Asia has no “New York times of crypto” and that matters for your media strategy

Asian crypto news does not live in one market or one model. Our Q2 2025 survey of media founders, editors, and KOLs maps three competing ecosystems: venture-driven media groups, exchange-anchored networks, and independent outlets under tight regulation. This report shows who actually shapes information in Vietnam, China, Hong Kong, South Korea, Japan, and Indonesia, and what that means for teams that try to reach those audiences.

Key takeaways –TL, DR

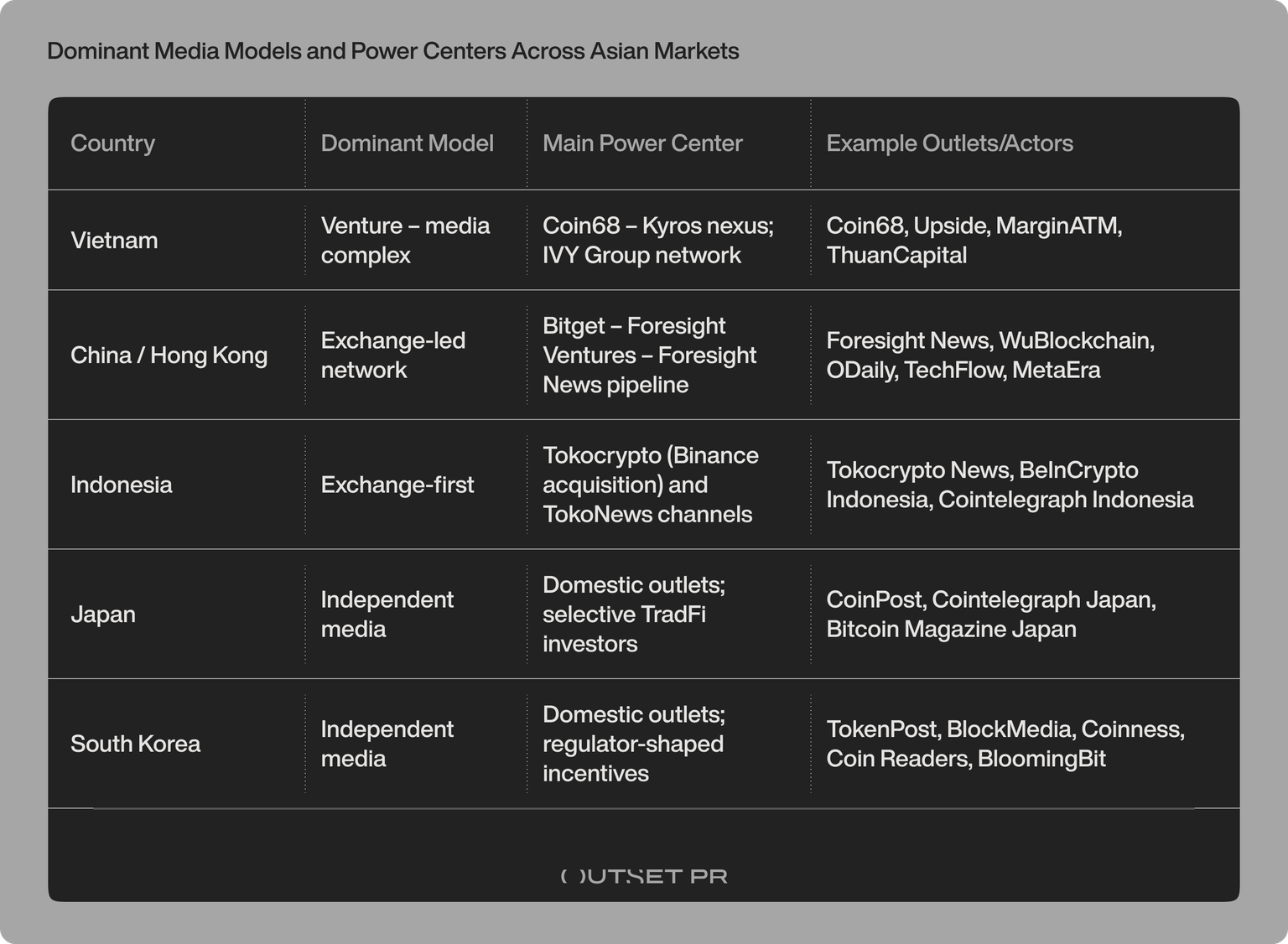

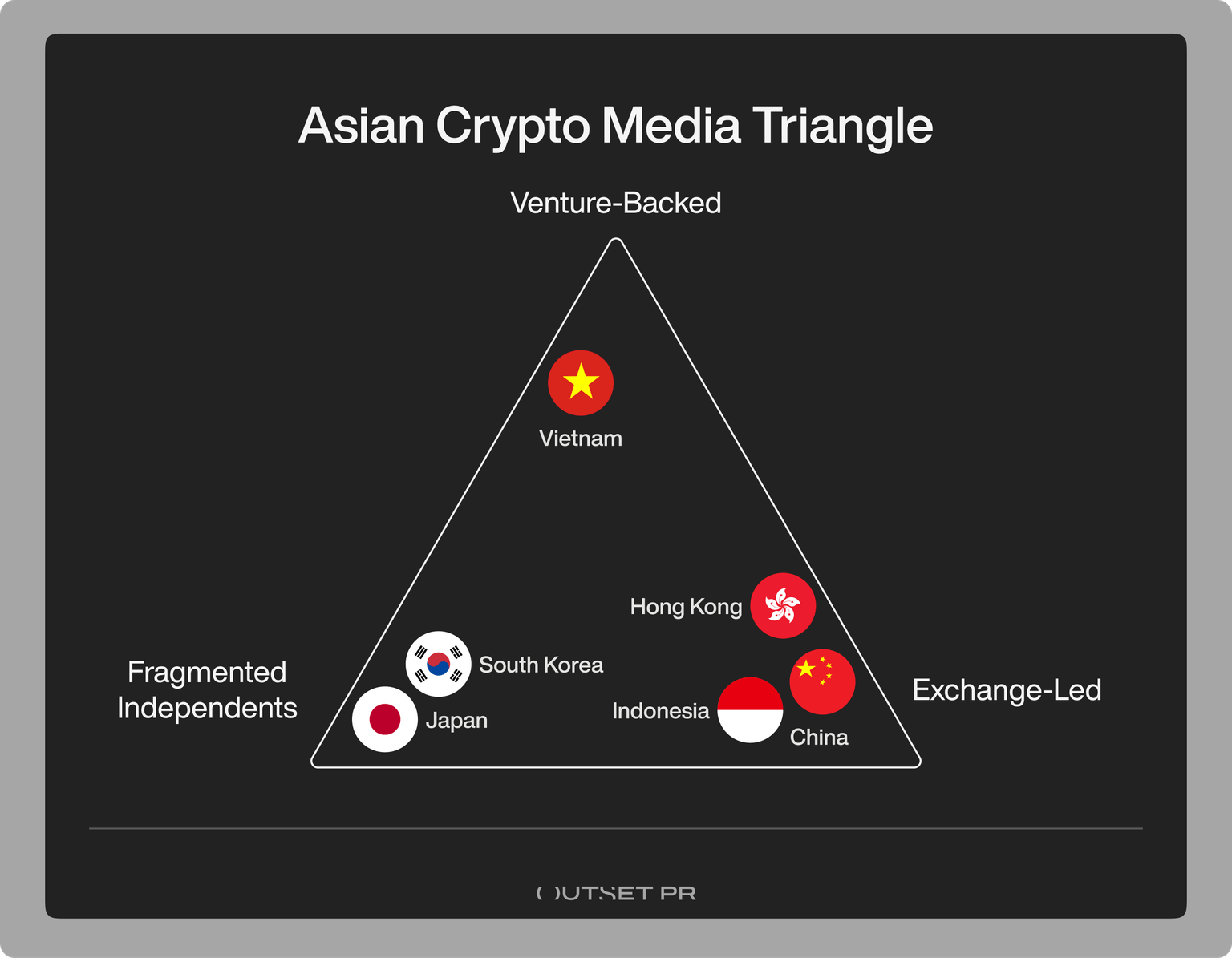

- Asian crypto media does not move toward one global model. Markets split into three playbooks: venture-media complexes (Vietnam), exchange-anchored ecosystems (China, Hong Kong, Indonesia), and independent media under regulation (Japan, South Korea).

