Binance coin price: Will too-eager bulls fold during their attempt to hit $320?

- Binance Coin price jumps over 3% intraday.

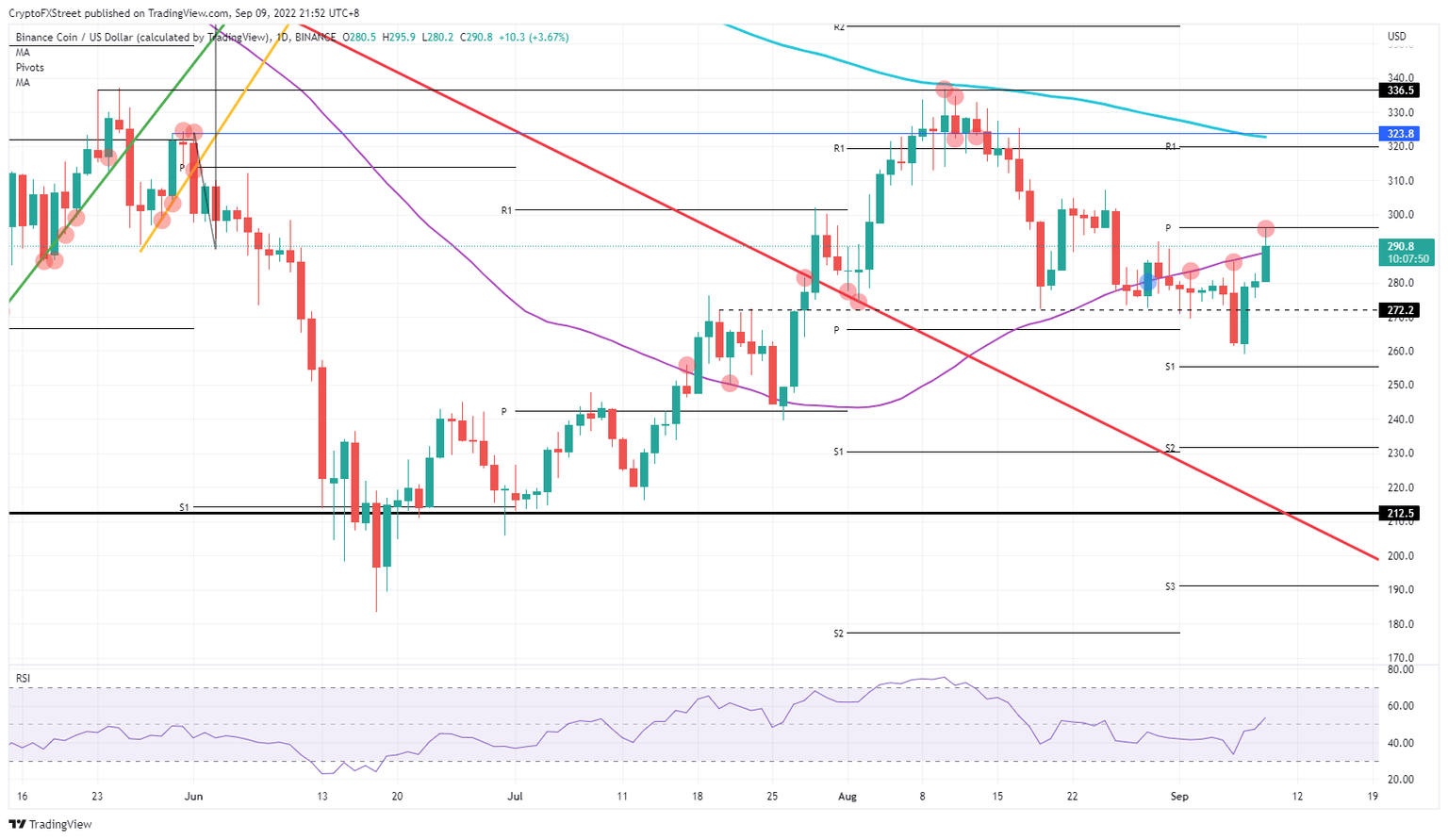

- BNB price hits monthly pivot at $295.70 and undergoes rejection.

- There is a risk price will keep fading and drop back to $260.

Binance Coin (BNB) price action saw bulls storming out of the gate this morning after the world mourned the death of Queen Elisabeth. What followed was some unwinding and profit-taking on dollar long-positions. This opened up room for equities and cryptocurrencies to move higher. Instead of trying to eke out a close above a technical level, bulls went all out to reach for the stars but could tumble back to earth on Monday.

BNB price prints 12% in three days and could stand to lose it all on Monday

Binance Coin price is at risk of dropping substantially after bulls stormed out of the gates on Friday morning during the ASIA PAC and European trading sessions. Unfortunately, they overshot their target, which was to reclaim a cap and tried to hold over the weekend so that on Monday, investors would see a solid entry-level to build upon throughout the trading week. Instead, the bulls went all out to try and reach $300 but failed in their attempt.

BNB price is now at risk of losing the 12% gains it built up in just three trading days, with the 55-day Simple Moving Average possibly proving to be a bull trap and continuing to play its role as a bearish price cap on the top side of Binance Coin price action. Should BNB price close above the 55-day SMA, expect to still see a possibility of it trading higher over the weekend. But should it slip below the 55-day SMA at the US closing bell, expect Monday to see a full paring back towards $260.

BNB/USD Daily chart

Should bulls be able to squeeze out that last piece of price action towards the close this evening, expect to see it printing $300. With that, the monthly pivot will be secured, and even a weekly close above that realised. That would be the utmost bullish scenario possible and could see traders thinking of $320 in the coming week with the monthly R1 and the 200-day SMA falling in line with each other.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.