Band Protocol Price looks for a pullback after a 34% upswing to $5.2

- BAND price has seen a 34% explosion in the past 48 hours, jumping to $5.2.

- The digital asset is ready for a pullback after such a hefty price spike.

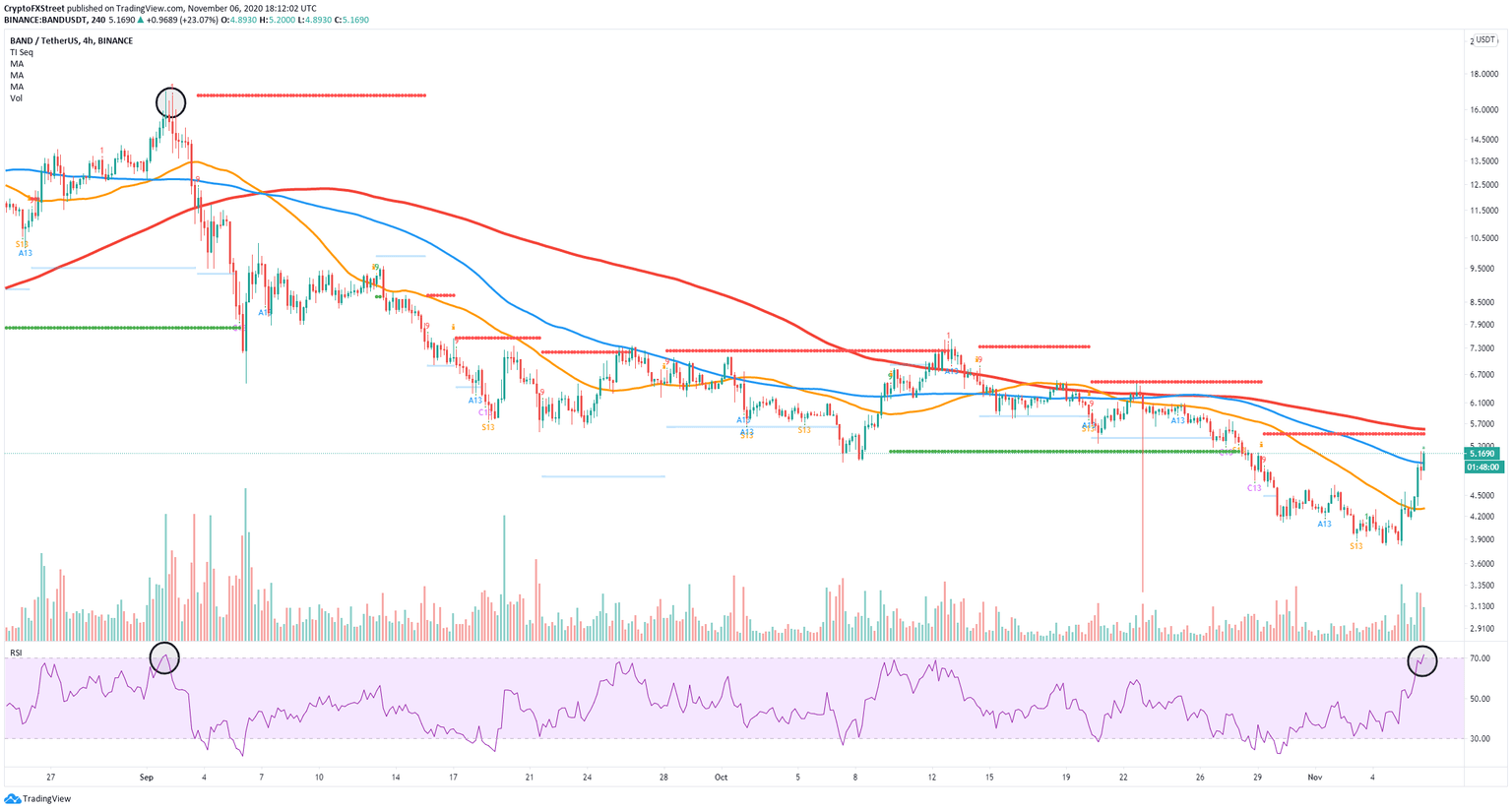

BAND has been trading in a daily downtrend since its 2020-high at $17 formed on September 2. Despite the recent 34% upswing, the digital asset is still down by 70%, trying to recover. The TD Sequential indicator is on the verge of presenting a sell signal on the 4-hour chart, which could spark a pullback.

BAND's price at risk of a pullback if the sell signal materializes

The TD Sequential indicator on the 4-hour chart has presented a green '8' signal, usually followed by a green '9', representing a strong sell signal. Additionally, the RSI hasn't been as overextended as it is now since September 2.

BAND/USDT 4-hour chart

On September 2, BAND's price dropped by more than 60% within the next week after the RSI got overextended. Validation of the sell signal in conjunction with the RSI can drive BAND's price towards the 50-SMA at $4.30.

BAND IOMAP chart

Despite the strong sell signals, the IOMAP chart shows that BAND still has some more room for growth before a pullback. The resistance area between $5.4 and $5.55, where 158 addresses purchased 1.03 million BAND seems to be the most significant range.

Looking at the 4-hour chart, it seems that the range described above coincides with the 200-SMA, which is located at $5.6, which means this level is a potential bullish price target in the short-term. Additionally, the IOMAP chart also shows a strong support range between $4.92 and $5.07.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.