- Bitcoin SOPR is at extreme overbought conditions suggesting that the bull-run still is intact.

- Short-term Bitcoin holders (traders) are helping to push Bitcoin in profit.

- The Entity-Adjusted SOPR points to a possible pullback after overshadowing the 2017 top.

Bitcoin boasts of a nearly 30% rebound after touching the major support at $30,000 early this week. Despite the massive liquidations in the futures market, which saw over $1.5 billion wiped off, BTC presented a strong bullish front, bringing down the seller congestion at $36,000 and $38,000.

At the time of writing, the bellwether cryptocurrency is trading marginally above $39,000 after touching $40,000 on Friday during the Asian session. The Spent Output Profit Ration (SOPR), an on-chain metric by Glassnode, is exceptionally overbought, as Rafael Schultze-Kraft discussed, a renowned on-chain analyst. This situation calls for a couple of events; Bitcoin may settle for consolidation or embrace some mid-term but healthy pullbacks.

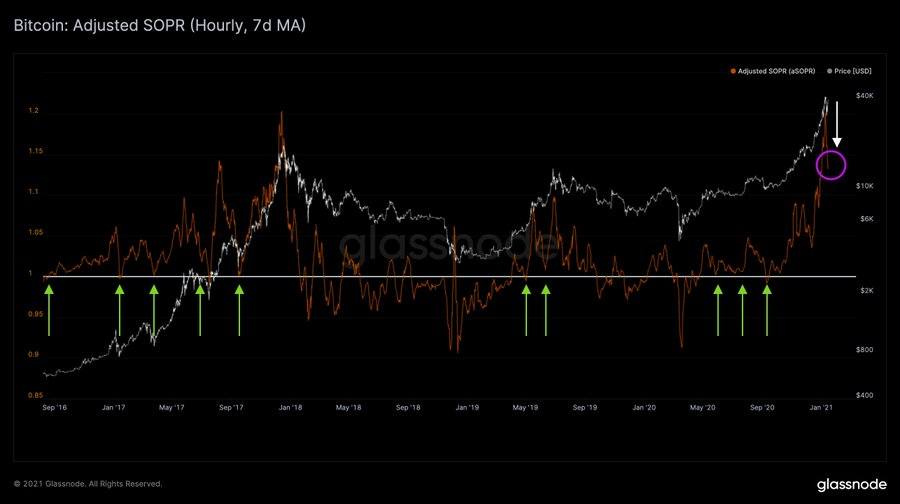

Bitcoin SOPR chart by Glassnode

Bitcoin’s 2020/2021 bull run differs from the retail-driven 2017 bull cycle

The adjusted SOPR significantly pulled back recently but held firmly at 1.13. Despite the correction, it remains well above average. Besides, it does not seem poised for a further retreat under the 1-line in the near-term. Nonetheless, a reset is not always mandatory because, in 2017, the aSOPR went for months without it.

Bitcoin’s aSOPR chart by Glassnode

Understanding the SOPR

The SOPR is an on-chain metric developed by Renato Shirakashi. It is arrived at by dividing the realized value (in USD) by its value at creation (USD) of a spent output. In other words, price sold/price paid.

Notably, a SOPR value beyond one suggests that investors of spent outputs realize profits at the transaction time; any other value below one means that they are at a loss. A graph like the one above is produced by plotting the SOPR of the spent outputs altogether and aggregated by the particular day they were spent.

Who is behind Bitcoin SOPR high levels?

The Bitcoin market has been known to have been dominated by a handful of large volume long-term holders. Although these long-term BTC holders are highly profitable, the Short-Term Holder SOPR suggests that traders are helping to move the largest cryptocurrency at a profit. It is worth keeping in mind that the Short-Term Holder SOPR only accounts for outputs younger than 155 days.

Bitcoin Short-Term Holder SOPR

Similarly, the Long-Term Holder SOPR is impressively on an upward path. However, it is a long way to 20, a value used to identify global tops in the past. The chart also shows a decent recent surge, almost in a perfectly straight line, showing little or zero volatility. This metric only puts into consideration outputs that are at least 155 days. It is used to study the behavior of long-term BTC investors.

Bitcoin Long-Term Holder SOPR

Another variant of the SOPR is the Entity-adjusted SOPR. It is applied to cancel the noise and does this by accounting for only the BTC that actually moved or exchanged hands. In simpler terms, the metric ignores the transaction taking place between addresses of the same entity. Therefore, it focuses on real economic activity.

The Entity-Adjusted SOPR has maintained extremely high levels over the last 30 days. A correction from its recent high still sits at the top in 2017, suggesting that Bitcoin is poised for a pullback.

Bitcoin Entity-Adjusted SOPR

Bitcoin’s ongoing bull run has proved to be different from the retail-driven run seen in 2017. Thus, technical levels and indicators are behaving differently. It also calls for caution among investors for proper risk management.

Meanwhile, the trend is still bullish, but it is essential to keep in mind the potential consolidation and pullbacks (healthy), mostly if we don’t crack $40,000.

BTC/USD 4-hour chart

At the time of writing, Bitcoin is doddering at $38,900 following a rejection at $40,000. Short-term support is expected at $38,000, which might give way for a period of consolidation. However, more declines will come into the picture if Bitcoin slides under the 50 Simple Moving Average.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

%20-%202021-01-15T061636.383-637462787111297817.png)