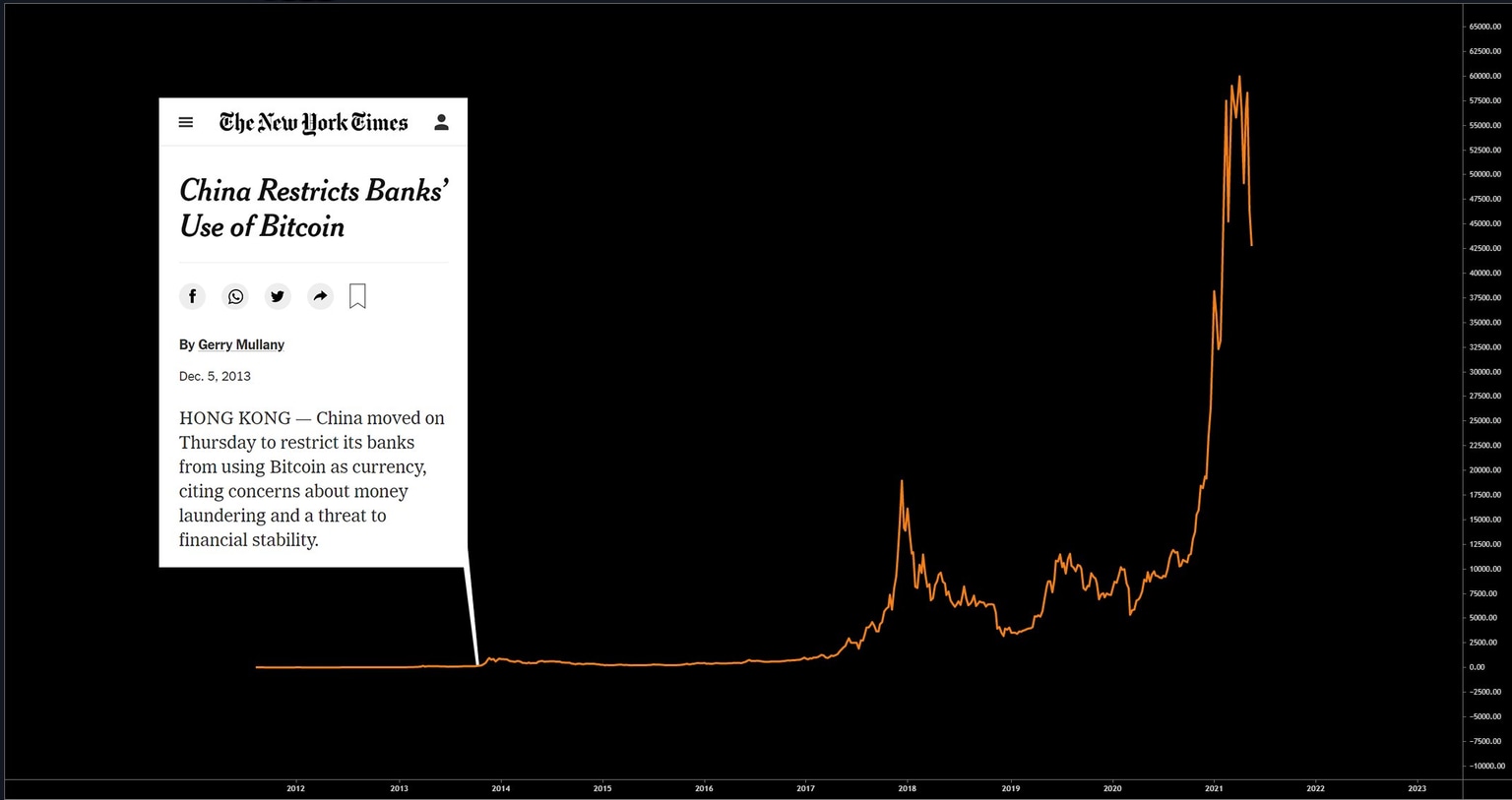

BTC/USD chart with Chinese press activity highlighted. Source: Documenting Bitcoin/ Twitter

Meanwhile, popular Twitter account Documenting Bitcoin became the latest to highlight the uncanny bullish consequences of Chinese "FUD" surrounding Bitcoin. BTC/USD tends to see its biggest gains in the period following a round of doomsday noises from Beijing.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.