Bitcoin climbs past $9.5K as analysts stress ‘Decoupling’ from stocks

A fresh surge sees BTC/USD well on its way back to $10,000 as the impact of its weekend crash continues to dissipate.

Bitcoin (BTC) rose to reclaim $9,500 on May 14 as the recovery from last weekend’s $1,200 crash gained fresh momentum.

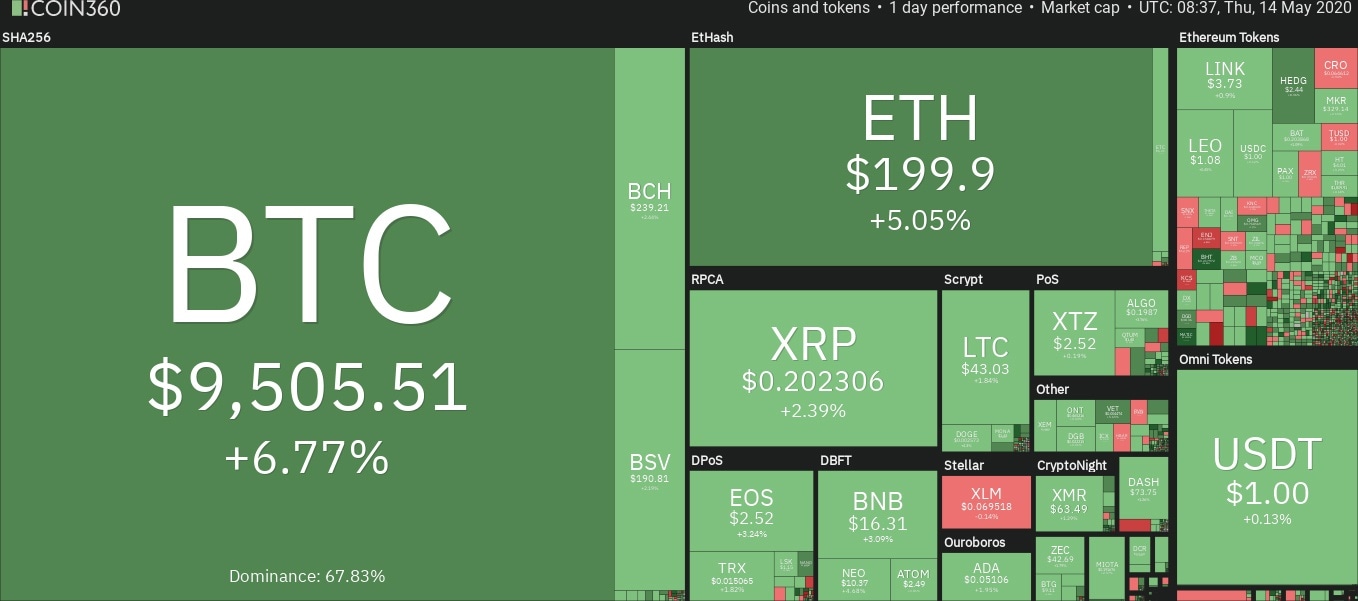

Cryptocurrency market daily overview. Source: Coin360

BTC price up 11% in days

Data from Cointelegraph Markets and CoinMarketCap showed BTC/USD quash another resistance barrier in Thursday trading, taking 3-day gains to 11%.

The past 24 hours alone has seen an uptick from closer to $8,900.

At press time, $9,500 appeared to be holding, the level marking a $1,300 improvement versus a momentary wick to $8,200 during the crash.

$8,200 marks the current zone of Bitcoin’s 200-day moving average.

Bitcoin 1-day chart. Source: CoinMarketCap

Bitcoin’s fortunes this week contrast it even further with traditional markets and macro assets. This stock “decoupling,” which Cointelegraph reported on previously, shows no signs of abating.

As Cointelegraph analyst Scott Melker wryly summarized on Twitter:

Remember that day that stocks dumped and Bitcoin went up? That was today. And yesterday. They’re not correlated now, and they weren’t correlated before. Thanks.

For fellow analyst Michaël van de Poppe, paying too much attention to correlating markets in times of crisis and afterward was a dangerous game.

“When shit hits the fan (which was in March), all correlations tend to go towards 1,” he tweeted on Thursday.

Since then, gold, silver & Bitcoin have been resilient for any downwards move and showing strength apart from the equity markets. Don’t pin yourself on those correlations.

Meanwhile, the latest technical analysis from Cointelegraph Markets shows several metrics once again suggesting that BTC is back on track toward the key $10,000 level.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.