Binance Coin Price Analysis: BNB could retrace to $25 in the short-term despite uptrend

- Several indicators are showing that BNB could be on its way to a retracement.

- BNB is currently trading at $27.1 after a strong rebound from $22.

BNB outperformed the market during September jumping to $33 after several positive announcements from Binance. The rally didn’t last too long, and the digital asset quickly fell to previous trading prices.

Is the hype of BNB coming to a pause?

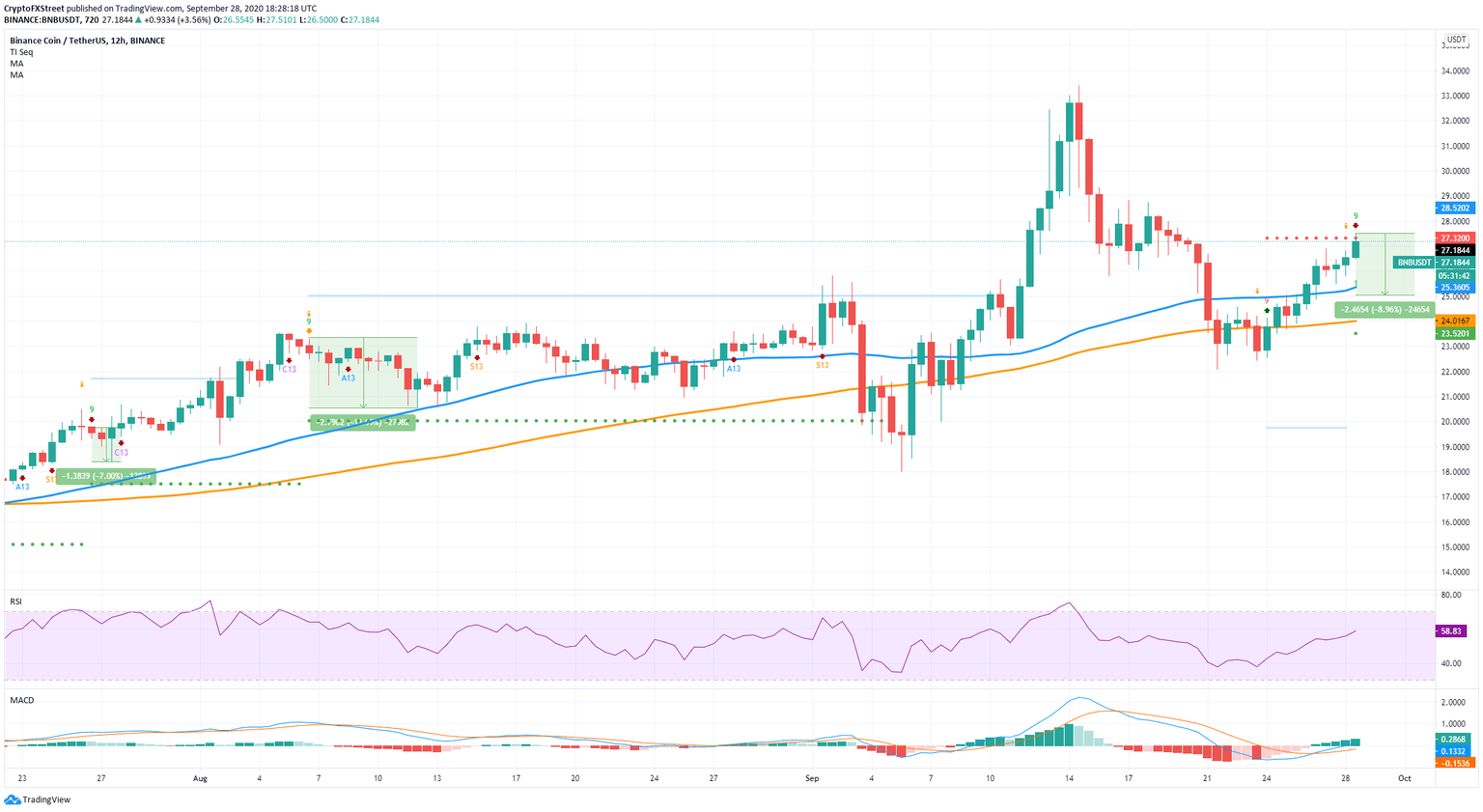

The last major correction started on September 14 and took BNB price down from $33.3 to $24.4. Bulls were able to push the price back up to a current high of $26.8, climbing above the 12-hour 50-MA and 100-MA.

