Bitcoin plunges below $25k, lowest level since December 2020

Bitcoin (BTC) plummeted under $25,000 on Monday morning amid weakness in the macroeconomic environment and systemic risk from within the crypto market, data shows.

The asset has slid for nearly twelve straight weeks, falling from nearly $49,000 in March 2022 to under $25,000. It showed some signs of bottoming out in mid-May, but worrying U.S. inflation data released last week did little to cushion falling sentiment.

The consumer price index (CPI), the most widely tracked benchmark for inflation, rose 8.6% on a year-over-year basis in May, topping expectations that it would decline to 8.2% from April's 8.3%, as reported.

Such data contributed to a fall in Asian markets on Monday. Hong Kong’s Hang Seng fell nearly 3.5%, Japan’s Nikkei 225 fell 3.01%, while India’s Sensex dropped 2.44%. Futures of U.S. technology-heavy index Nasdaq opened 2% lower, while S&P500 fell 1.65%.

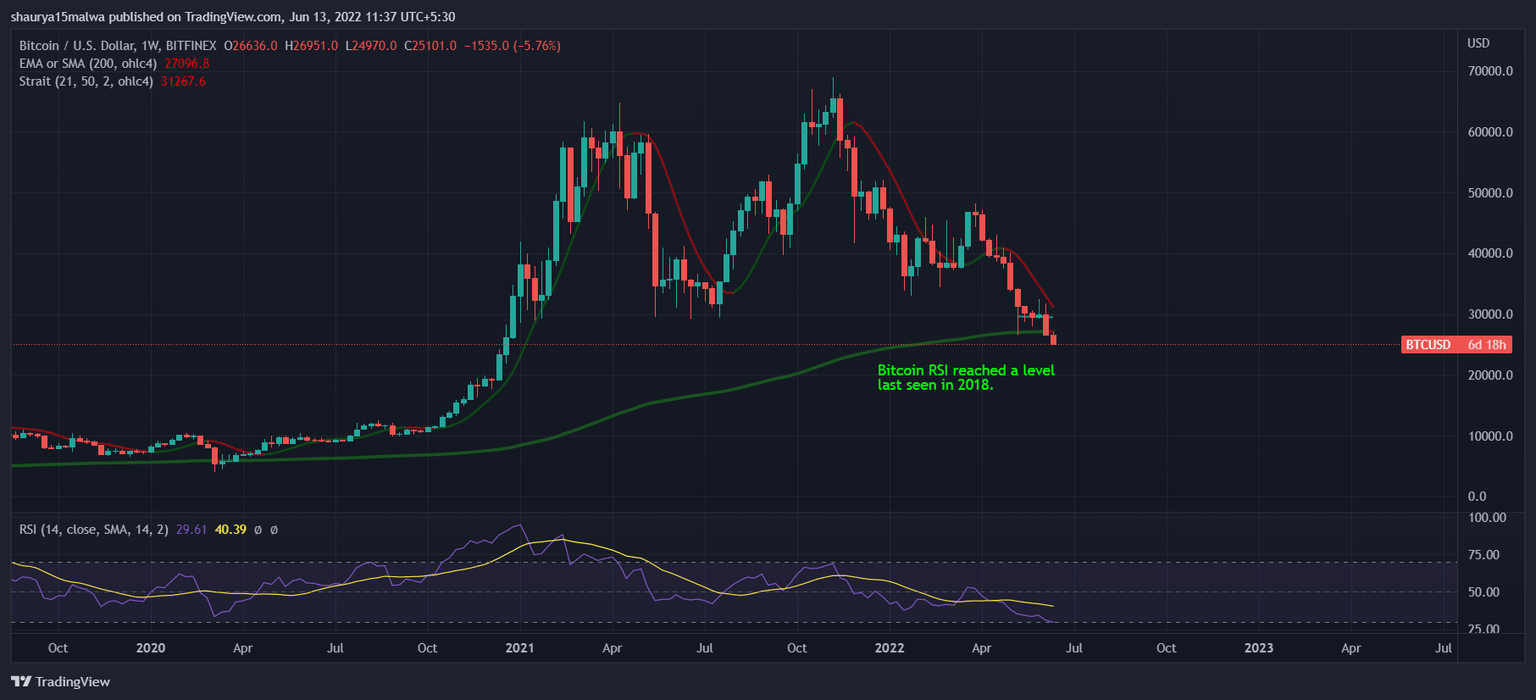

According to price-charts, bitcoin had strong support at the $29,000 mark, but the fall below that level now means that the cryptocurrency could drop to its 2017 high of nearly $20,000.

Readings on the Relative Strength Index (RSI) – a tool used by traders to calculate the magnitude of an asset’s price move – dropped under 30, suggesting a reversal could be on the way as short-term buyers react to technical data.

Bitcoin RSI dropped under 30 this week, technical indicators show. (TradingView)

Elsewhere, crypto lender Celsius paused withdrawals citing “extreme market conditions,” fueling crypto twitter concerns that the company may not have enough liquidity to pay out its depositors.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.