AVAX price increasingly hopeless, may retest $57

- AVAX price continues to trade in the same value area as in November 2021.

- Bulls and bears continue to ping-pong above and below the $75 price level.

- Price action is markedly bearish, but bulls can easily turn the trend around.

AVAX price shows a similar bearish structure across the entire altcoin market. The weak technical levels on the candlestick chart are exacerbated by weak economic data, inflation fears, and Russia's continued invasion of Ukraine. But despite a series of black swan events and unknowns, AVAX has held up surprisingly well.

AVAX price action confirms bearish breakout setup, warning of a 25% move lower may be coming soon

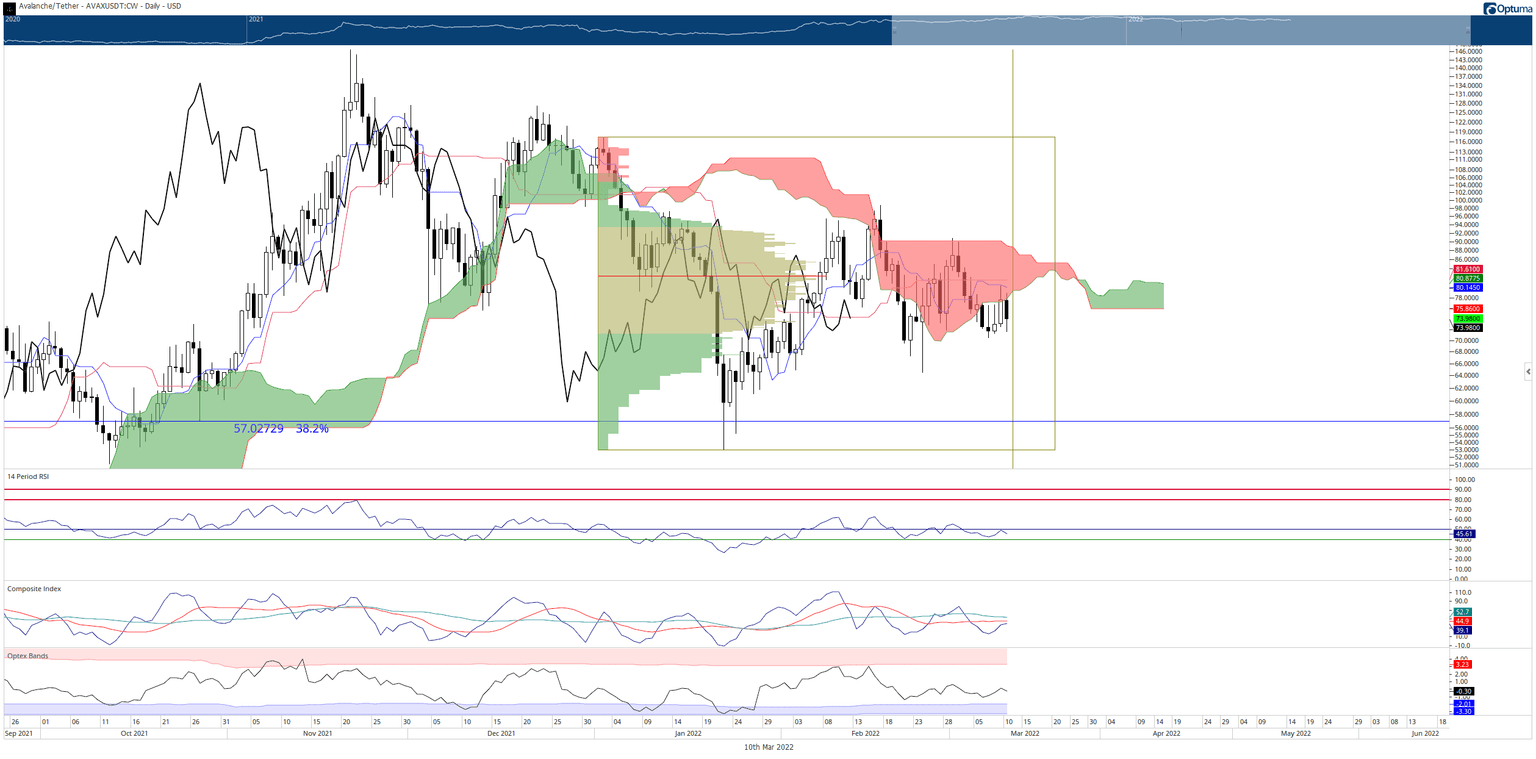

AVAX price confirmed an Ideal Bearish Ichimoku Breakout entry this past Sunday (March 6, 2022), but without any follow-through selling. Instead, buyers spent Monday – Wednesday attempting to push AVAX back inside the Ichimoku Cloud but have been handily rejected from doing so.

The rejection has occurred in the $81 value area. It contains the bottom of the Ichimoku Cloud (Senkou Span A), the Tenkan-Sen, the Kijun-Sen, and the 2022 Volume Point Of Control. In other words, $81 represents the single largest and strongest collection of resistance currently on the daily AVAX price chart.

Sellers may view the rejection on Thursday as confirmation that that initial break is valid and genuine. If that is true, short-sellers may pile into AVAX price and begin another round of bearish price action. The likely target is returning to the 38.2% Fibonacci retracement at $57.

AVAX/USDT Daily Ichimoku Kinko Hyo Chart

If bulls want to invalidate this near-term bearish outlook, they will need to push AVAX price to a close above the Ichimoku Cloud or at least back inside the Cloud and above the Tenkan-Sen and Kijun-Sen at or above $83. A close above the Ichimoku Cloud near $90 would probably terminate any further bearish forecasts because AVAX price would likely enter a new bullish expansion phase.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.