- Global brands such as CoinDesk and Cointelegraph play a secondary role. Local outlets, KOLs, and community channels carry the real influence because they work in native languages and react faster to local news.

- In Vietnam and parts of Southeast Asia, ventures and media merge into one funnel. Coin68, Kyros, IVY, and their KOL networks act as a gate to the wider retail audience.

- In China and Indonesia, exchanges behave like media holding companies. Bitget, Binance, and their affiliates fund newsrooms, own local brands, and push projects from investment to listing.

- In Japan and South Korea, regulation and culture keep the media independent. Trust concentrates in a small set of domestic outlets that focus on compliance, accuracy, and low-hype coverage.

- Generative AI increases the pressure on every model. Search traffic declines, zero-click answers grow, and Asian outlets respond with human-driven commentary and a long-term bet on “entity authority” inside AI systems.

Introduction

The Asian cryptocurrency media ecosystem presents a paradox: rapid digital adoption and intense competition coexist with significant structural differences across countries. Unlike Western markets, dominated by a few independent, English-language outlets, Asia’s crypto information space is fragmented into distinct “information bubbles”, each defined by local language, cultural context, and unique trust hierarchies.

Our survey of Asian crypto media leaders, part of the region-wide Q2 2025 analysis, confirms that global brands such as CoinDesk and Cointelegraph, while recognized, operate mostly as tier-2 sources in Asia. For the region’s retail investors and “alpha seekers,” local channels deliver faster, granular insights in native languages through community forums or KOLs seen as industry insiders. In Vietnam, for example, traders favor real-time tips from respected community figures (“OGs”) over the more detached reporting of international outlets.

A central finding of recent interviews is that Asian crypto media is not converging toward a single model, but splintering into three:

- Concentrated media groups in some markets.

- Exchange-anchored networks in others.

- Fragmented independent outlets elsewhere.

This divergence stems from organic market dynamics, audience preferences, regulatory environments, and business incentives, rather than any unified strategy.

One common thread, however, is the rise of the “Exchange–Media–Venture” complex. Facing scarce advertising revenue (now under further threat from generative AI), many Asian crypto outlets have integrated into larger exchange or venture ecosystems for survival. Exchanges like Bitget and Binance are not just advertisers but equity owners or strategic partners of media, blurring the line between news and market promotion.

At the same time, mature markets like Japan exhibit a different trend: traditional financial institutions acquiring or backing crypto media to drive mainstream adoption. Across the board, the disruptive impact of AI looms large, redirecting user traffic away from search engines toward AI chatbots, which forces publishers to rethink their content strategy from SEO to “entity authority” and human-centered branding.

In the following sections, we analyze key Asian markets: Vietnam, China (and Hong Kong), South Korea, Japan, and Indonesia, highlighting who truly shapes the crypto narrative in each, how media groups (or the lack thereof) have formed, and what role exchanges, KOLs, and communities play. We then compare patterns across countries, before concluding with insights into why these media structures differ so markedly from one another and from the Western model.

Vietnam

Media–Venture complex

Vietnam’s crypto media landscape is dominated by a tight-knit Media–Venture nexus centered on Coin68 and Kyros Ventures.

Coin68, founded in 2017, is Vietnam’s most-visited crypto news portal (reportedly over 5 million monthly page views). Uniquely, it serves as the top of funnel for Kyros Ventures’ investments, a symbiotic strategy where Kyros incubates early-stage projects, and Coin68 amplifies them through news, AMAs, and community events.

