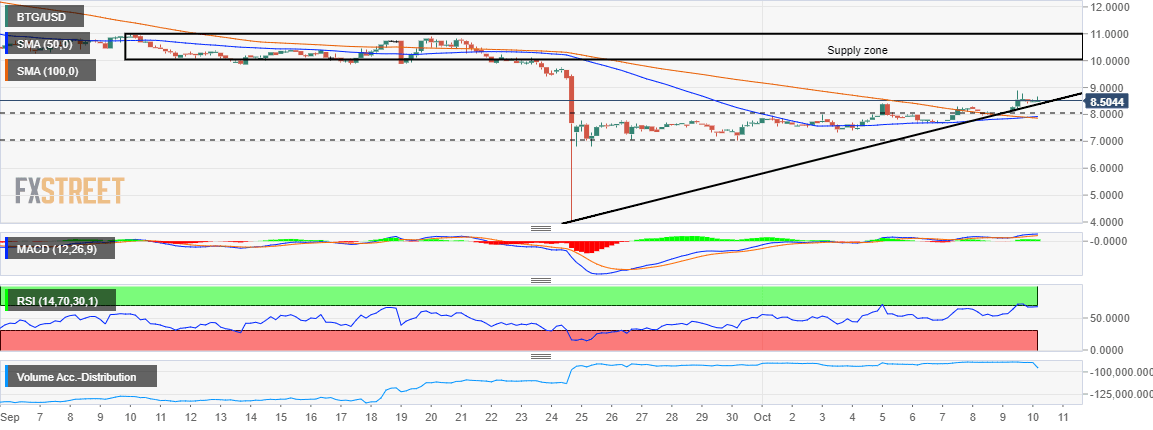

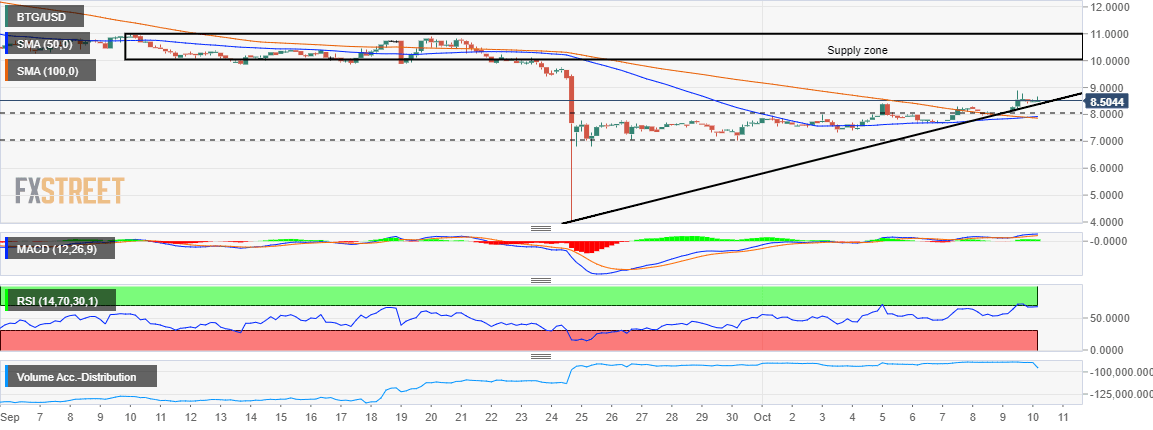

Bitcoin Gold price analysis: BTG/USD ignores widespread retreat to post gains over 2% on Thursday

- Bitcoin Gold separates from other coins to push for recovery towards $10 (supply zone).

- The bullish action is happing after a two-week consolidation phase between $7 - $8.

Bitcoin Gold remains the bull among a sloth of bears following a bearish wave that is sending most cryptocurrencies back to retest key levels. Bitcoin (BTC), for instance, failed to sustain gains above $8,700 and retreated to test $8,500 support. The majority of cryptocurrencies are also posting losses between 0.01% and 2% on the day.

On the other hand, BTG/USD is defying the general downtrend with a 2.33% increase in value. The enthusiastic move comes after roughly two weeks of consolidation between $7and $8. The initial break above the Simple Moving Averages (SMAs) gave the price a kick towards $10 (supply zone).

Read also: Bitcoin technical analysis: BTC/USD not bothered by BTC ETF's rejection, all eyes on $9,000

Bitcoin Gold has tested the intermediate resistance at $9.00 but is trading at $8.68. The uptrend is supported by the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The indicators send out bullish signals to show that the action towards $10 is not over. Besides, the volume accumulation-distribution indicator is pointing north as a sign of a stronger bullish momentum. Inline to offer support is the trendline, the former consolidation range at $7-8 and $4.0 primary support level.

BTG/USD 240’ chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren