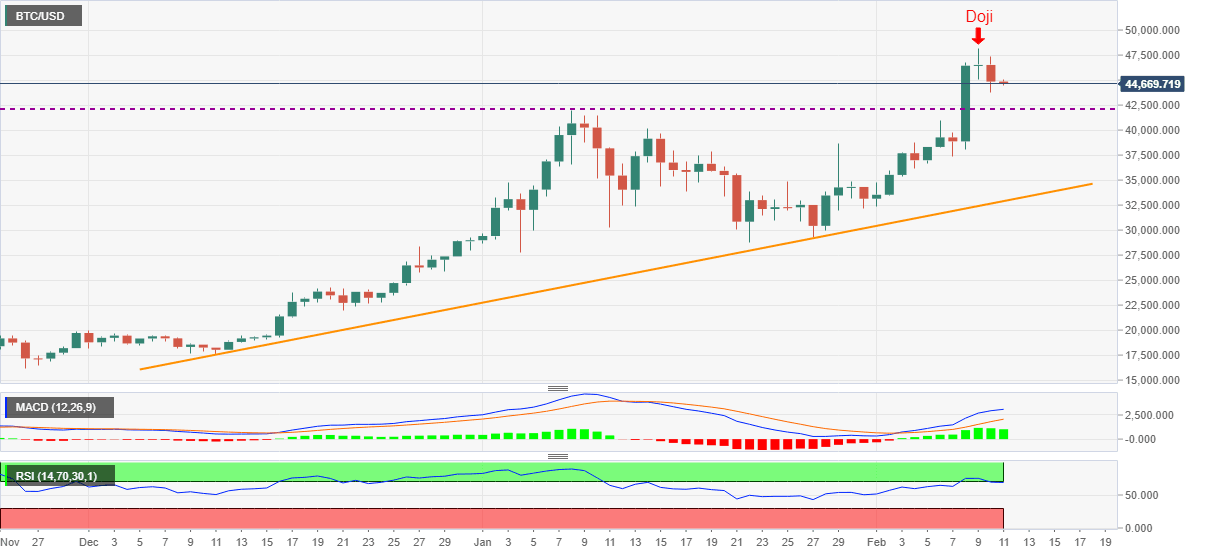

Bitcoin Price Analysis: BTC pullback eyes former resistance-turned-support around $42,000

- BTC/USD holds lower ground near three-day low, keeps corrective moves from record top.

- Overbought RSI, doji on the record top keeps short-term sellers hopeful.

- Two-month-old support line adds to the downside filters.

BTC/USD takes rounds to $45,000 during the early Thursday’s trading. In doing so, the cryptocurrency major keeps consolidation of gains from the record top, marked on Monday, while teasing short-term bears.

Not only the bitcoin’s all-time high but overbought RSI and Tuesday’s Doji at the top also favor the risky sellers’ entry.

However, January’s top near $41,990 will be a test for the bears before they aim for an ascending trend line from December 11, 2020, currently around $32,900.

If at all the BTC/USD prices drop below $32,900, the yearly bottom surrounding $27,770 will be the key to watch.

Alternatively, $47,000 guards the cryptocurrency pair’s immediate upside ahead of directing the BTC/USD bulls to attack the latest all-time high of $48,200.

During the quote’s successful run-up beyond $48,200, the $50,000 psychological magnet will be in the spotlight.

BTC/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.