In return, Coin68 gains privileged access to project founders and data via Kyros, creating a self-reinforcing pipeline (a flywheel effect) from investment to publicity to exchange listing. This vertical integration makes the Coin68–Kyros alliance the de facto gatekeeper for reaching Vietnam’s crypto audience: as one report noted, a new project that bypasses this nexus “misses out on the largest organized community in the country”. The influence is such that partnering with Coin68/Kyros is now seen as the primary gateway to Vietnam’s user base.

Rise of IVY Group

Alongside Coin68, Vietnam has seen the emergence of IVY Group as a structured crypto media holding.

Founded in 2018, IVY has corporatized what started as community blogs into a multi-channel network. It operates several branded media properties, together reaching millions of readers:

- Upside (a major Web3 news site and investor community).

- MarginATM (trading education).

- Interlock (tech and finance for youth).

- Coin98 Insights (research hub).

- Săn Gem (investor forum).

IVY also partners with over 50 KOLs and independent outlets such as BlogTienAo and HC Capital, effectively creating Vietnam’s only structured crypto media consortium.

Notably, IVY instills professional editorial standards uncommon in the region (e.g., banning writers from covering tokens they hold, and avoiding speculative hype).

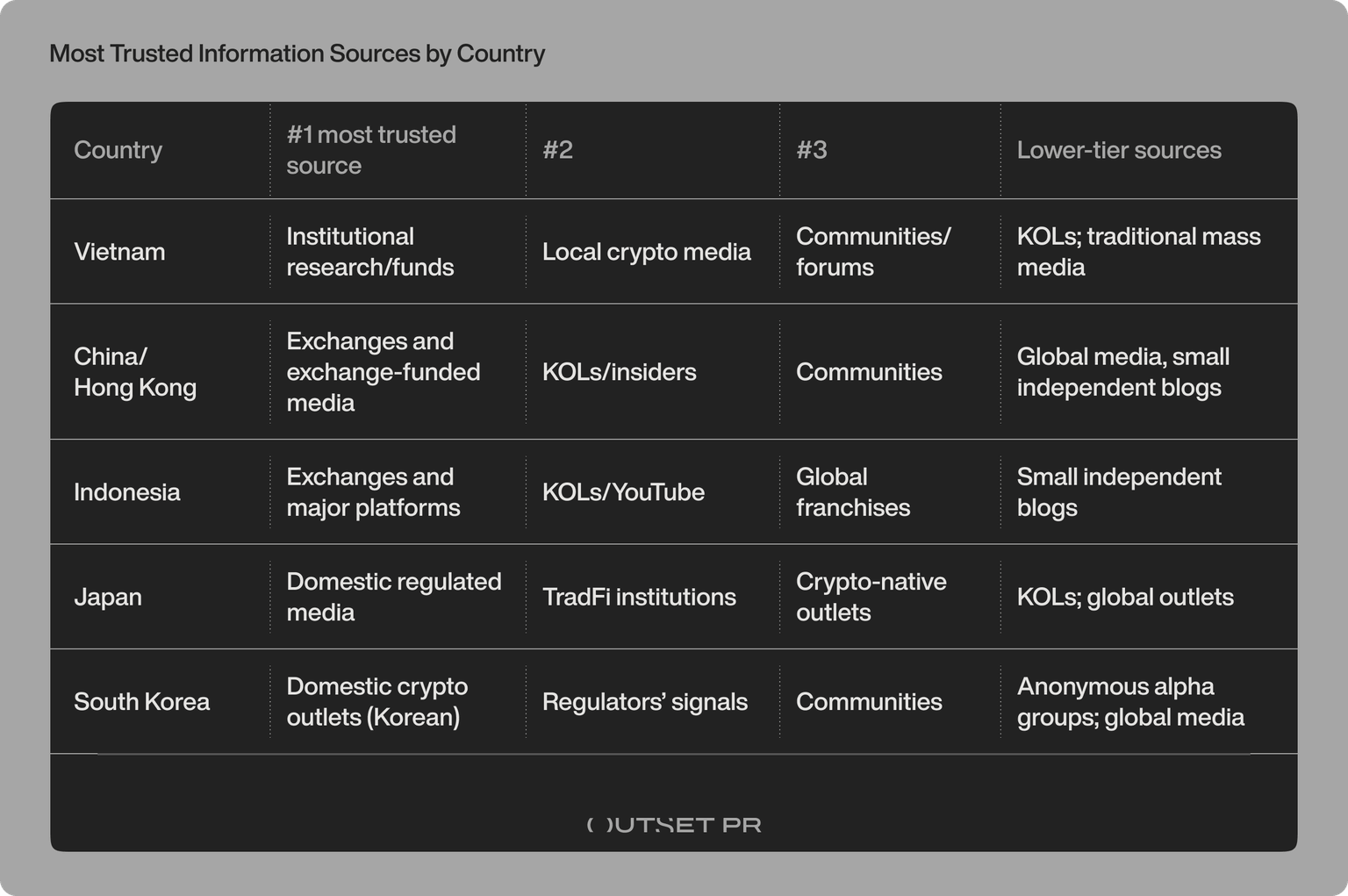

According to its leadership, Vietnam’s information trust hierarchy places institutional sources (funds, research firms) first, local crypto media second, followed by communities, KOLs, and lastly traditional mass media. The ranking emphasizes that even within a retail-driven market, many Vietnamese value professional standards over influencer chatter when it comes to serious information.

KOLs and “dark matter” influence

Underneath the formal media structures lies an active, dynamic layer of independent KOLs, YouTubers, and Telegram community leaders, described as the market’s “dark matter” of influence. Figures such as ThuanCapital (a popular YouTuber) and blogs such as 5pcrypto can move markets with their analysis, especially for speculative altcoins.

Vietnamese respondents noted a bifurcated trust model: they “trust Coin68 for industry news, [but] trust ThuanCapital for what to buy”. This reflects a broader pattern seen in Asia, where trust is personalized rather than institutional.

