Bitcoin, altcoins facing stiff resistance

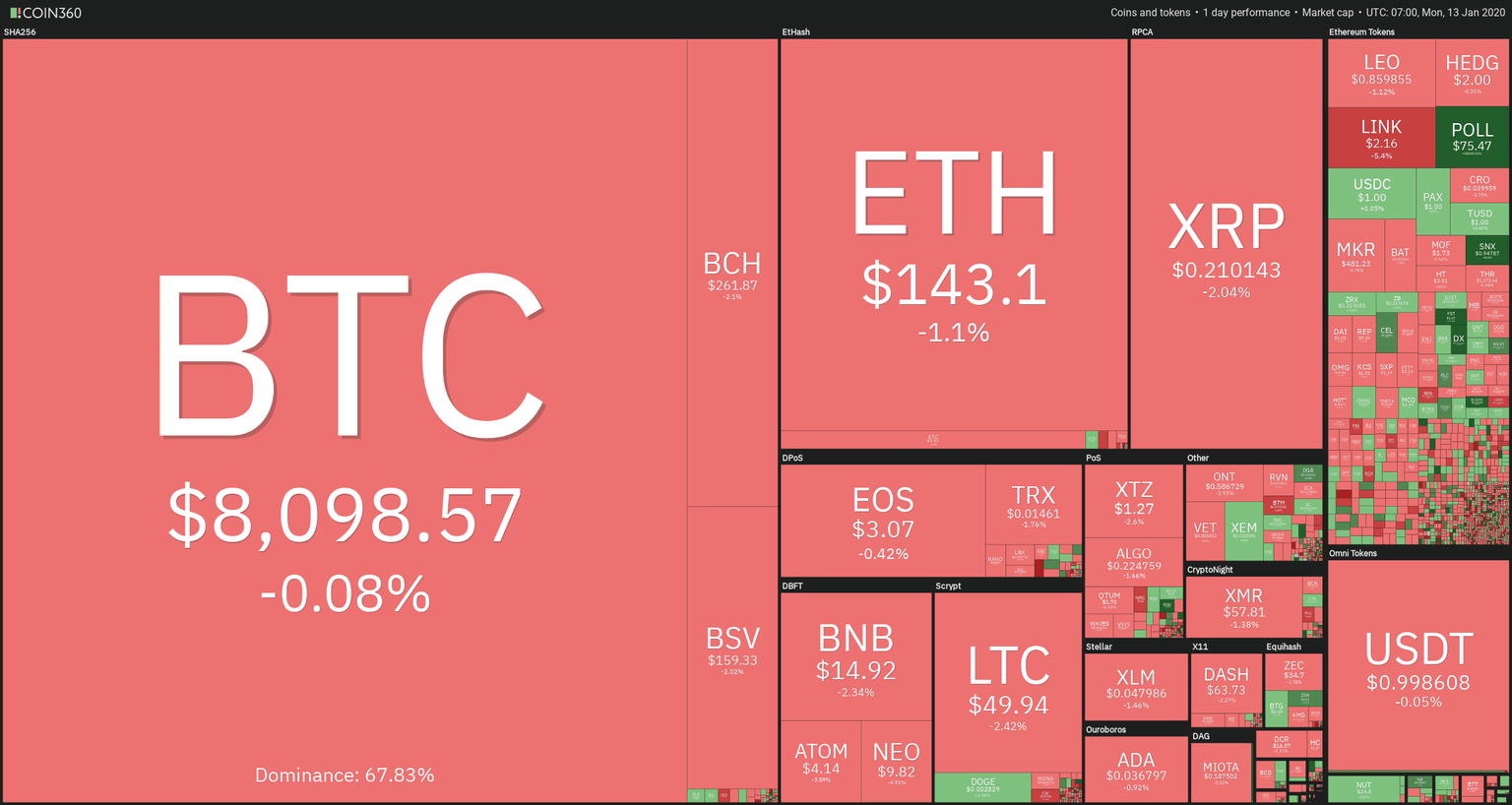

Bitcoin (-0.06%) and altcoins are experiencing selling at key levels that keep their prices in a tight range. XRP (-2.04%), LTC(-2.32%) and XTZ (-2.8%) are the most bearish, and XEM(+1.53%), ZEN(+5.5%), and DIgibyte (+9.65%) are the most bullish. In the Ethereum token sector, POLL is the star of the day with a price jump of $75 (+58,110.35%), Also nicely moving are SNX(+20.36%), and FST(+75%), whereas LINK drops 5%.

