Bitcoin Price Analysis: BTC charts triangle breakdown as correction from record highs gathers steam

- BTC/USD threatens 100-HMA after correcting sharply from $34,800.

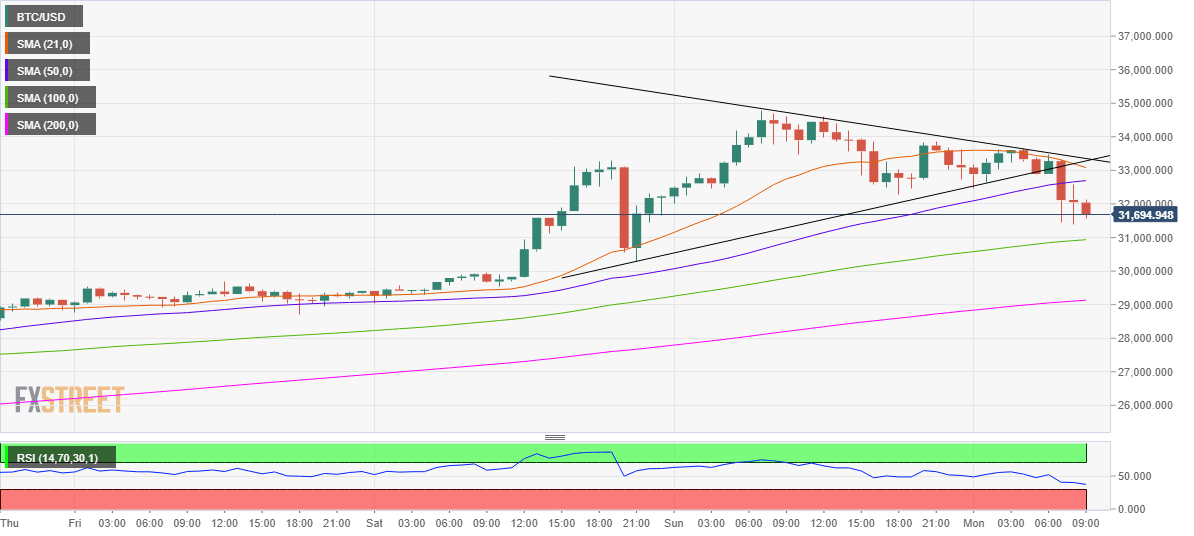

- A symmetrical triangle breakdown spotted on the hourly chart.

- Dip buying could be seen again in Bitcoin so long as $30K holds.

Bitcoin (BTC/USD) is looking to crack the $30K level, as the retracement from all-time-highs picks up pace in the first full trading week of 2021.

The no. 1 coin extended its recent rally and recorded fresh parabolic highs at 34,799 on Sunday, having surged by over 300% in 2020. The sellers stepped in thereafter, knocking off the prices by almost $3400.

BTC/USD: Hourly chart

Looking from a technical perspective, the most favorite digital asset is set to extend the corrective pullback, as it has confirmed a symmetrical triangle breakdown on the hourly chart.

The price continued to face rejection at the critical 21-hourly moving average, now at $33,088, prompting the bears to regain control.

At the moment, the bears are taking a breather before the next push lower. Immediate support awaits at the 100-HMA of $30,935.

Further south, the critical $30K level will challenge the bears’ commitment, below which the upward-sloping 200-HMA support at $29,131 could be tested.

Markets could witness dip-buying opportunities so long as the bulls manage to defend the $30K threshold.

Any pullbacks could meet strong supply at the bullish 50-HMA hurdle at $32,695. Acceptance above the latter could bring the 21-HMA resistance back in play.

The hourly Relative Strength Index (RSI) points south, holding well above the oversold territory, suggesting that there is room for a deeper correction.

Bitcoin: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.