Bitcoin on-chain data and BTC’s recent price rally point to a healthier ecosystem

Positive signs of Bitcoin's recovery can be seen in on-chain, spot exchange and futures data.

But fresh on-chain and futures market data show positive signs that the leading cryptocurrency by market capitalization has started to recover.

After a bevy of short liquidations, the futures market is pointing toward renewed equilibrium. According to data from Glassnode, short position liquidations cleared out unhealthy market speculators, on-chain and exchange data now point to an improving spot market and exchange netflows.

A large group of investors that were previously at a loss is now back in the category that Glassnode analysts label as “unrealized profits.”

Massive short liquidations set the groundwork for new investors to thrive

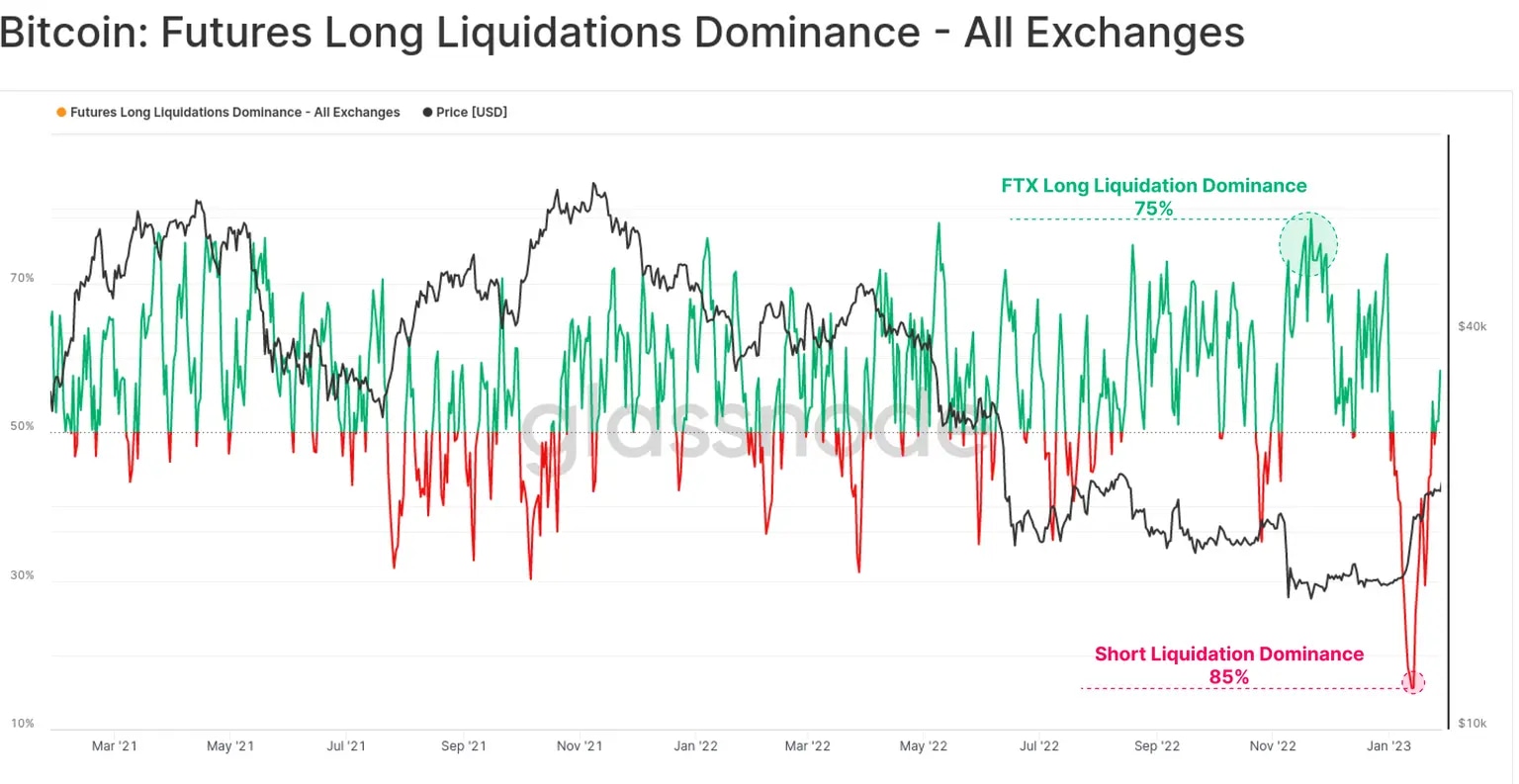

Futures data typically hold an equilibrium between longs and shorts. As the market moves, investors tend to update their futures to avoid liquidation. Conversely, in mid-January investors were caught off guard which resulted in an all-time high of 85% short liquidations.