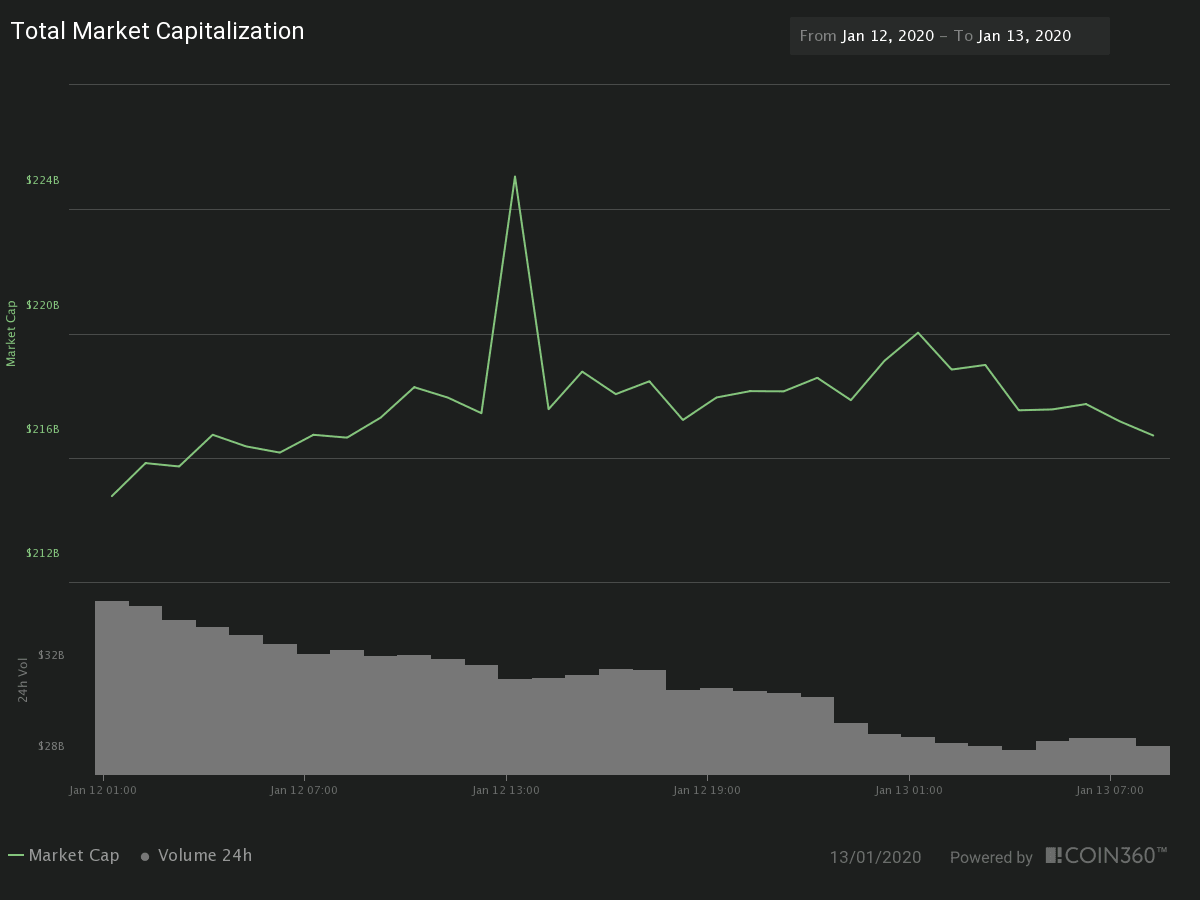

The market capitalization of the crypto sector is now $216.717 billion (+0.85%), and the traded volume in the last 24 hours was $29.3 billion (-18.3%). The market dominance of Bitcoin descended slightly to 67.84%.

Hot News

Block One jas released EOS.io 2.0, bringing major changes to EOS smart contract virtual machine, which is said to enhance performance and improve security.

Leading crypto-asset investment firm Grayscale Investments has filed a total of $2.2 billion in assets under management, according to an official tweet: "01/10/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products. Total AUM: $2.2 billion" (source: AMBCrypto.).

FTX, a crypto-derivatives exchange, has launched Bitcoin options trading. The announcement was tweeted on Jan 11. Later on the same day, they also claimed that the options volume hit $1 million in the next two hours after the announcement.

