Bitcoin falls with NFP in focus

- BTC drops to 86.5k, down 3% over 24 hours.

- The delayed NFP is expected to show 50k jobs added in November.

- US retail sales, CPI data, & BoJ rate decision are also due this week.

- Sharks buy the dip, institutions and whales sell.

- Bitcoin technical analysis.

Bitcoin trades lower on Tuesday, falling 3% over the past 24 hours to 87k amid cautious trading ahead of key U.S. data points that could affect the Fed’s rate path.

Attention is focused on the US nonfarm payrolls report, due for release at 1330 GMT. The delayed November and partial October jobs data are expected to show 50k jobs added, following 119k in September. The unemployment rate is expected to remain at 4.4%. This would be consistent with an ongoing weakening in the jobs market.

The data come after the Fed cut rates by 25 basis points last week, as concerns over the cooling labor market outweighed worries about sticky inflation. However, according to the CEM FedWatch tool, the market is pricing in a 75% probability that the Federal Reserve will leave rates unchanged at the January meeting. Weak jobs data could lift expectations for a rate cut, supporting BTC. Although there is still one more jobs report before the next Fed meeting on January 28.

Attention will also turn to US retail sales and CPI data on Wednesday and Thursday, followed by the BoJ rate decision on Friday.

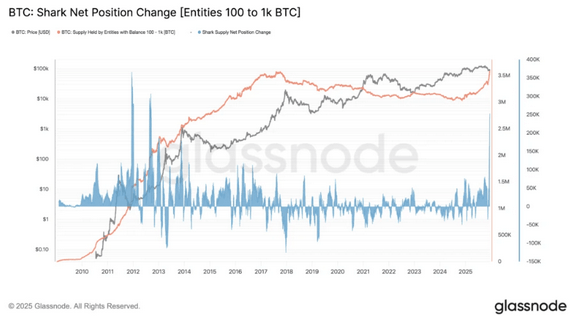

Sharks buy the dip, whales and institutions sell

According to Glassnode data, Bitcoin sharks, holding between 100 and 1000 BTC, increased their holdings by 54,000 BTC over the past 7 days. Collective shark holding rose from 3.521 million BTC to 3.575 million BTC, marking the most aggressive accumulation since 2012, suggesting strong bullish conviction among this cohort despite BTC’s 30% drawdown. However, this alone may not be enough to lift BTC higher, as institutional and whale sell pressure persists.

BTC ETFs recorded $357.7 million in net outflows on Monday, the largest outflow since November 20. BTC ETF outflows for December totaled $158.8 million, following $3.48 billion in outflows in November.

Whales holding over 10,000 BTC have been behind the selloff over the past two months, as OG whales and long-term holders sell at rates not seen in years. Any upside in BTC may be capped until this selling pressure eases.

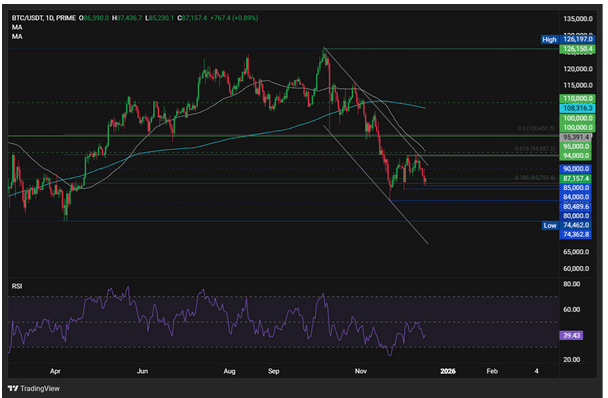

Bitcoin technical analysis

BTC/USDT trades within a falling channel dating back to early October. BTC/USDT also trades below its 50 and 200 SMA. The price recently faced rejection again at 94k, falling back to test the 78.6% Fib retracement at 85k.

Sellers supported by the RSI below 50 will look to break below 85k to extend the move lower to 80k, the round number, the November low, and the mid-point of the falling channel. Below here, 74.4k, the 2025 low comes into play.

Should the 85k support hold, buyers will look to rise towards 90k. A rise above 94k, the 78.6% Fib retracement is needed to create a higher high and bring 100k into focus.

Start trading with PrimeXBT

Author

PrimeXBT Research Team

PrimeXBT

PrimeXBT is a leading Crypto and CFD broker that offers an all-in-one trading platform to buy, sell and store Cryptocurrencies and trade over 100 popular markets, including Crypto Futures, Copy Trading and CFDs on Crypto, Forex, I