Bitcoin and crypto Bears Back on MATIC 70% drop

In the last 24 hours, cryptocurrencies were rejected after trying to overcome their resistance levels. Most of the crypto sector is in the red. Bitcoin drops 1.9%, Ethereum -2.1% , Ripple -3.17% and Litecoin -1.84%. Tezos (-7.16%), ALGO (-9.78%), Vechain (-12%), and notably, MATIC (-70%) were among the most harmed. In the Ethereum token sector, there is a majority of assets underwater, although there are notable exceptions such as Link (+8.7%), Jewel (+14.5%), or MovieBloc (+48%).

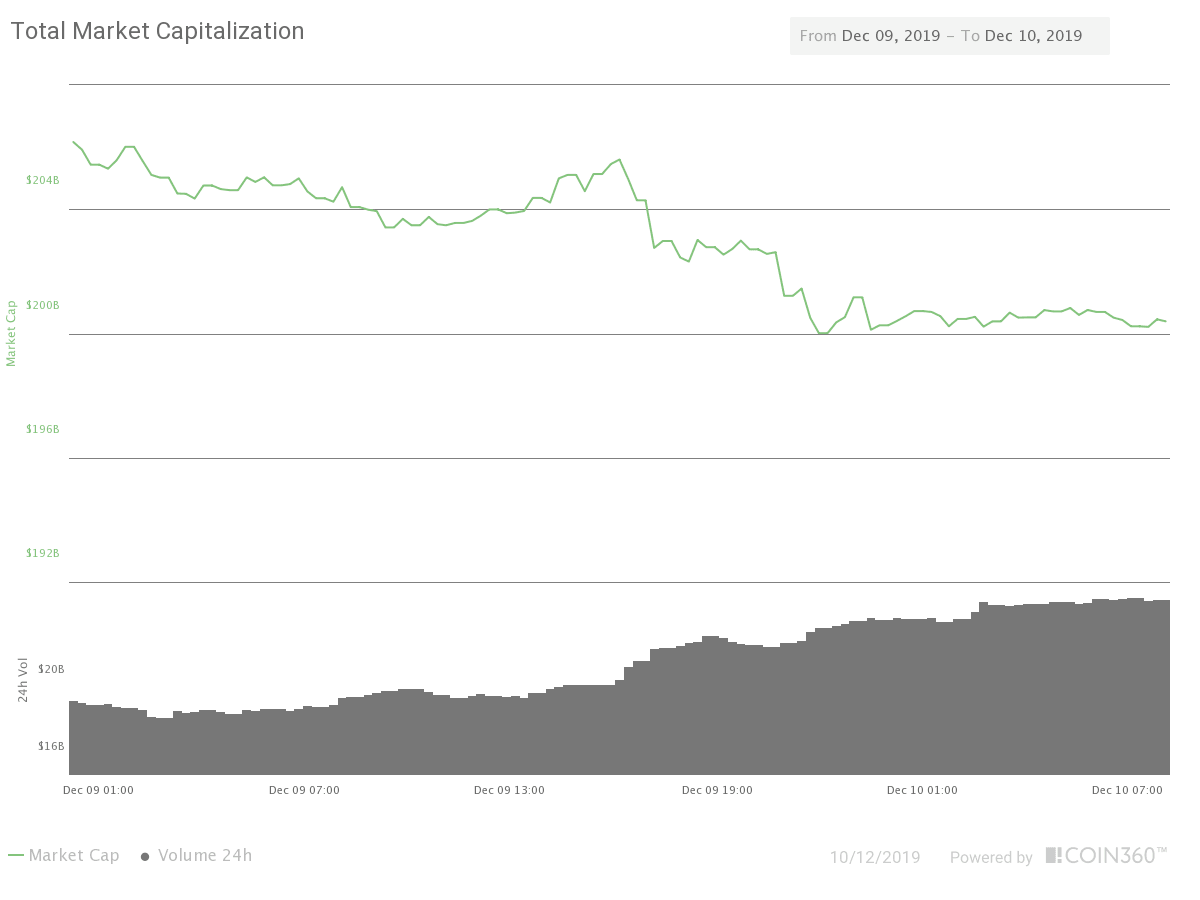

The current market cap descended 2.45% to $200.4 billion on a $25.1 billion traded volume in the last 24H (+37.67%). Meanwhile, Bitcoin dominance keeps at 66.62%.

Hot News

The price of MATIC drops 70% in an hour after climbing 200% in two weeks after rumors of the company liquidated over 1,495 billion coins at #Binance.

Swiss finTech Amun AG, which now is offering crypto ETPs (Exchange-traded products) in Switzerland and Germany, is now approved to provide them within the European Union. Amun offers currently mine crypto ETPs, among which are BTC-ETP, Ether-ETP, and XRP-ETP.

Technical Analysis

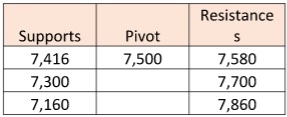

Bitcoin

Bitcoin dropped hard on high volume yesterday, after a spike that brought its price to $7,689 to, then, fall below the $7,416 support and break the triangular formation. The inability to hold above $7,580 brought new sellers eager to take the lot of buyers with buy-stop orders above that level.

Currently, the price is holding above $7,300, but this won't hold for long if the weakness continues. Now we see the MACD in a bearish phase and the price below the -1SD line. Therefore, the critical level to watch is $7,300.

