Bitcoin Cash Price Analysis: Strong resistance lies in BCH’s path to $300 – Confluence Detector

- BCH outperformed the rest of the altcoins toward the end of Tuesday, as per Santiment.

- The downside is capped at $235 by the 50-day SMA.

Bitcoin Cash has been on an upswing since September 24, going up from $207.25 to $255, as of press time. Towards the end of Tuesday, BCH went on a bit of a rampage jumping up from $243 to $255 in just about an hour. Santiment, a crypto analytics platform, noted that the fifth-largest coin by market cap outperformed the rest of the “altcoin pack” in the process.

The often written off $BCH decoupled from the #altcoin pack this morning with a surprising run-up from $243 to $255 in just about an hour. Price has managed to tread water since, and trading volume has managed to climb to near one-month high levels. https://t.co/709B0PgldC pic.twitter.com/Hx1079lTbv

— Santiment (@santimentfeed) October 13, 2020

The technical outlook

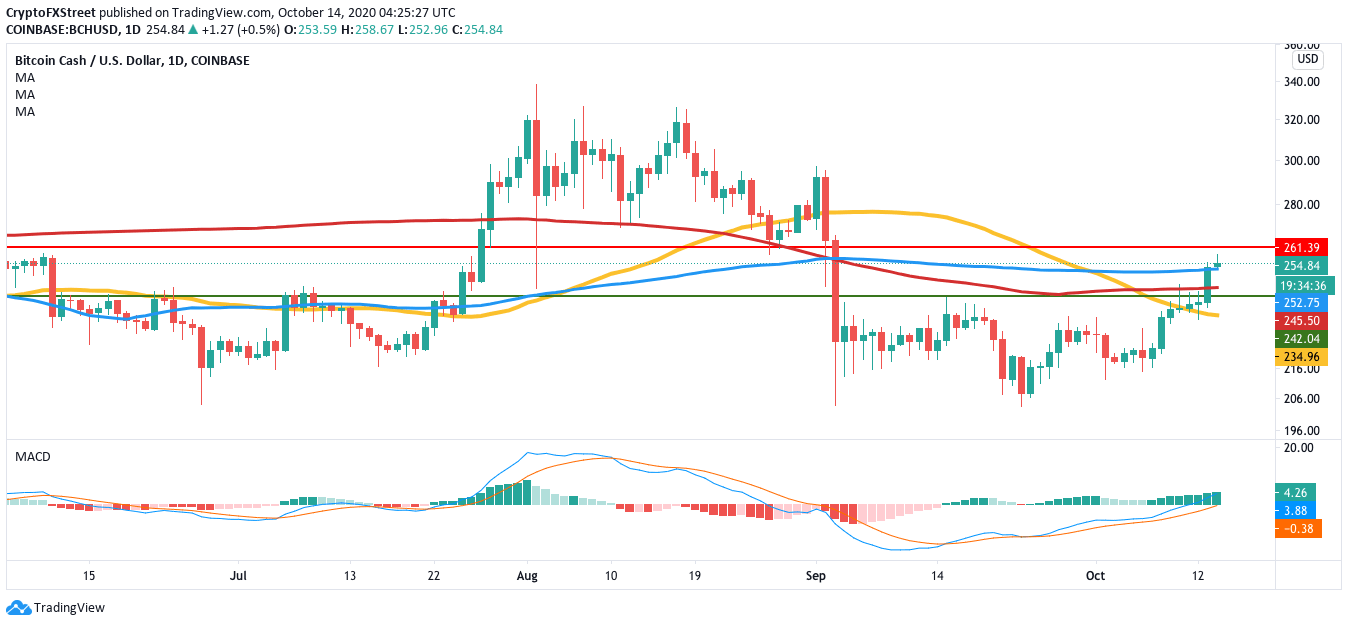

BCH has managed to flip the 100-day SMA from resistance to a support level. The MACD shows increasing positive momentum, which should give the buyers enough firepower to aim and break past the $262 resistance line.

BCH/USD daily chart

The daily confluence detector shows a lack of strong resistance walls on the upside. Hence, if the buyers manage to break past this level, they should take the price near the $300 zone.

Bitcoin Cash confluence detector

IntoTheBlock’s daily active addresses metric also adds further credence to the bullish outlook. According to this, the number of new addresses created daily, based on a one-month trailing average, reached a low of 14,800 on October 12. Since then, it has spiked to 28,000, as of writing.

BCH daily active addresses

This is a positive sign for BCH since new addresses entering the network is a very bullish signal.

The Flipside: Can the bears reverse this trend?

If the bears want to reverse the bullish narrative, they will need to reclaim the 100-day SMA and flip it back into a resistance barrier. However, even then, the downside looks pretty limited.

Referring back to the daily confluence detector, it seems that there are strong support zones at the 200-day SMA and the $242 line. Even if BCH somehow manages to break below this, it will only drop till the 50-day SMA ($235).

Key price levels to watch

Currently, the bulls need to aim for the $262 resistance line. Breaking past this will give the buyers enough momentum to reach $300.

On the downside, the bears face many strong support walls that should be resilient enough to absorb a tremendous amount of selling pressure. This effectively caps the downside at 50-day SMA ($235).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.