Futures liquidation long versus short ratio. Source: Glassnode

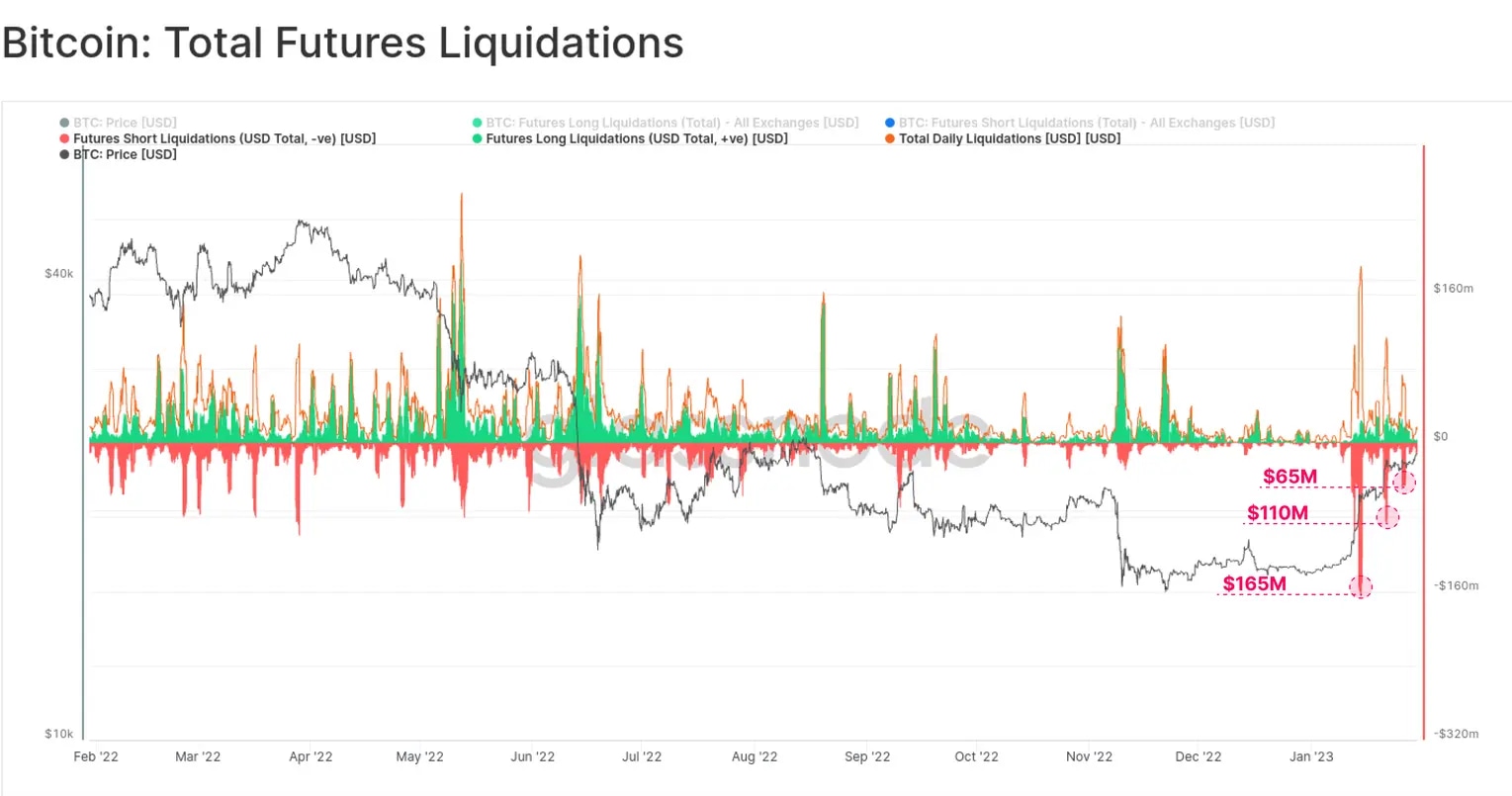

The short liquidation dominance has helped fuel the current Bitcoin rally. In January 2023, over $495 million in short futures were liquidated. Liquidated shorts create automatic Bitcoin purchases thus driving up the BTC price. The year-to-date liquidations have three large waves that peaked at $165 million in one day of liquidations.

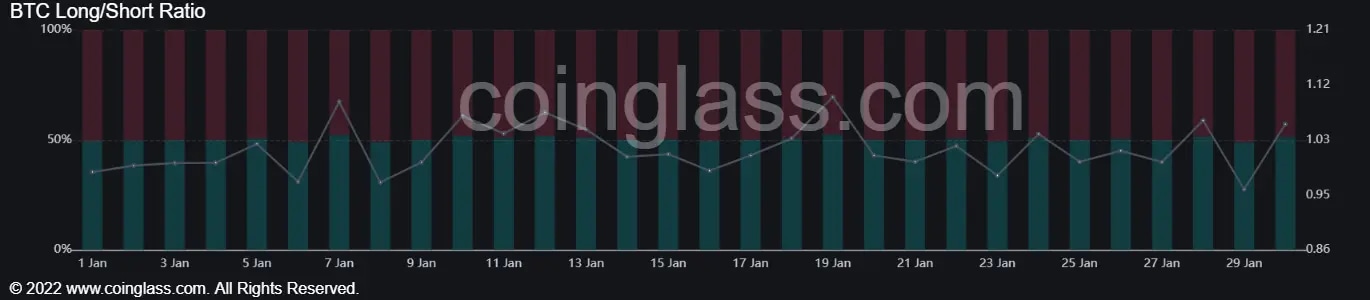

After the historic amount of short liquidations, the futures market is trending towards longs. On Jan. 30, 51.46% of open interests are long positions rather than shorts.