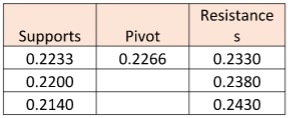

Ripple

Ripple is making a leg down, after being rejected yesterday by the resistance set by its previous high of Nov 30. Now we see the MACD in a bearish phase and the price moving below the -1SD line. We see also the price held by its 50-period SMA, but the weakness is evident, as there are no convincing upward movements.

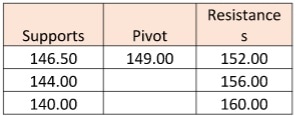

Ethereum

Ethereum was affected by the Bitcoin drop, as was the rest of the sector, but the drop seems unconvincing so far. The price is held but the $146.5 support, and it is making a series of small- bodied candles that are symptoms of indecision on the seller's camp. The MACD is in a bearish phase, although showing no progression. Also, the price is currently touching the -1SD line of the Bollinger Bands, although the bands move horizontally. That means the price also moves in a horizontal range. The critical levels to keep an eye on are $145.6 and $149.

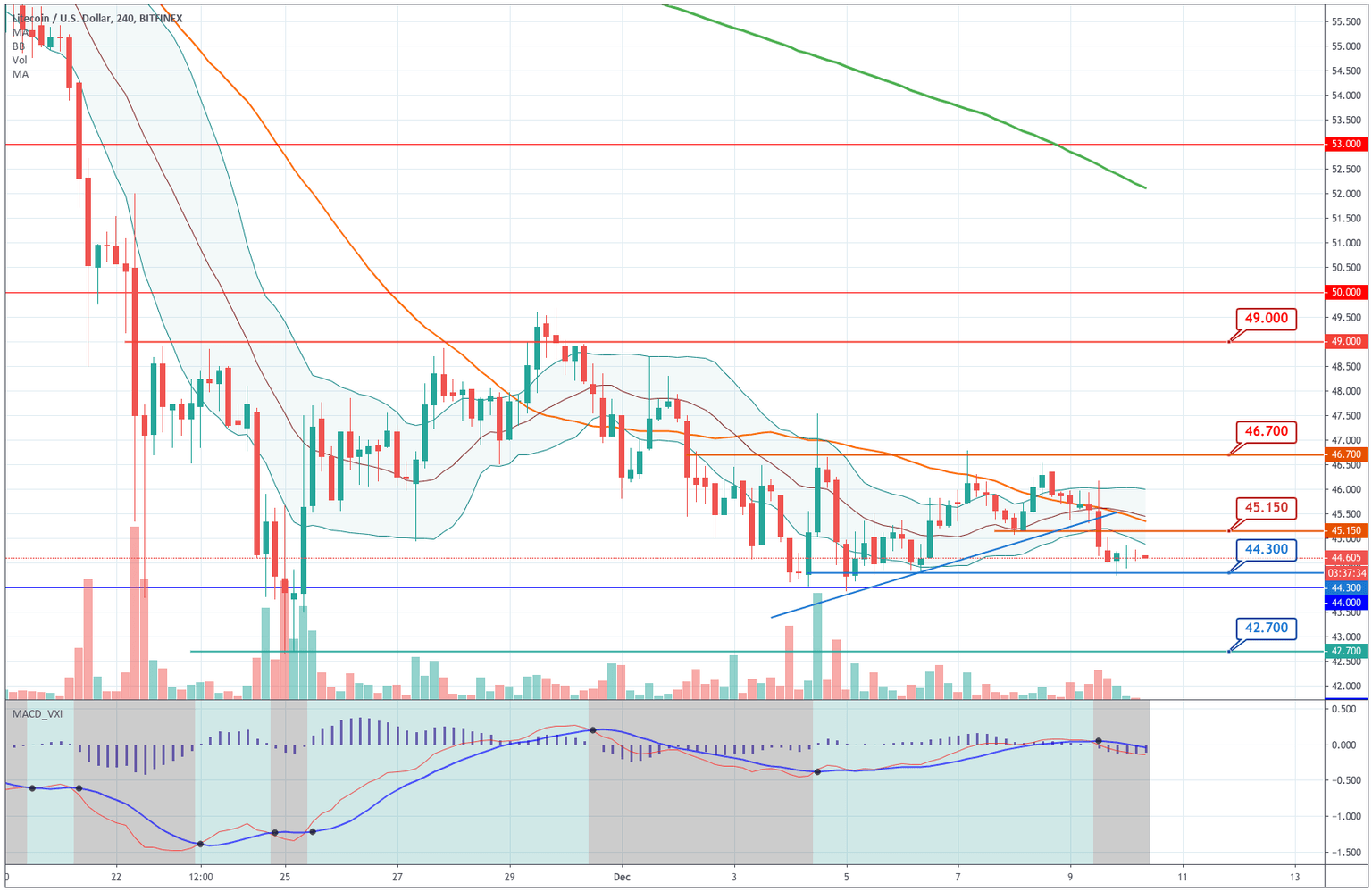

Litecoin

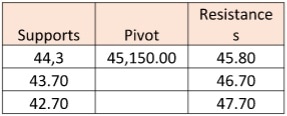

Litecoin made a very similar movement, as Ethereum did. The price dropped at the time of the bitcoin's spike and crossed the $45.15 level to touch the 44.3 support that was at the lows made on Dec 5. Now we see the price losing volatility and making two doji. The price seems to stabilize below the -1SD line while the MACD shifted to a bearish phase. That situation is likely to resolve to the downside if no new buyers come to rescue. The critical levels to keep are $45.15 to for buyers and $44.3 for sellers.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and