Bitcoin Cash price benefits from Kim Dotcom's endorsement; bulls aim for $500 before $2,700 - Confluence Detector

- Kim Dotcom sent BCH to the highest level since February.

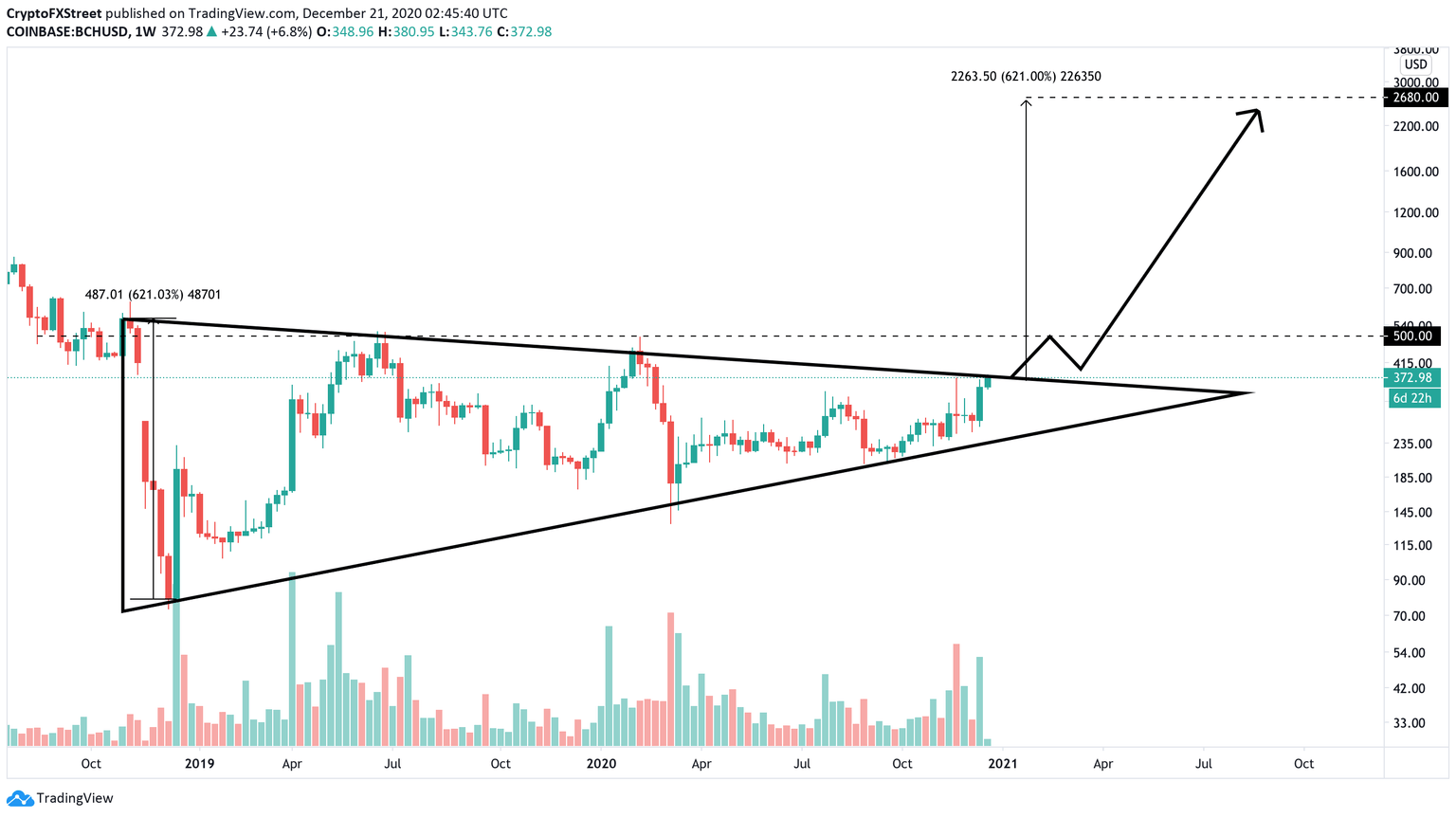

- The coin is trying to break from an ascending triangle pattern.

