Binance Coin Price Prediction: An Autumn rally targeting $500

- Binance Doin price printed 2 impulsive waves during summer’s 80% rally.

- A Fibonacci Retracement Tool surrounding the 2nd impulsive wave places the recent swing low at a 50% FIB level.

- Invalidation of the uptrend scenario is 10 % below today's market value at 240.

Binance Coin price shows reasons to believe in one more wave up targeting $474 and $500.

Binance Coin price could rally

Binance Coin price has been somewhat slept on throughout the summer as Ethereum’s Merge narrative continues to headline in the crypto arena. Nonetheless the BNB price quietly rallied 80% since the June 18 flash crash.

During the summer rally the BNB price appears to have printed 2 impulse waves. A Fibonacci retracement tool surrounding the 2nd wave qualifies the current downtrend’ swing low at $270 as a 50% retracement level.

The Volume Profile Indicator confounds the bullish possibility as the bears are consistently tapering amidst the 18% decline since the August 10 swing high at $335. Additionally the BNB price hovers above the 200 week-moving average unlike many of its crypto peers.

On-Chain Metrics

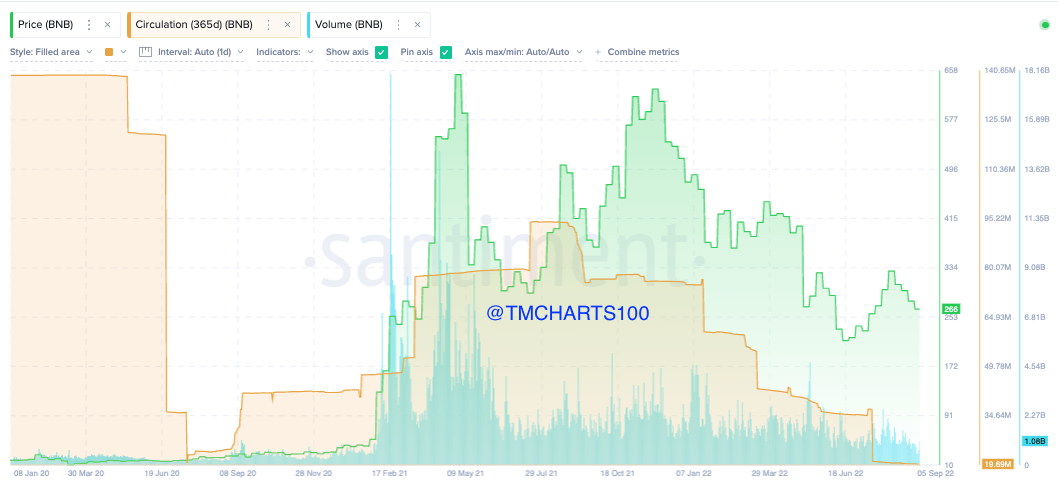

Last month a very interesting on-chain metrics signal was spotted on that indicated extreme bullish undertones for the BNB token. The total 365-day circulating supply has come down to historic lows. At just 21 million tokens, the last time BNB’s circulating supply was this low BNB price traded at $17 in July of 2020.

Santiment's Price, Volume and 365-Day Circulating Supply

When combined Binance Coin price shows great potential for an Autumn rally. Invalidation of the uptrend scenario is 10 % below today's market value at 240.

If the bears breach this level, consider this thesis void, the bears could be able to re-route south targeting the 200-week moving average currently positioned at $171. Such a move would result in a 35% decline from the current BNB price.

In the following video, our analysts deep dive into the price action of Binance Coin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.