BNB/USD 12-hour chart

On the 12-hour chart, the TD sequential indicator has presented a sell signal. The last two signals on this time frame were both validated and dropped the price of BNB by an average of 9%. A similar dip would take BNB to $25, just below the 50-MA at $25.3 currently.

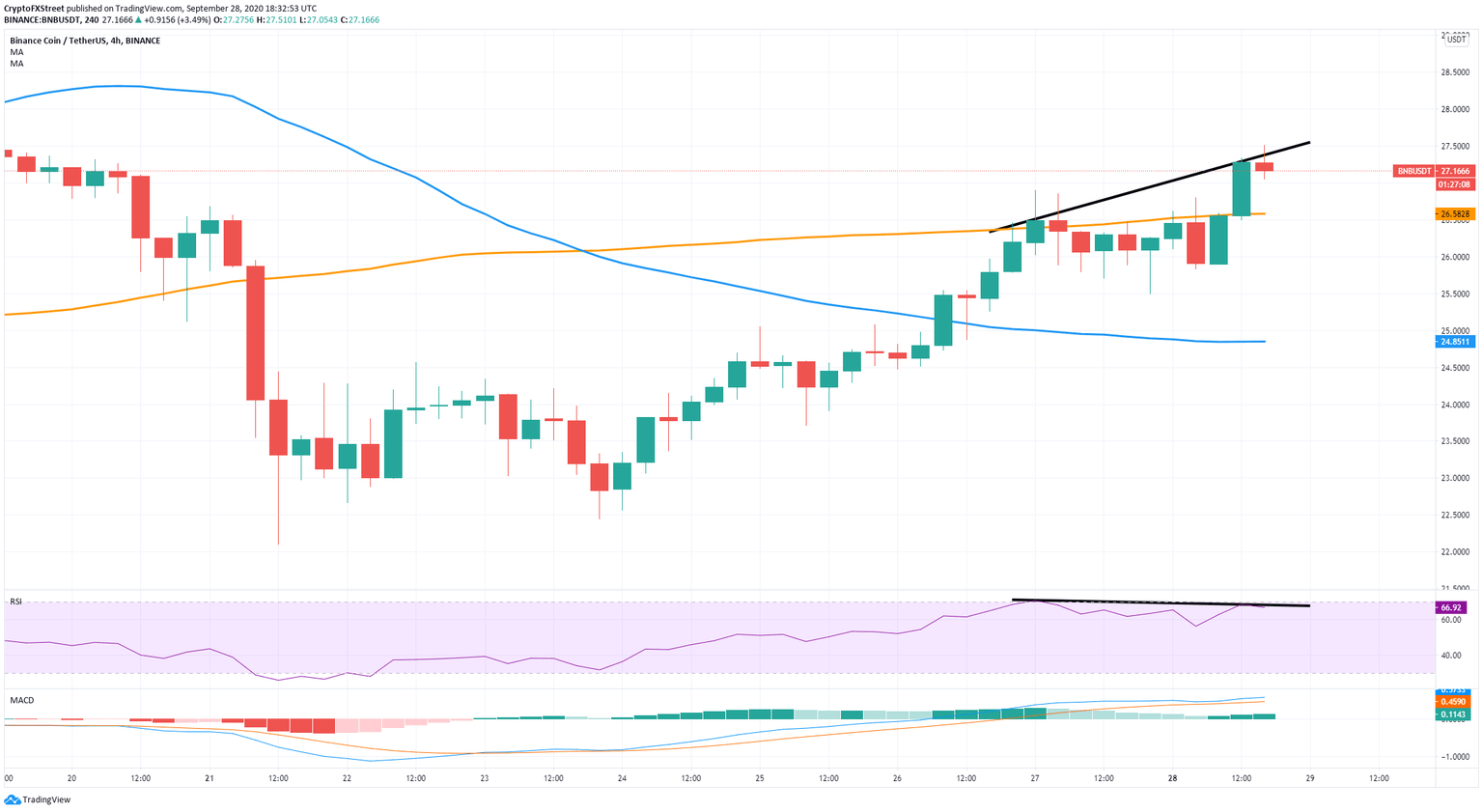

BNB/USD 4-hour chart

The native coin of Binance seems to have created a bearish divergence between its price and the RSI. This happens when the uptrend of the price doesn’t match the trend of the RSI. It usually means that momentum is slowing down, and the price is likely to see a rapid decline in the short-term.