Technical Analysis

Bitcoin

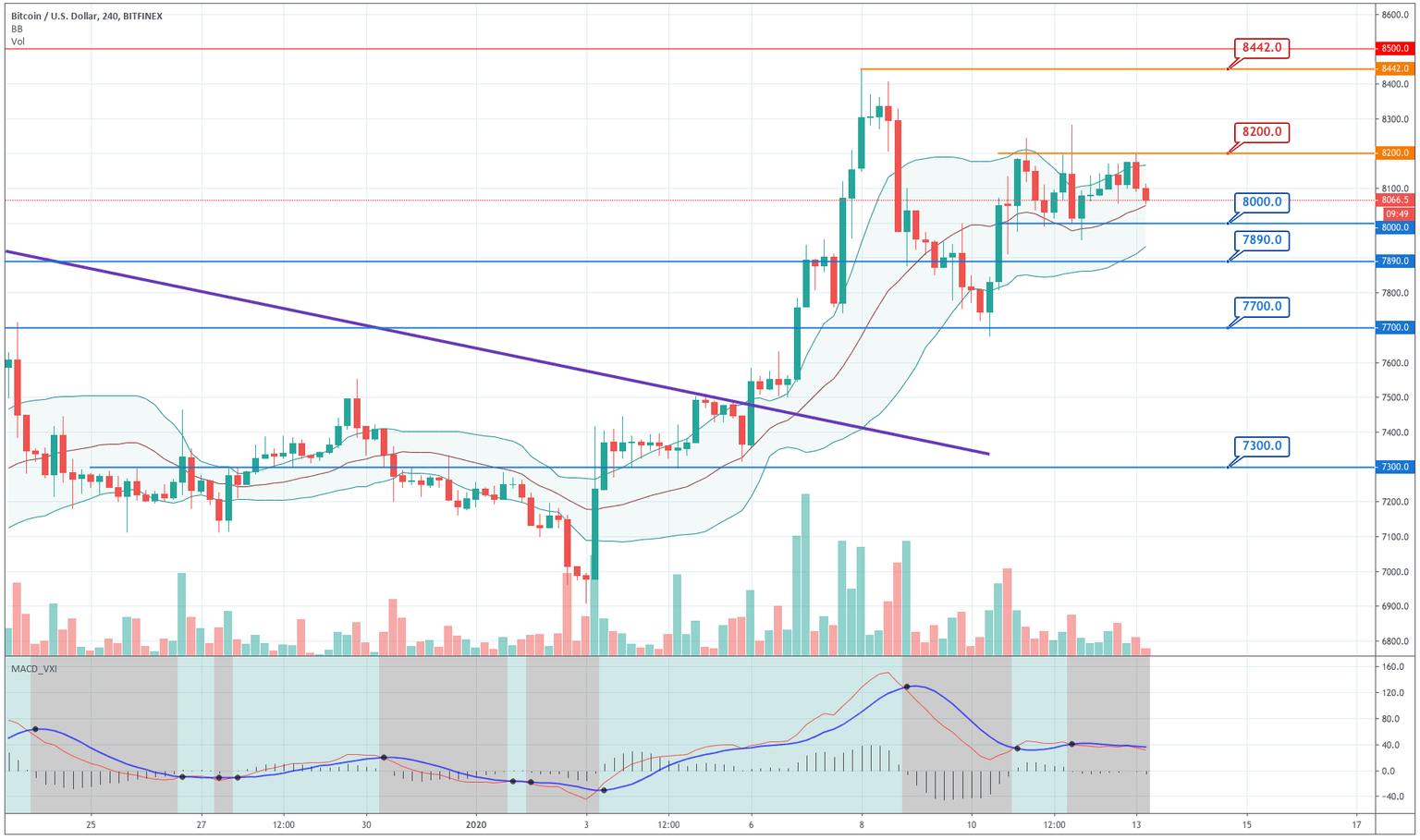

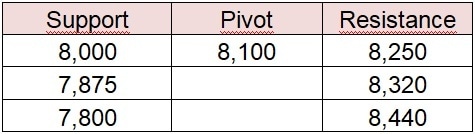

The price of Bitcoin is moving in a tight range between $8,000 and $8,200, as the sellers step in at that level, and buyers hold the price above $8K. The price keeps moving on the upper side of the Bollinger bands, and the MACD is unable to tell any direction. That situation is hinting for a slightly bullish bias.

That impression is confirmed, in the daily chart, with a MACD still bullish and the current price action picturing a triangular formation with higher lows. A break of the $8,200 level might drive BTC's price towards $8,500 and $8,700.

