Bitcoin bull run won’t end ‘any time soon’ as whale buying hints at new $52K floor

Funds are ready on exchanges as existing whale behavior suggests that $52,000 is now the floor for Bitcoin.

As Ether (ETH) passed $4,000 and multiple altcoins saw their own all-time highs on Monday, data shows that there is still more buying appetite to come.

Traders prepare to sink funds into crypto

A trading frenzy is gripping altcoins, while Bitcoin (BTC) continues to consolidate, showing signs that it is ready to tackle $60,000 resistance.

While some alts, notably Dogecoin (DOGE), have cooled since last week, traders are far from exhausted and are ready for more. This is aptly demonstrated, analyst Lex Moskovski said, by the number of stablecoins entering exchanges.

Stablecoin inflows have been on an uptrend for months, and apart from brief “reset” periods where they leave exchanges, the overall direction is clear.

This suggests that traders are ready and waiting to enter positions in various cryptocurrencies at short notice.

Stablecoin reserves across exchanges hit a fresh all-time high of over $11.5 billion in recent days, still above $11 billion after a small reversal at the time of writing.

“Stablecoins on exchanges keep staying in the ATH range,” Moskovski told Twitter followers.

“Barring some black swan event, I don’t see this rally ends any time soon.”

$52,000 “should be BTC floor”

Earlier, Cointelegraph reported on the composition of exchange order books, notably that of Binance, which reveal a lack of bidding interest above $50,000.

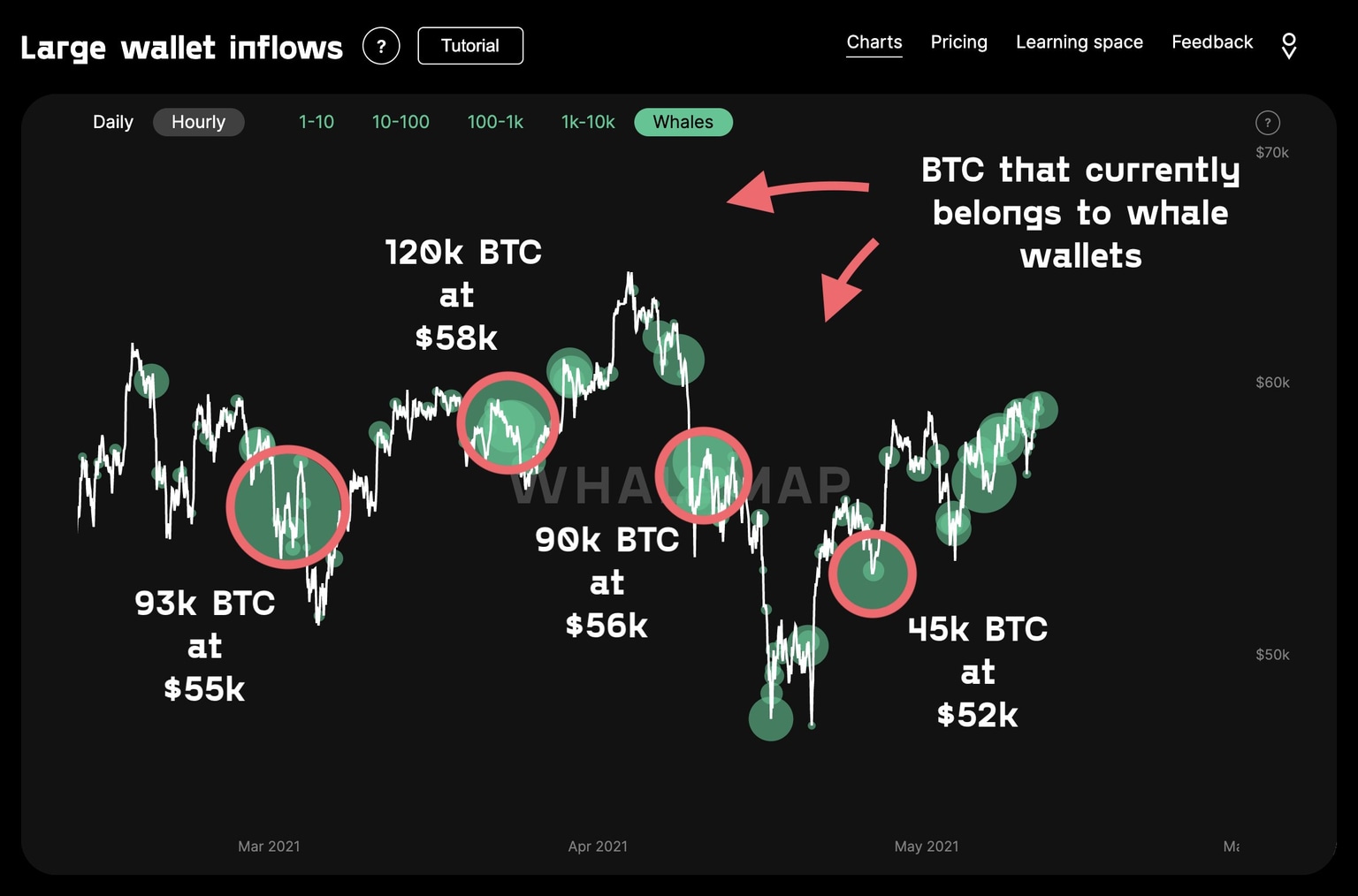

At the same time, however, data shows that Bitcoin whales — large-volume investors — have amassed significant positions between $54,000 and $58,000.

Compiled by monitoring resource Whalemap, the figures show that curiously, the largest cluster of whale coins in the range is 120,000 BTC at $58,000.

Cryptocurrency traders are still sending stablecoins to exchanges in a sign that the bull run for many cryptocurrencies won’t end “any time soon.”

“Whale accumulation clusters, NVT, on-chain volume profile and other on-chain metrics are showing $52K should be the floor,” the Whalemap team told Cointelegraph.

“BTC’s bull run is not over yet.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.