Bitcoin clings to $56K as whales keep buying — Watch these BTC price levels

Testing times continue for Bitcoin bulls with the trillion-dollar market cap next up for support.

Bitcoin (BTC) is demanding a “slightly bearish” rethink on price action as old support levels give way overnight.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Analysts sounds alarm over open intere

Data from Cointelegraph Markets Pro and TradingView showed a low of $55,640 on Bitstamp on Nov. 19.

Capitalizing on its lowest levels in over a month, Bitcoin has failed to bounce significantly since — and now price forecasts are beginning to change with it.

In his latest YouTube update, Filbfilb, an analyst at trading platform Decentrader, warned that 50-day and 100-day moving average (DMA) may be all that can aid bulls.

BTC/USD then fell through the first, leaving just the 100DMA at just above $53,000.

“I’m definitely going to go spot long at $53,000 again,” he told viewers, having said that the chances of the 100DMA protecting price were “reasonably good.”

That level coincides with Bitcoin’s $1 trillion market cap valuation, something which was previously held to be permanent.

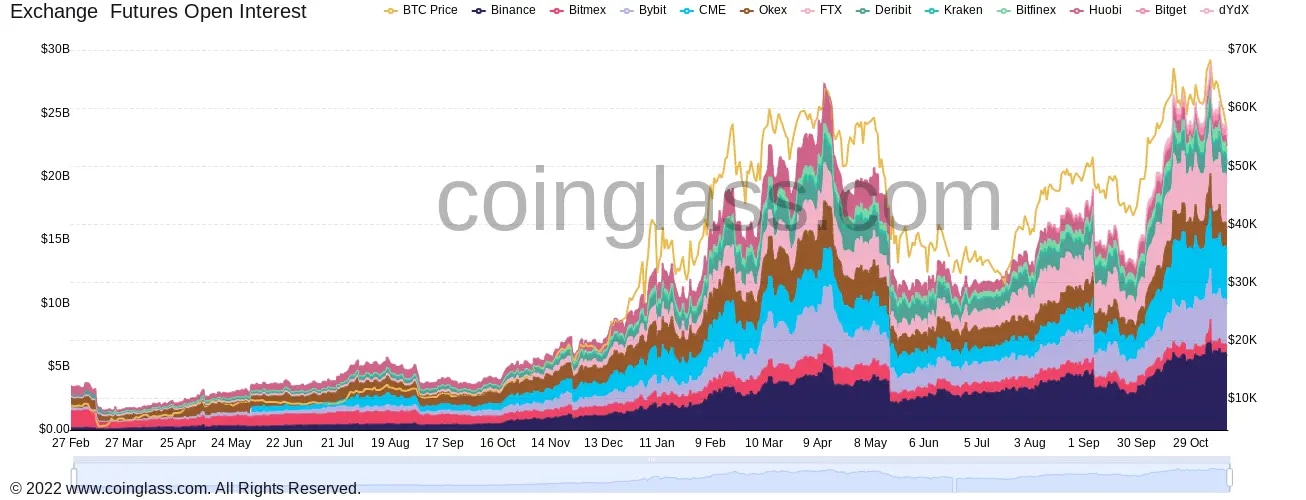

Causing problems for Filbfilb and others, meanwhile, is the still high open interest on Bitcoin derivatives in spite of the price comedown.

This, he suspects, is down to traders taking longs — and the result will be either a clean sweep via a rebound, or a “flushing out” of their positions.

Bitcoin futures open interest chart. Source: Coinglass

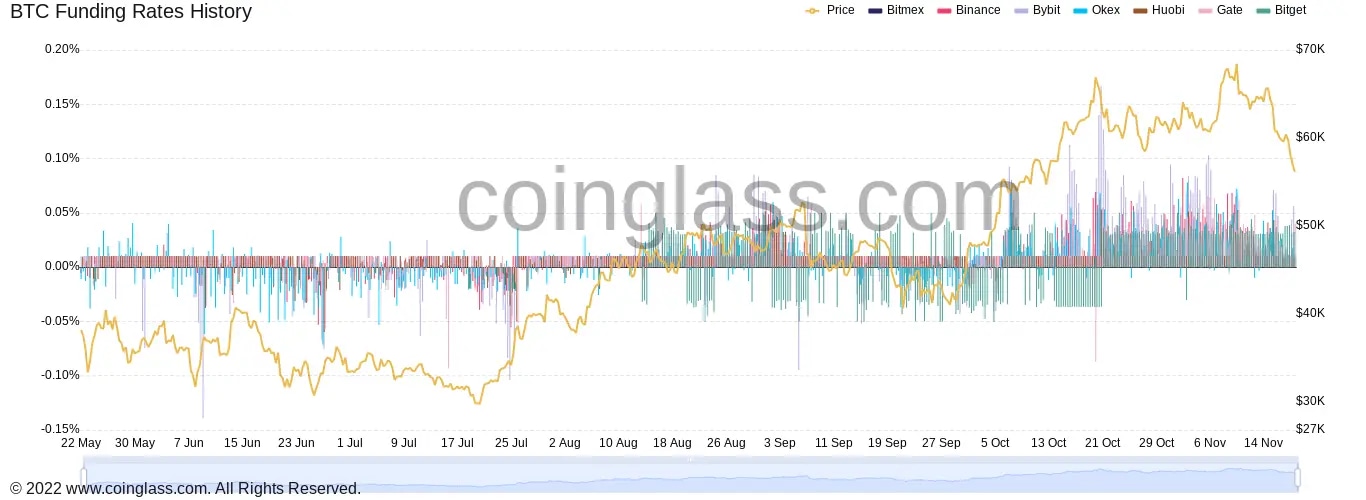

Funding rates likewise remained elevated on some major exchanges, indicating expectations of higher prices returning.

Bitcoin funding rates chart. Source: Coinglass

Whales (keep) buying the dip

Elsewhere, some large-volume hodlers are putting their money where their mouth is.

According to blockchain data, the third-largest BTC address has continued to buy this week. After increasing its balance by 207 BTC at $62,000, bigger accumulations followed in the form of 1,647 BTC, 700 BTC and 484 BTC purchases.

As Cointelegraph additionally reported, those who bought in over the past six to twelve-month period remain determined not to sell their coins.

Even at all-time highs, selling remained low, with the one-year hodl accounting for the largest proportion of the current Bitcoin supply.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.