Bitcoin Price Analysis: BTC/USD may retest $10,000 during US hours – Confluence Detector

- Bitcoin's recovery is gaining traction on Thursday.

- The psychological target of $10,00 is within reach.

Bitcoin price has gained over 6% on a day-to-day basis and 4% since the start of Thursday. The first digital coin hit the intraday high of $9,944 and retreated t0 $9,720 by the time of writing. The further recovery is capped psychological $10,000, which is still a hard nut to crack for Bitcoin bulls. This barrier prevents BTC from moving towards $10 500. Once it is cleared, the recovery may start snowballing.

While the short-term momentum remains bullish, the RSI on the intraday charts has shown signs of reversal, which means, the coin may stay range-bound in the nearest future.

BTC/USD 4-hour chart

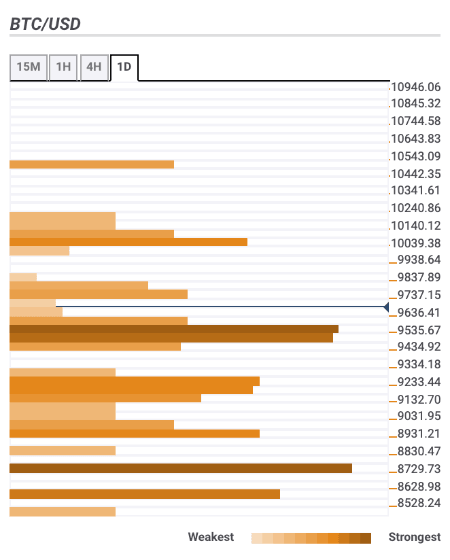

Let’s have a closer look at support and resistance levels clustered around the current price.

Resistance levels

$9,800 – the highest level of the previous hour, the upper line of the 15-min Bollinger Band, Povit Point 1-day Resistance 2

$10,000 – psychological level, Pivot Point 1-month Resistance 1

$10,500 – Pivot Point 1-week Resistance 1

Support levels

$9,500 –38.2% Fibo retracement weekly, the middle line of the 1-hour Bollinger Band

$9,200 –1-hour SMA200, 4-hour SMA50, daily SMA10

$9,100 – SMA100 on 1-hour and 4-hour charts, Pivot Point 1-week Support 1

Author

Tanya Abrosimova

Independent Analyst

-637250672137766091.png&w=1536&q=95)