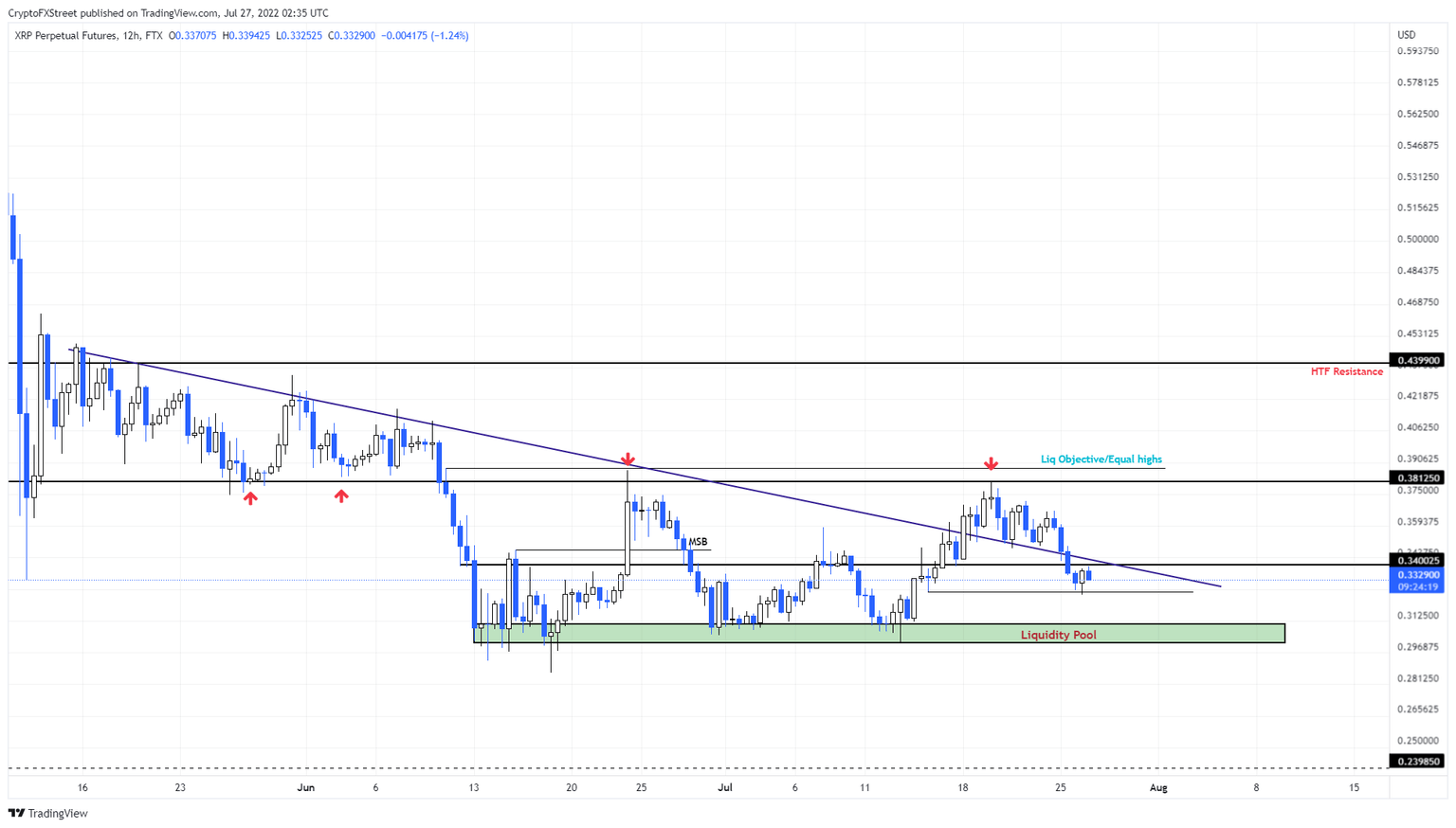

Being bullish on XRP price before this level is an easy way to lose money

- XRP price has retraced 12% after failing to move past the $0.381 hurdle.

- Ripple is likely to dive lower before arriving at a stable support area, extending from $0.301 to $0.310.

- A daily candlestick close below $0.301 will trigger a 22% crash to $0.239.

XRP price shows little strength as it continues to tumble after rejection at a significant resistance barrier. The ongoing downtrend is likely to continue as investors continue to book profits and drive the altcoin lower.

XRP price could see a limited bounce

XRP price saw massive gains in the third week of July as it retested the $0.381 resistance barrier for the second time. However, this move failed to push past the said level, leading to a reversal and a 12% retracement consequently.

Judging from the sentiment in the market, the retracement will continue until a stable support level is discovered. Investors can expect XRP price to stabilize around the liquidity pool, extending from $0.301 to $0.310.

Assuming the sellers take a break, investors can expect a small bounce. The originating uptrend here is unlikely to make it far. Therefore, market participants should exercise caution with regard to trading XRP price.

If Bitcoin price crashes below $19,000 again, this might get extremely bearish. Such a market development could push the XRP price down by 22% to $0.239.

XRP/USDT 1-day chart

On the other hand, if XRP price produces a daily candlestick close above $0.381, the bearish outlook will face invalidation. In such a case, XRP price might attempt a push to the $0.439 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.