Axie Infinity price consolidates ahead of breakout to $80

- Axie Infinity price continues to hold the $65 value area as its immediate support zone.

- Several attempts to push AXS lower have been met with responsive buying pressure.

- AXS is positioned for a substantial breakout with limited downside risks.

Axie Infinity price faced intense selling pressure during the release of the U.S. CPI data. The data was higher than expected, and fears of the Fed introducing higher rates returned, but those concerns were already known. As a result, the initial selling pressure across all risk-on markets resulted in a massive ‘buy-the-dip’ opportunity for AXS longs.

Axie Infinity price poised to launch to $80

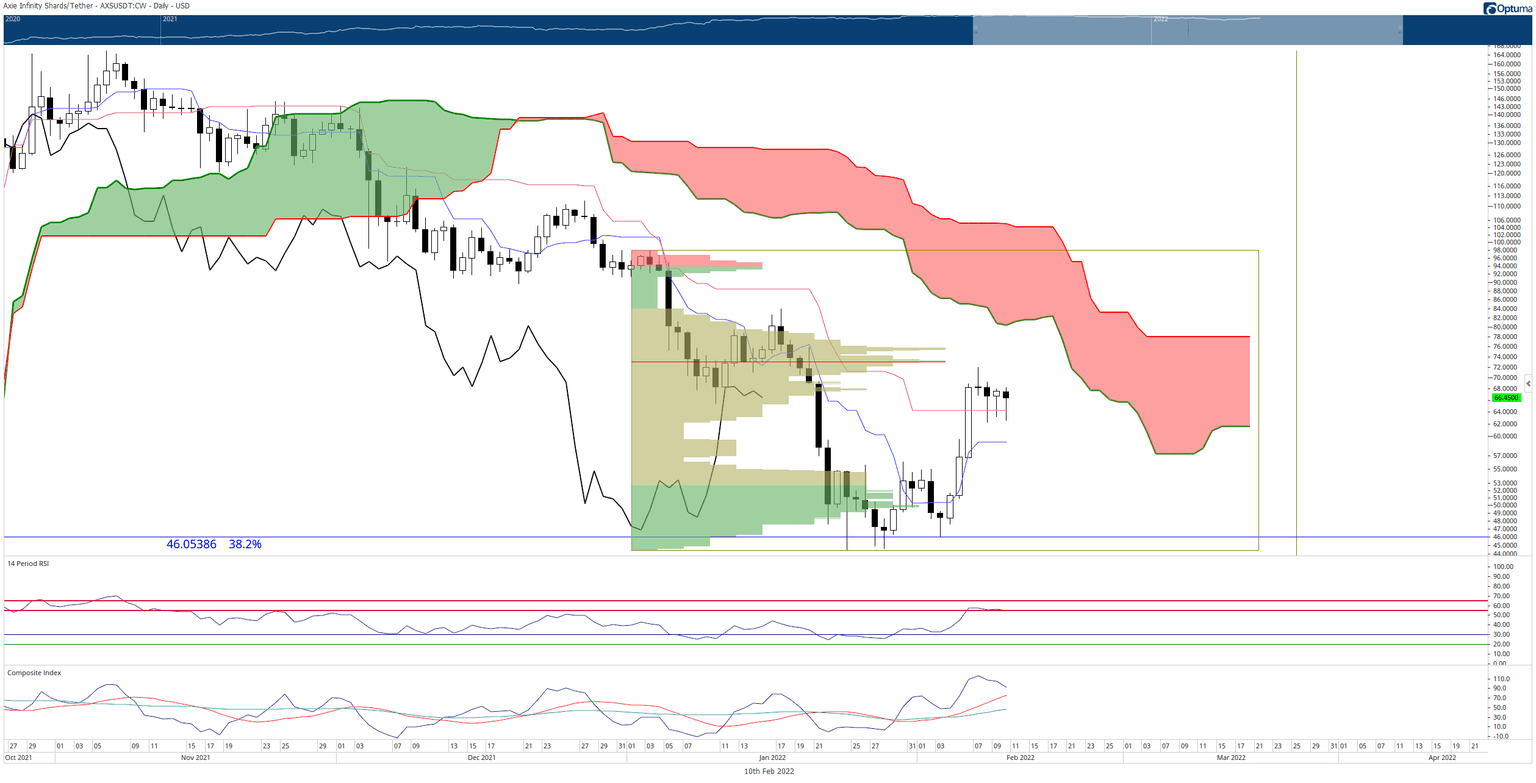

Axie Infinity price action has been on a roller-coaster of intraday price swings during the Thursday session. The worse-than-expected US CPI data resulted in AXS collapsing nearly 7% before rallying and recovering the entirety of that loss. Today’s drop represents the third consecutive day that bears have attempted to push AXS to a close below the Kijun-Sen – all attempts so far have failed.

The key, near-term resistance Axie Infinity price needs to close above is the $70 level. A close at $70 would break the current resistance between $68 and $69. Enough momentum and stops would be triggered that a spike to the bottom of the Ichimoku Cloud (Senkou Span A) at $80 would be highly likely.

AXS/USDT Daily Ichimoku Kinko Hyo Chart

Downside risks are likely limited to the Tenkan-Sen at the $59 level. However, a close below the Tenkan-Sen could likely trigger a bearish continuation move that could threaten a breakout below the current 2022 lows in the $40 range.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.