Axie Infinity price waits for no one, as AXS prepares for launch

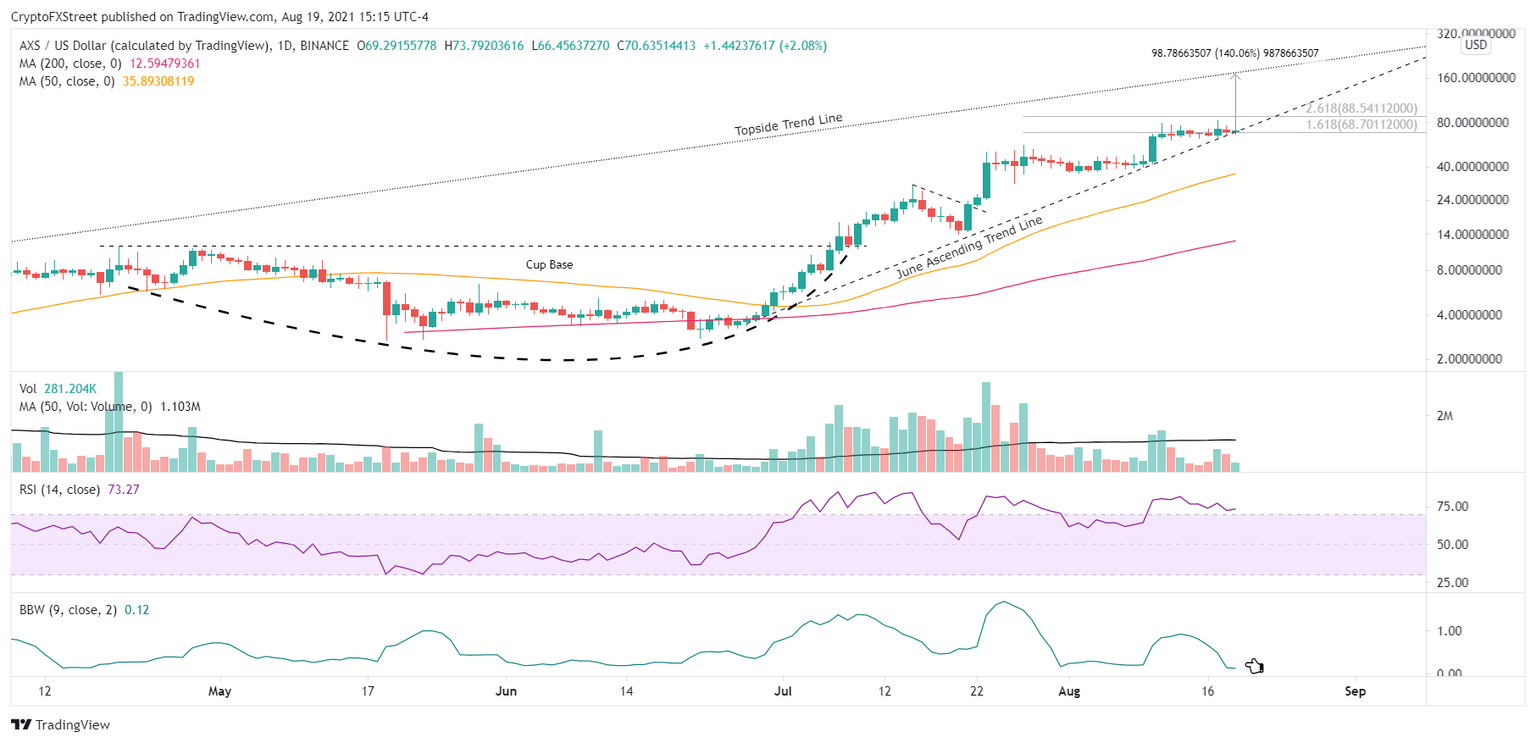

- Axie Infinity price steadies on the 161.8% Fibonacci extension of the early August consolidation at $68.70.

- The nine-day Bollinger Band Width (BBW) is the tightest since trading began last year, pointing to a sharp move.

- AXS volume profile continues to show accumulation over distribution, despite tremendous gains.

Axie Infinity price has been transacting in a very tight range since the August 10 spike higher of 47.59%, squeezing the Bollinger Bands to the tightest reading since trading began in 2020. The price compression combined with the June ascending trend line and no hint of distribution suggests that AXS is on the cusp of another sharp move.

Axie Infinity price compression seeks resolution

Axie Infinity price has delivered impressive returns since the June low of $2.78, accented by large positive days of 40-70% and forecasts for $100.00. Meanwhile, underlying the decisive advance has been a steady accumulation/distribution profile, with heavy volume on positive days and below-average volume on negative days, underscoring the strength of the AXS bid.

The absence of selling has generated a new consolidation phase since the August 10 spike higher of 47.59%. Over the last nine days, the Axie Infinity price compression has squeezed the BBW to the lowest reading on record.

Adding to the timeliness of the AXS situation is the support currently offered by the June ascending trend line crossing with the 161.8% extension of the August consolidation at $68.70. A daily close below the trend line would risk the larger uptrend.

A resurgence of the AXS advance would strike some resistance at the 261.8% extension of the August consolidation at $88.54 before ramping higher to the psychologically important $100.00. If Axie Infinity price can record a weekly close above $100.00, it would renew the forecasts for a test of the topside trend line beginning at the November 2020 high and passing through the April 2021 high. A rise to the trend line would represent a 140% profit from the price at writing.

A technical obstacle to the ambitious Axie Infinity price forecast is the current overbought condition on the daily and weekly Relative Strength Indexes (RSI). The consolidation in early August and now have not reset the momentum count, limiting the runway for a new AXS leg higher.

AXS/USD daily chart

For now, Axie Infinity price needs to hold the intersection of the June ascending trend line with the 161.8% extension around $68.70 on a weekly closing basis, or the bullish AXS narrative will lose credibility.

Axie Infinity price is in a timely position for a burst higher, as the price compression and the strong support are currently working together. It is difficult to calculate if the rip will mimic the August 10 or July 23 gains but the overbought conditions on both RSIs question the sustainability of the AXS resolution to the upside. Nevertheless, speculators should not blink, or they will miss a fresh trading opportunity.

Here, FXStreet's analysts evaluate where AXS could be heading next as it looks prime for volatility.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.