Investors follow KOLs who have skin in the game (personal investments at stake) for trading tips, while relying on established outlets for factual reporting. The paradox is that while KOLs are valued for unfiltered “alpha” (profit-generating insight), many audience members remain wary of their potential biases or “pump and dump” schemes.

In response, even corporate media brands are experimenting with more personality-driven content, putting real names and faces forward to foster a human connection that pure corporate or AI-generated news lacks.

Overall, Vietnam’s crypto media scene shows a co-existence of venture-backed media, a formalized holding company, and grassroots influencers, all catering to one of the world’s highest crypto adoption rates (despite minimal regulatory clarity).

China and Hong Kong

Exchange-backed ecosystem

In China (and to a large extent Hong Kong), the crypto media operates under an exchange-dominated network model. With direct crypto trading officially restricted in mainland China, major exchanges and their affiliates have become the backbone of the mediascape.

Bitget, a Singapore-based exchange with a strong Chinese user base, shows how that influence works in practice. The exchange is the anchor limited partner of Foresight Ventures, a crypto VC fund, which in turn bankrolls Foresight News, a leading Chinese-language crypto news outlet. This creates a tightly coupled pipeline:

The VC (Foresight Ventures) invests in projects → the media (Foresight News) covers those projects → the exchange (Bitget) later lists them, aligning content with commercial interest.

Ambitions of the Bitget–Foresight group extend well beyond China. For example, Foresight Ventures acquired a majority stake in the U.S. publication The Block in 2023, giving the exchange-linked group a foothold in Western crypto media. (The Block maintains editorial independence publicly, but the investment shows how Chinese exchange capital is intertwining with media internationally.)

Key outlets and partnerships

Despite the heavy presence of exchange money, China’s top crypto outlets present themselves as independent news sites. WuBlockchain, ODaily, TechFlow, 8BTC, and MetaEra are among the most cited Chinese crypto media, each with strong followings.

