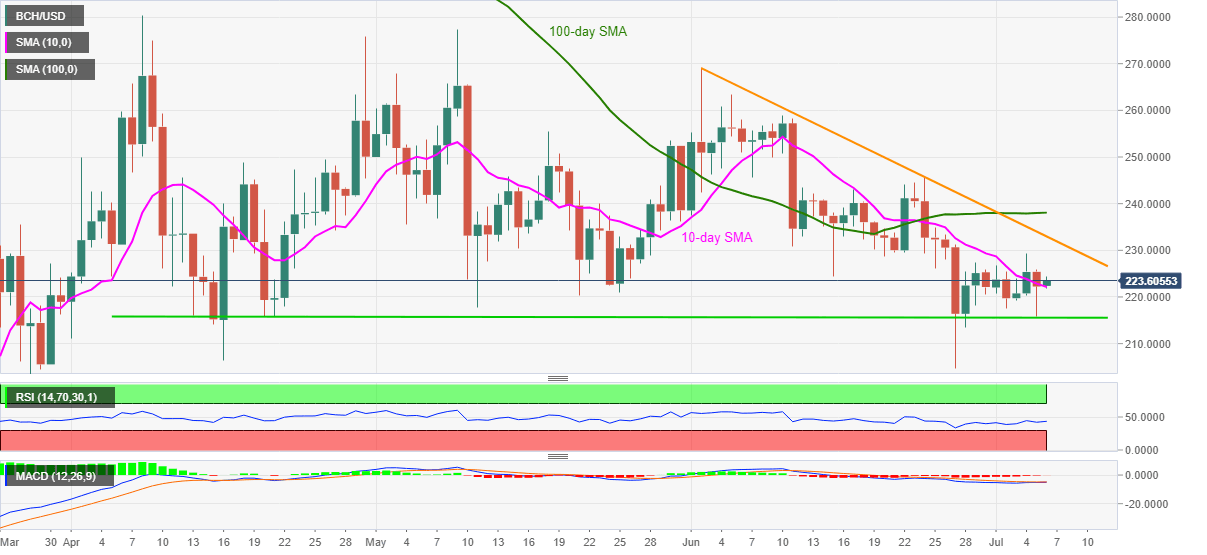

BCH/USD Price Analysis: Bounces off 10-day SMA to regain 223.00

- BCH/USD refrains from extending Sunday’s losses below 220.00.

- MACD, RSI suggest gradual recoveries toward monthly resistance line.

- Seller will attack Friday’s low during fresh downside ahead of aiming June month’s bottom.

BCH/USD takes the bids near 223.50, up 0.60% on a day, while heading into the European session on Monday. In doing so, the quote recovers from 10-day SMA and takes clues from price-positive MACD, RSI conditions.

As a result, the bulls may again attempt to break a downward sloping trend line from June 02, around 233.00 now. However, Saturday’s top near 229.30 and 230.00 threshold could offer intermediate halts during the rise.

In a case where the bulls dominate past-233.00, 100-day SMA near 238.00 and the June 24 top close to 245.50 could become their favorites.

On the contrary, the pair’s declines below the 10-day SMA level of 222.12 could take rest on 220.00 before highlighting a horizontal line stretched from April 13, near 215.50.

Although 215.50/55 is likely to trigger the pair’s pullback, a failure to do so could divert sellers towards 200.00 psychological magnet with June 27 low near 204.63 expectedly being a buffer.

BCH/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.