Bitcoin may soon wake from slumber, derivatives data indicate

Day traders bored of bitcoin's recent slumber may soon have to remain glued to their screens, as a large number of open futures positions signal renewed price turbulence ahead.

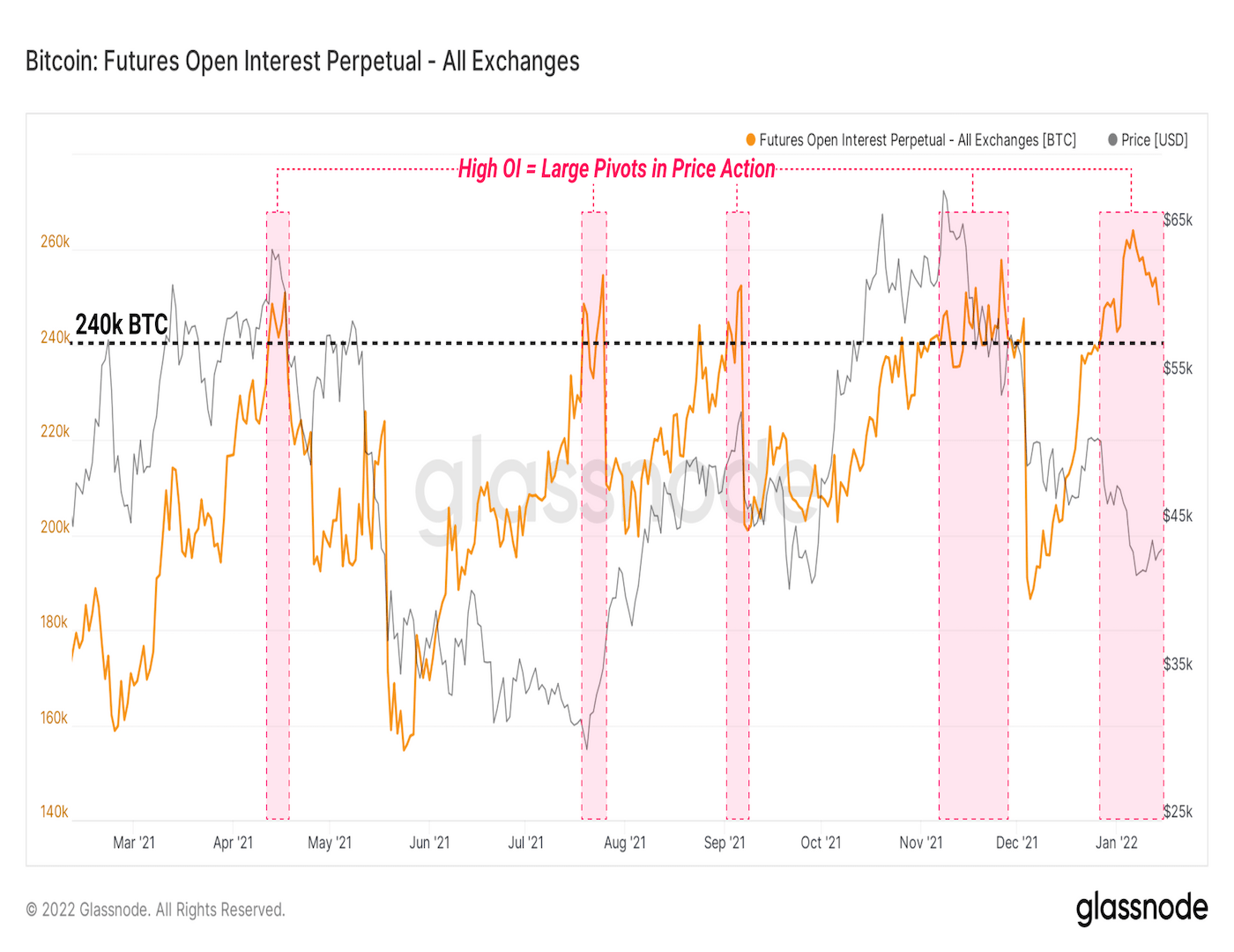

"Futures markets remain a powder keg for short-term volatility with Perpetual Futures Open Interest at ~250,000 BTC- a historically elevated level," blockchain analytics firm Glassnode said in a research note published on Monday.

An above-250,000 BTC open interest has coincided with volatility spikes in the past. "Since April 2021, this has paired with large pivots in price action as the risk for a short or long squeeze increases, resolved in a market-wide deleveraging event," Glassnode added.

A futures contract is the obligation to sell or buy an asset at an agreed-upon price on or before a specific date. Perpetuals are futures with no expiry. Open interest refers to the number of contracts traded but not liquidated with an offsetting position.

Abnormally high open interest indicates excess leverage – funds borrowed to amplify returns from the trade. In such situations, the market becomes vulnerable to liquidations and resulting price turbulence. Liquidations refer to the forced closure of long or short positions by exchanges due to margin shortage. These lead to exaggerated price moves, as seen several times over the past 12 months.

As a standalone indicator, open interest doesn't conclude directional views on the market but only indicates the amount of money allocated to derivatives.

However, open interest coupled with funding rates or the cost of holding long/short positions in perpetual futures reveals the market's bias. A positive funding rate means longs pay shorts for bullish exposure, while a negative rate implies payment from shorts to longs.

Per Glassnode, bitcoin's funding rates recently dipped to negative territory. This, coupled with high open interest, suggests leverage is skewed to the bearish side. So, if bitcoin continues to move sideways, the funding payment would become a burden for shorts, and they may decide to unwind their position, leading to volatility on the higher side.

Similarly, a move higher can also lead to forced liquidation of shorts, which, in turn, could yield more volatility.

Bitcoin was last seen trading near $41,970, representing a 0.6% drop on the day. The leading cryptocurrency has been restricted to the narrow trading range of $40,000 to $44,000 since Jan. 7, CoinDesk data show.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.