In practice, however, their viability depends on a web of partnerships, content syndication deals, and sponsorships from exchanges or exchange-funded ventures.

For example, Bitget’s transparency reports frequently cite independent analysts like WuBlockchain and TechFlow, hinting at symbiotic relationships where exchanges rely on these outlets for credible coverage while the outlets benefit from the exchanges’ distribution channels.

A respondent from TechFlow noted that editorial teams actively monitor Chinese social media (WeChat, Weibo) and even exchange communities for story leads before publishing. This suggests non-journalistic gatekeepers, such as exchange insiders or influential traders on social platforms, shape what gets reported.

It’s a media environment operating in a legal gray zone: crypto news is produced and disseminated, but under the unofficial patronage of trading platforms that can skirt China’s bans.

Hong Kong’s role

Hong Kong, with its relatively open regulatory stance toward crypto, serves as a regional media hub and proxy for mainland content. Some Chinese outlets base operations or servers in Hong Kong or Singapore to avoid mainland oversight. Hong Kong-specific publications (like Techub News or localized versions of global media) exist, but they network closely with the mainland ecosystem.

The overall China/HK model remains one where exchanges and fintech firms are the central nodes, providing funding and audience reach that media startups alone could not achieve under restrictive conditions. The consequence is a high churn rate of new outlets.

Respondents observed that “new crypto media brands pop up at least 3 times monthly” in the Chinese market. Many chase hype and multi-language audiences but flame out within months, especially if they’re built around short-term token promotion rather than quality content.

Without robust editorial standards, some outlets resort to inflated traffic stats or AI-generated articles. As one interviewee quipped, analytics can be “easily manipulated with LLMs”.

South Korea

Fragmented but loyal market

South Korea’s crypto media scene is mature yet fragmented, characterized by strong independent outlets and intense local readership loyalty. No single holding company or conglomerate dominates Korean crypto news. Instead, a handful of standalone publishers have built their own followings.

Major players include TokenPost (launched in 2017, cited as Korea’s first and largest blockchain-focused news outlet), BlockMedia, Coinness, Coin Readers, and BloomingBit, among others.

Unlike in some neighboring countries, there are no exchange-owned media giants or venture-funded ecosystems in Korean crypto journalism. The independence is partly by design as Korea’s regulators impose strict rules on crypto advertising and promotions, which limit direct exchange involvement in media. Exchanges cannot easily run their own news arms without facing compliance scrutiny, so news outlets subsist on traditional models (ads, sponsored content, events) and sometimes venture funding, but remain separate entities.

Consolidation signs

Interviews indicate that while the market is fragmented, it has begun to consolidate in the face of financial pressures. One media representative noted the number of active crypto news sites shrank from about 10 a few years ago to roughly 5 currently, as smaller players either merged or shut down. The high cost of producing quality journalism and complying with Korea’s regulations (such as registering as official news businesses) may be driving this shake-out. Still, Korean crypto media retains a healthy diversity of voices compared to elsewhere in Asia.

Readers exhibit a pronounced language preference. Despite widespread English skills, Korean investors overwhelmingly consume news in Korean, even if similar content is available via global outlets.

For instance, TokenPost parlayed its domestic success into international expansion (recently launching editions in Thailand and planning entries into Turkey, Taiwan, and Vietnam). This suggests Korean outlets see opportunity in exporting their model to other localized markets, rather than ceding ground to global English media at home.

Additionally, partnerships such as TokenPost’s research collaboration with Crypto.com show that independent Korean media can achieve global relevance without being part of a larger conglomerate.

Community and KOL role

South Korea’s crypto discourse is also influenced by active communities (on KakaoTalk, Telegram, etc.) and a few prominent KOLs, but to a lesser extent than in Vietnam or China. The highly regulated environment and the legacy of past scandals (e.g., fraudulent schemes) have made Korean audiences somewhat skeptical of anonymous Telegram “alpha” groups or unverified influencers. Professional news sites thus enjoy relatively higher trust for reliable information.

