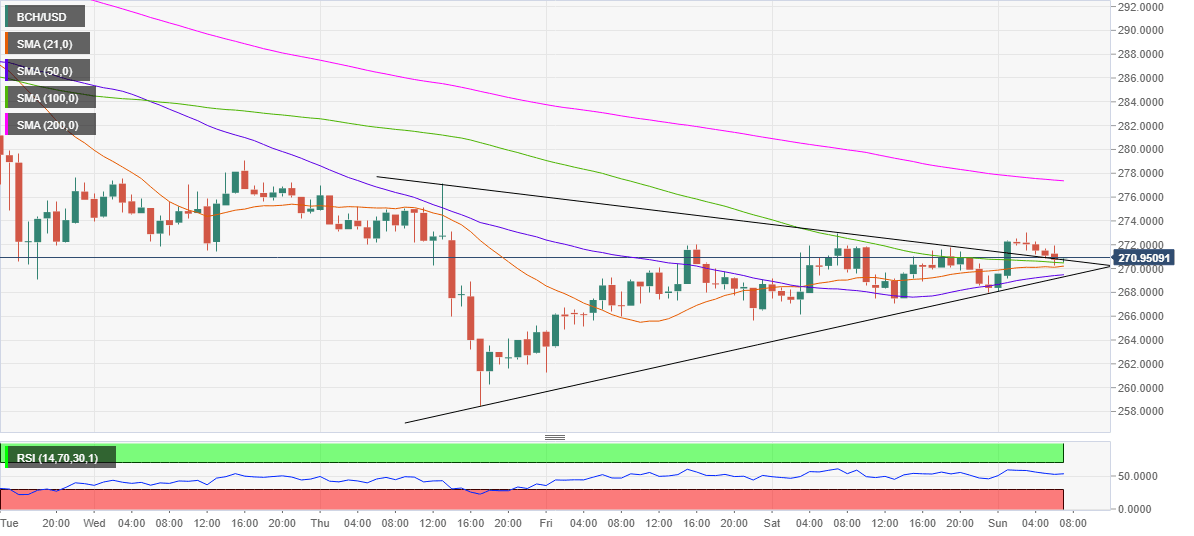

Bitcoin Cash Chart Analysis: Symmetrical triangle breakout on 1H, more gains likely?

- BCH/USD off the highs, but bullish bias intact.

- No. 6 coin sees a symmetrical triangle breakout on hourly chart.

- 200-HMA is likely to be tested in the near-term.

Bitcoin Cash (BCH/USD) caught a fresh bid-wave in early trades this Sunday and rose as high as $273.02 before reversing towards $270 levels, where it now wavers.

Despite the minor pullback from daily highs, the spot trades nearly 1% higher on a daily basis, enjoying a market capitalization of $5.08 billion.

The bulls are gathering pace for the next push higher, especially in the wake of a symmetrical triangle breakout confirmed on the hourly chart after the coin closed the hour above falling trendline (pattern) resistance, then located at $271.30.

The buyers now aim for the pattern target at $290. Ahead of that level, the 200-hourly Simple Moving Average (HMA) at $277 will be the level to beat for the BCH bulls.

Alternatively, a cluster of critical support at $270 should cushion the downside. That level is the confluence of the pattern resistance now turned support, 21 and 100-HMAs.

A break below which the next support at $269 will be put to test. Friday’s low of $266.10 will be next on the sellers’ radar.

BCH/USD: Hourly chart

BCH/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.