Long versus short ratio. Source: Coinglass

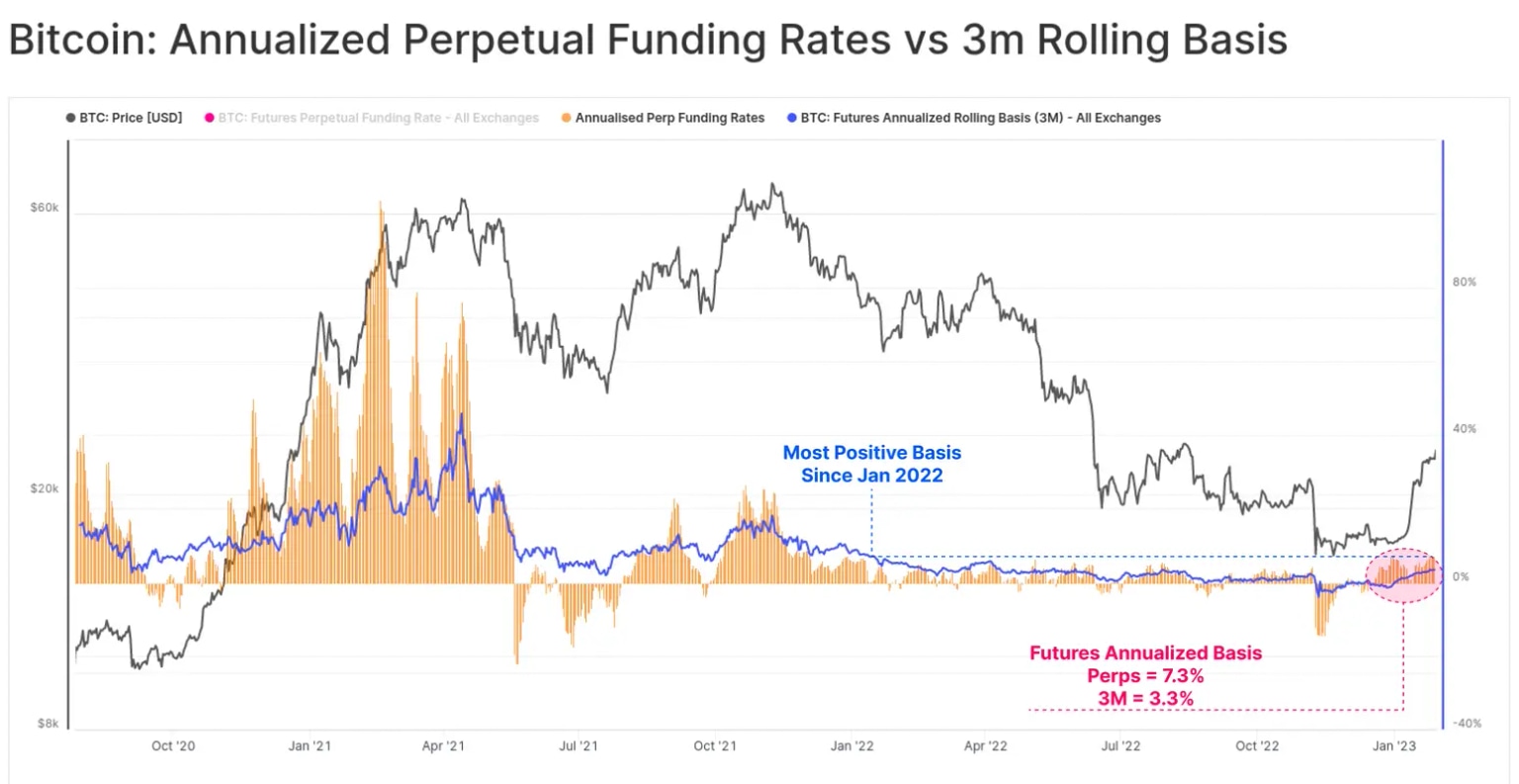

The liquidation of shorts not only helped Bitcoin price rally but also seemingly suggests a return of positive sentiment in the BTC market.

Glassnode researchers said:

"Across both perpetual swap, and calendar futures, the cash and carry basis is now back into positive territory, yielding 7.3% and 3.3% annualized, respectively. This comes after much of November and December saw backwardation across all futures markets, and suggests a return of positive sentiment, and perhaps with a side of speculation."