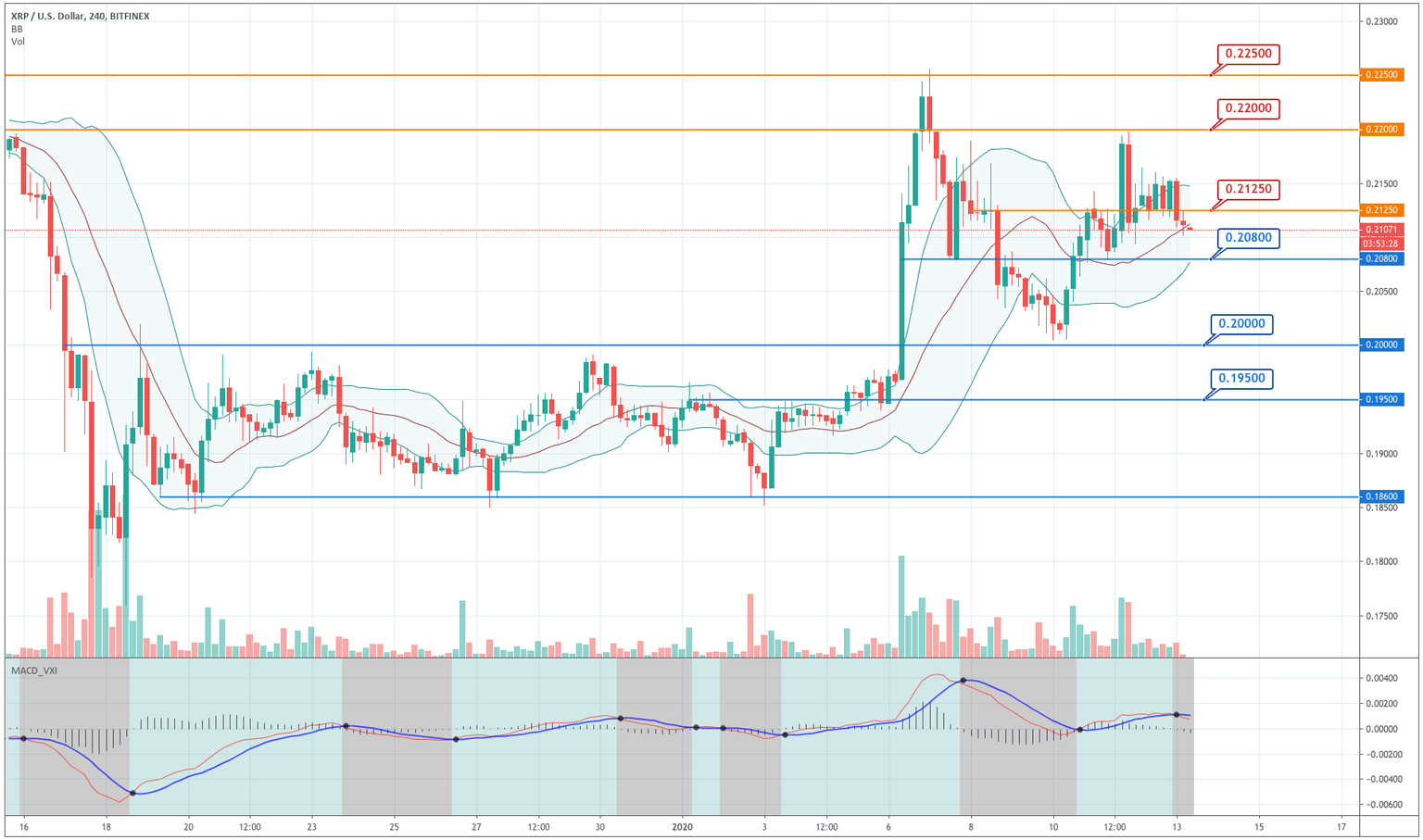

Ripple

Ripple was stopped at $0.22 last Saturday. The price created two candlesticks on strong volume, a bullish one, and a bearish one negating it. The result is that buyers lost their strength, and the price may begin another descent. MACD has made a bearish crossover, and the action is moving to the lower side of the Bollinger bands. We expect the price to test the $0.208 support level. If this level doesn't hold, the price would likely go to test $0.2 again.

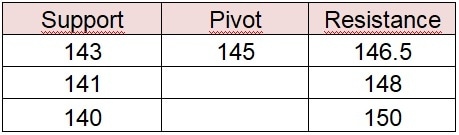

Ethereum

Ethereum's price was rejected twice near $148 in the last 48 hours, the last candle being an engulfing candle. The price has also broken the $144 level moving to the lower side of the Bollinger bands, while the MACD made a bearish transition. $141 is critical to avoid a new visit to $135.

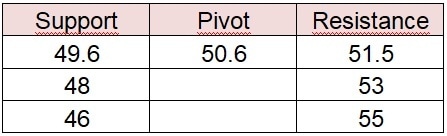

Litecoin has been very bullish since Friday afternoon, although the price has moved in a range on the weekend. The price has hit stiff resistance at $51.5 and now it is struggling to hold the $40.8 resistance level. The price still moves in the upper side of the Bollinger Bands, and the bands themselves have a quite positive slope, the only contrasting note is the MACD showing a bearish phase. Overall, we still keep a bullish bias on LTC.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and