The fortune smiled upon Bitcoin Cash. The first Bitcoin's fork and now the 6th largest digital asset gained over 16% on a day-to-day basis and over 32% on a weekly basis amid a strong bullish momentum. At the time of writing, BCH is changing hands at $365 after testing an intraday high of $380.

BCH market value jumped to $6.7 billion, while its average daily trading volume is registered at $7 billion.

Kim Dotcom pumps BCH

A famous internet entrepreneur and political influencer, Kim Dotcom, added fuel to BCH bullish trend by saying that the coin is great for payments. He also added that the Bitcoin's fork could reach $3000 in the coming year as more and more merchants would start accepting it as a means of payment.

Bitcoin > great for asset storage

— Kim Dotcom (@KimDotcom) December 17, 2020

Bitcoin Cash > great for payments

Bitcoin Cash at $310 today.

I expect $3000+ next year.

Why?

More and more vendors accept crypto. Vendors want low fees and fast transactions.

I’m bullish on BCH.

I’ll retweet this in a year.

Maybe earlier.

Moreover, answering to the criticism from Bitcoin maximalists, Kim promised that he would implement BCH support within the K.im platform that allows people to create and share digital content and get paid for it.

BCH ready to break free from an ascending triangle

From the technical point of view, BCH is hovering around the upper x-axis of an ascending triangle on a weekly chart. This chart pattern usually implies that the price has a lot of unrealized bullish potential.

BCH, weekly chart

Once the price breaks above $372, the upside momentum may start snowballing with the first estimated target at the psychological $500 and the ultimate bullish goal of $2,680. This move will represent an over 600% increase from a breakout point.

On the other hand, the rejection from the above-mentioned resistance of $372 will lead to the downside correction towards the ascending triangle's hypotenuse at $235.

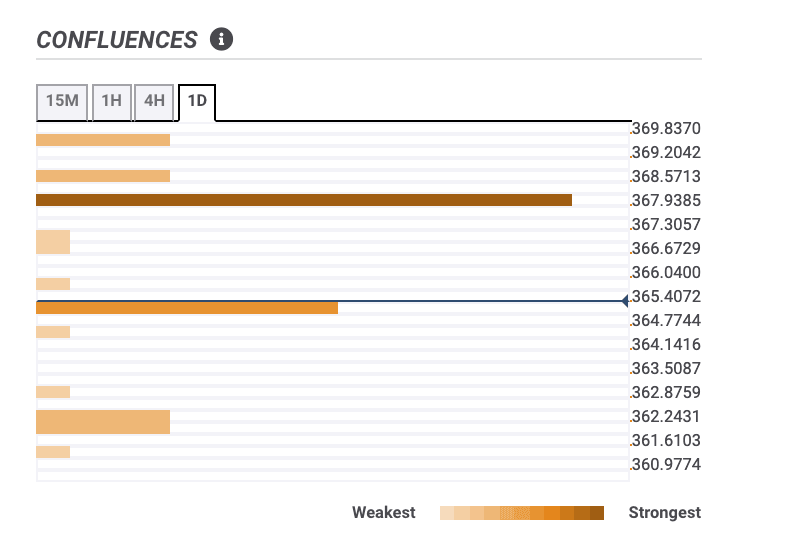

BCH confluence levels

Meanwhile, the BCH confluence detector implies that the coin may have a hard time pushing through the $368 resistance created by the previous day's highest level. Once int is cleared, the upside momentum may gain traction.

On the downside, the initial support sits below the current price at $365. It is reinforced by the upper line of the 4-hour Bollinger Band. The next short-term bearish target is around $361 (1-hour SMA10).

Author

Tanya Abrosimova

Independent Analyst