Centralized exchange netflows reach equilibrium

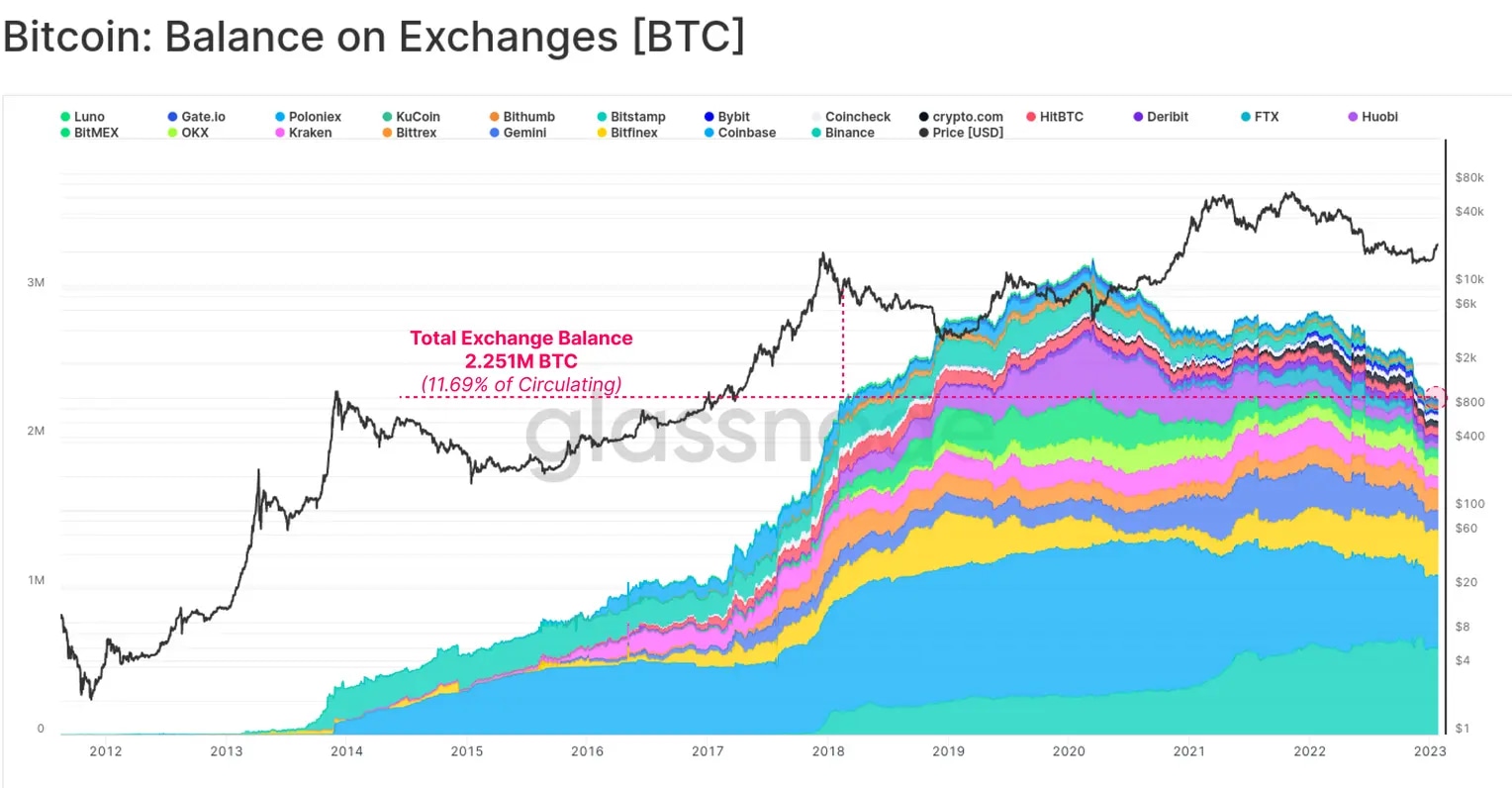

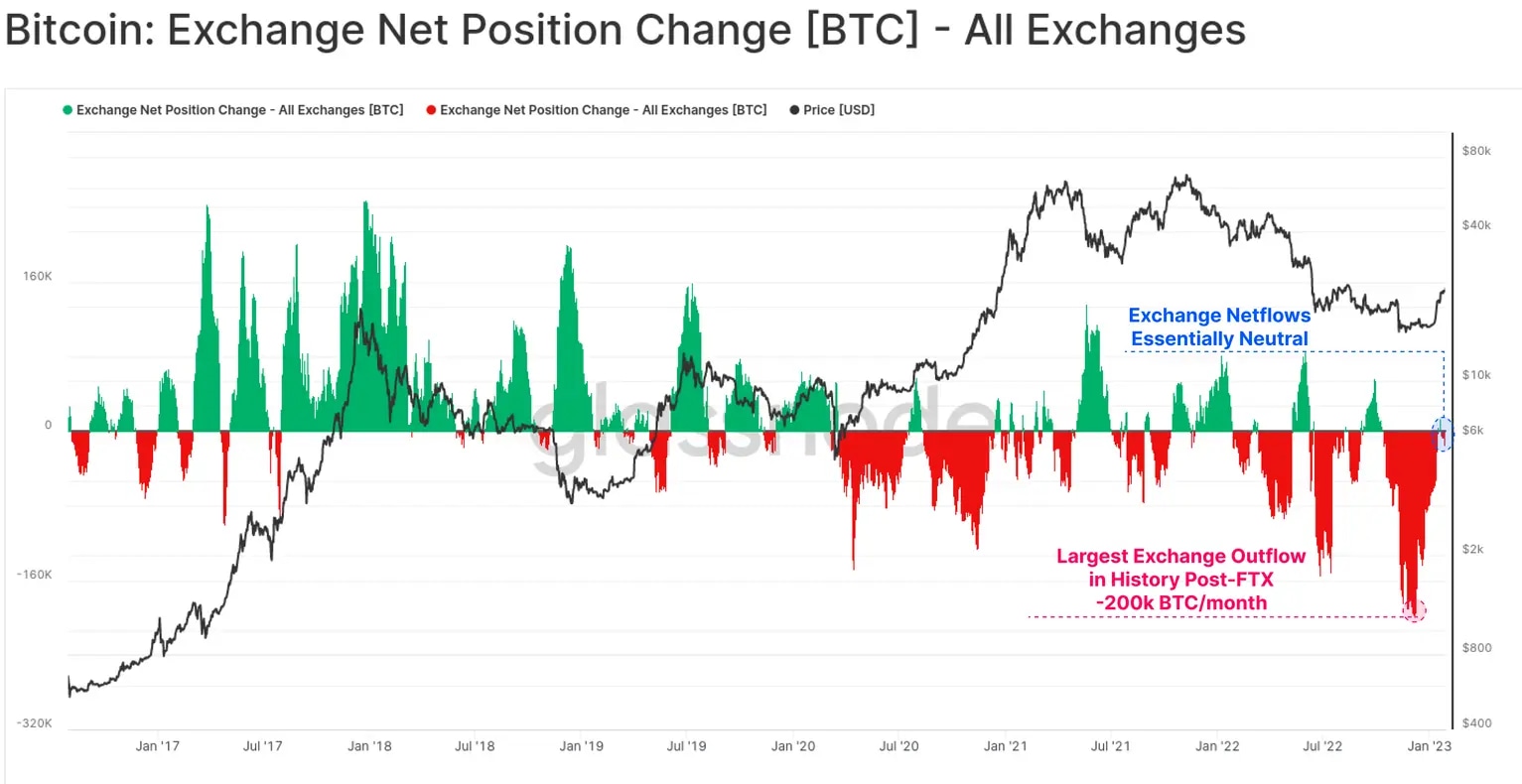

In March 2020 centralized exchange (CEX) Bitcoin balances reached an all-time high. Since the all-time high was reached, Bitcoin has flowed out of spot exchanges. Approximately 2.25 million BTC are currently held across 21 of the top exchanges, which is a multi-year low. The 11.7% of the total Bitcoin supply held on centralized exchanges was last witnessed in February 2018.

Typically throughout Bitcoin’s history, exchange inflows and outflows are similar creating an even balance. The balance was disrupted in November 2022 when net outflows of Bitcoin from exchanges reached $200 million to $300 million per day. The large outflow during this period was historic, reaching negative 200,000 Bitcoin leaving exchanges for the month.