BNB Holders Distribution Chart

The chart presented by Santiment seems to prove our theory further. The number of holders between 100,000 and 1,000,000 BNB coins and between 1,000,000 and 10,000,000 has increased since August 11. However, the number of whales has stopped growing since September 14. This metric is showing a lack of interest in the digital asset in the past two weeks.

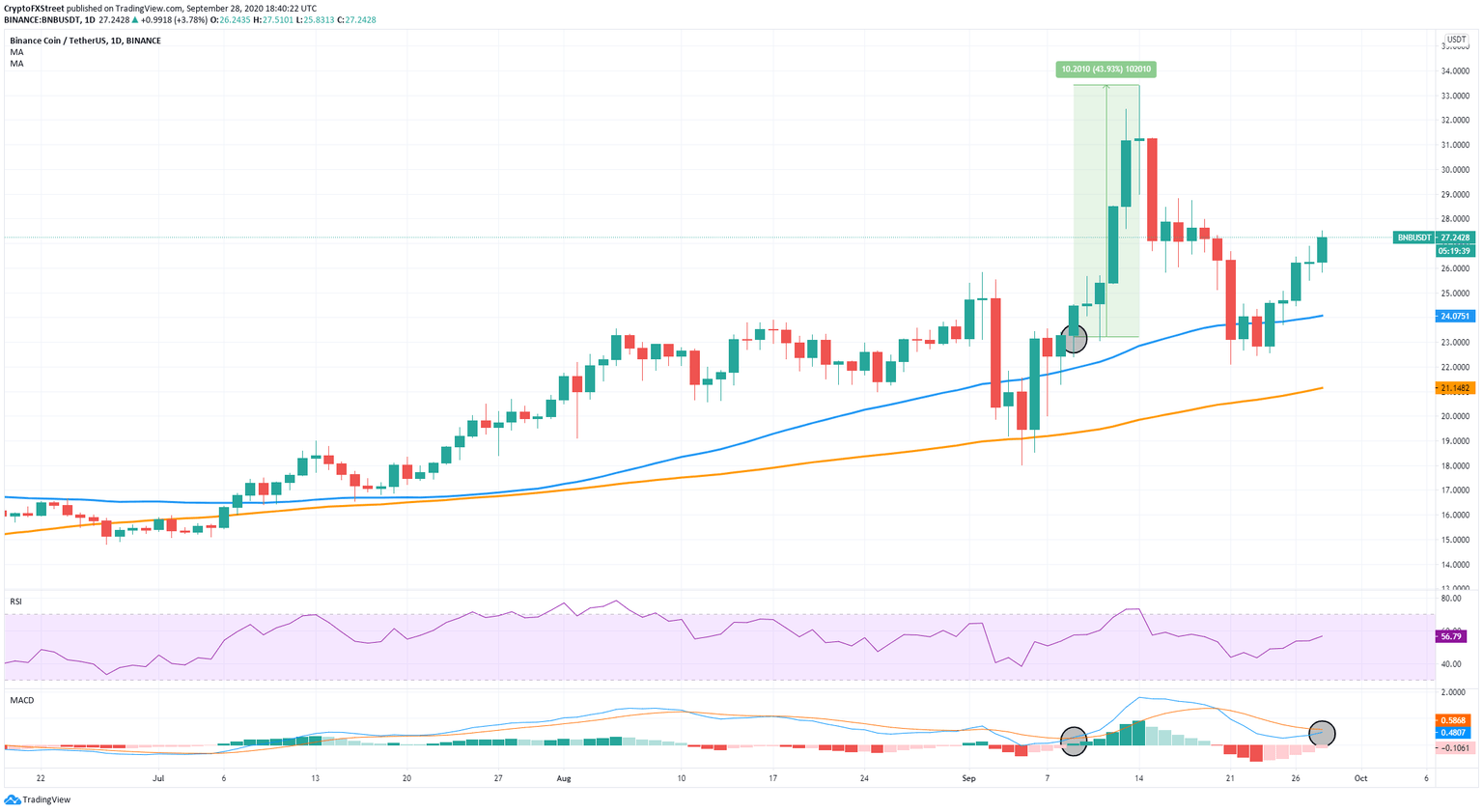

BNB/USD daily chart

Although the shorter time-frames show a bearish outlook for BNB, zooming out to the daily chart can give us a better perspective of the price action. The MACD is on the verge of turning bullish, and the price of BNB is trading above the 50-MA. The last time the MACD crossed positively, BNB rallied up by 44%.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B20.34.32%2C%2028%20Sep%2C%202020%5D-637369153836745614.png&w=1536&q=95)