Binance Coin price to grow by 20% as BNB consolidation nears an end

- Binance Coin price consolidates under a declining resistance level and a support level at $407.7.

- A breakout from this consolidation could result in a 20% move to $504.22.

- A four-hour candlestick close below $35.45 will invalidate the bullish thesis for BNB.

Binance Coin price is looking to shatter a blockade that has prevented it from moving higher since December 2021. As BNB coils up under this hurdle, a breakout seems like the most plausible outcome.

Binance Coin price awaits catalyst

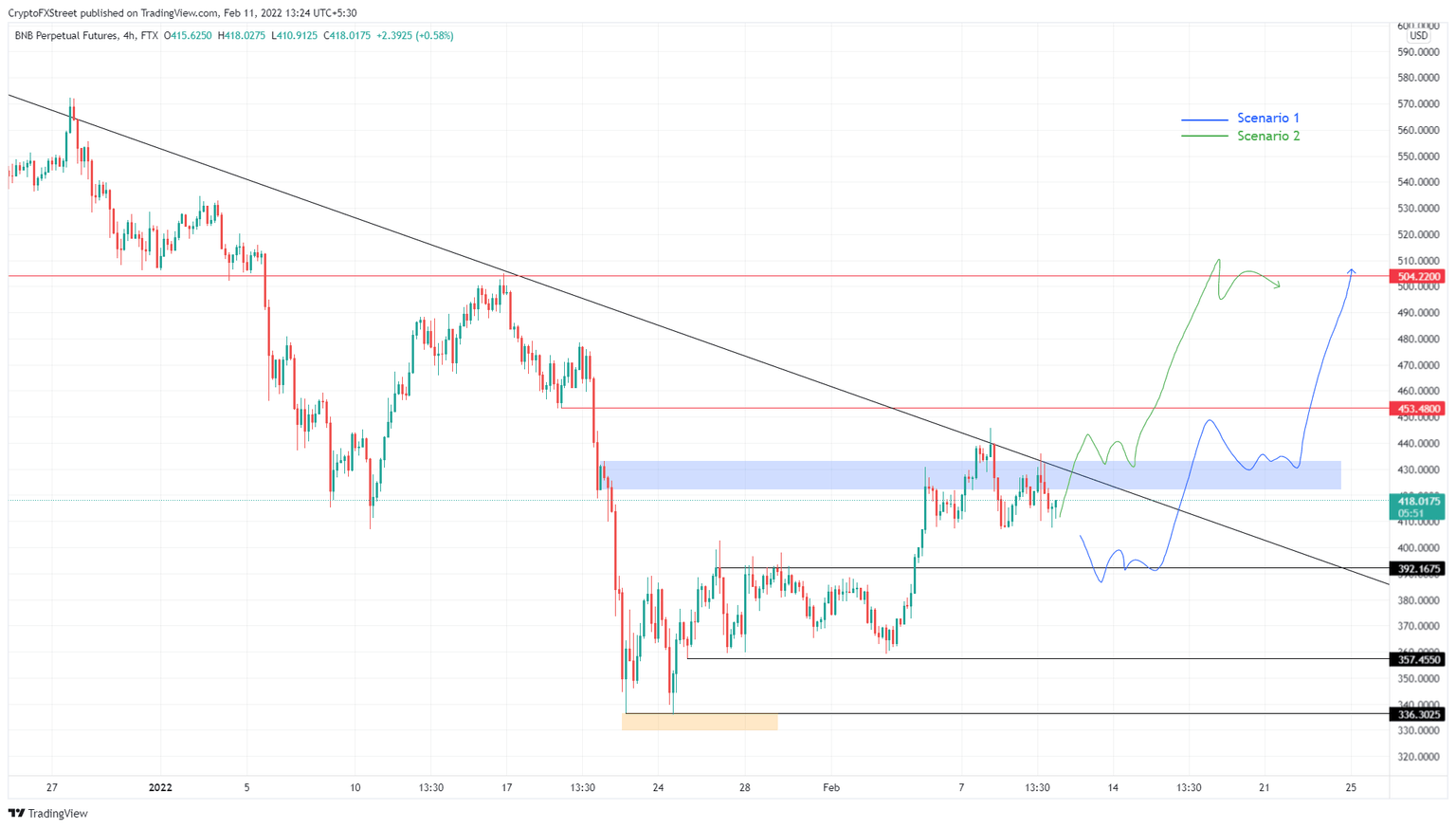

Binance Coin price has retested the declining trend line four times since December 28, 2021. The last two retests have resulted in a consolidation between this hurdle and a support level at $407.70. A breakout from this sideways movement is likely to be accompanied by a massive spike in volatility.

Interested investors could go long BNB upon a breakout at roughly $430 and take partial profits at $453.48. The remaining position can be offloaded at $504.20, bringing the total run-up to 20%. This breakout constitutes scenario one and is a bullish approach.

In a conservative approach, investors can expect Binance Coin price to retrace to the $392.17 support level and make a run for the breakout. In this scenario, market participants can enter a long position at the retest of $392.17 and book profits at $453.48 and $504.20. This move, however, would represent a 28% gain for Binance Coin price.

BNB/USDT 4-hour chart

While things are looking optimistic for Binance Coin price a breakdown of the $392.17 support level will complicate things. A four-hour candlestick close below $357.46 will create a lower low and invalidate the bullish thesis.

Such a development will open the path for market makers to push Binance Coin price to $336.30 or lower to collect liquidity resting below the double bottom formed in January.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.