As Bitcoin started gaining bullish momentum in January 2023, centralized exchange inflow and outflow has normalized. The netflows are now closer to neutral showing a reduction in the high outflow trend.

Multiple Bitcoin investor cohorts return to the “unrealized profit” zone

Bitcoin’s movement in and out of exchanges helps provide analysts an estimate for investors’ BTC acquisition price. During the 2022 bear market, only investors from before 2017 were in potential profit. Investors arriving to Bitcoin after 2018 were all at an unrealized loss.

According to Glassnode researchers,

“Through the 2022 downtrend, only those investors from 2017 and earlier avoided hitting a net unrealized loss, with the class of 2018+ seeing their cost basis taken out by the FTX red candle. The current rally however has pushed the class of 2019 ($21.8k) and earlier back into an unrealized profit.”

Bitcoin average withdrawal price. Source: Glassnode

The fact that a growin number of investor cohorts have returned to profitability is a good sign, especially after Bitcoin witnessed record realized losses in December 2022.

Two of the largest investor groups, those who purchased BTC on Coinbase and Binance, hold an average BTC acquisition price of $21,000. As Bitcoin continues to try to reach $24,000, any upcoming correction caused by macro factors may push down the unrealized profits in these groups.

Exchange average withdrawal price. Source: Glassnode

Positive signs of Bitcoin's price recovery can be seen in on-chain, spot exchange and futures data. The futures market is indicating a renewed equilibrium following a record-high amount of short liquidations.

The market is now showing improved exchange netflows and spot market activity suggests that investors are slowly trickling back into the crypto market.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.