That said, when it comes to pure market speculation (so-called “degen” trading), even Korean traders sometimes follow charismatic YouTube analysts or X personalities for tips. The difference is that many of those influencers are themselves aligned with or sourced by the established media, for example, ex-journalists or industry analysts who have built personal brands.

In summary, Korea’s crypto media remains independent and credibility-focused, shaped by a readership that values local language and reliability, all under the watchful eye of regulators.

Japan

Stable independent outlets

Japan’s crypto mediascape is characterized by stable, independent crypto-native outlets, with comparatively less influence from exchange or venture ownership. Leading platforms include CoinPost (a top domestic crypto news site), Cointelegraph Japan (the local franchise of the global media), Aera dot (mainstream media dabbling in crypto coverage), AICoin Japan, and CoinOtag, among others.

These outlets operate without formal media holding companies or exchange backing, relying on traditional business models and the credibility earned over Japan’s many years of regulated crypto markets.

Japanese crypto audiences are known to favor domestic sources for reliability, and mainstream tech or finance media only occasionally cover crypto news. The dynamic has kept niche crypto publications relevant and allowed them to professionalize.

Notably, factual accuracy and compliance are paramount. Japan has some of the strictest laws for crypto exchanges and token listings, and by extension, misinformation in the media can draw regulatory scrutiny.

As a result, Japanese crypto news tends to be more conservative in tone, focusing on regulatory developments, major corporate moves, and technical innovation rather than day-trader “alpha.”

TradFi acquisition moves

A recent trend in Japan is the incursion of traditional financial (TradFi) institutions into crypto media.

A prime example is SBI Holdings (a large Japanese financial conglomerate) acquiring a significant stake in CoinPost in 2022. This purchase signaled that established financial players see strategic value in controlling crypto information channels, possibly to steer the narrative toward institutional and compliant growth.

Another example is Metaplanet, a publicly listed Japanese company. It transitioned from its original businesses, hotel management, real estate development, and more recently, media (running the local version of Bitcoin Magazine), to become a "Bitcoin treasury."

These moves show a different motive for media consolidation: rather than exchanges seeking user acquisition (as in China or Indonesia), in Japan, it is regulated financial firms seeking to groom the market by disseminating trusted content.

Still, these are exceptions. By and large, Japan has no sprawling crypto media conglomerates, and no exchange wields outsize media influence domestically (even Binance’s name is barely visible due to strict licensing requirements). The high barrier to entry (both regulatory and the expectation of quality) has kept the media space from fragmenting; instead, a few reputable outlets hold long-term readership.

Conservative culture

Cultural factors also play a role. Owing to high taxes on crypto gains (up to 55%) and a history of infamous exchange hacks (like Mt. Gox), Japanese retail investors are generally less impulsive and more risk-averse than those in, say, Vietnam. This translates into a media appetite for “high trust, low hype” content.

Outlets that provide measured analysis and factual reporting earn more loyalty than those chasing trendy coin tips. In interviews, Japanese respondents emphasized reliability as the key value. Even if global outlets like Bloomberg or CoinDesk cover a story, many locals prefer to wait for a CoinPost article in Japanese to consider it confirmed.

Thus, Japan’s crypto media ecosystem remains somewhat insular, prioritizing trust and accuracy, with slow incorporation of international voices unless vetted through the local context.

Indonesia

Exchange-owned dominance

Indonesia’s crypto media has increasingly come under the sway of exchange-affiliated media and marketing channels. The most prominent example is Tokocrypto, once the leading domestic crypto exchange, which was acquired by Binance in 2022.

Following the acquisition, Tokocrypto’s media arm (referred to as TokoNews or Tokocrypto News) and its educational content platforms effectively became extensions of Binance’s ecosystem.

In other words, it means that much of the crypto news and learning materials circulated in Indonesia carry the subtle imprint of Binance’s strategic objectives. By owning Tokocrypto (a fully licensed local entity) and repurposing its media outreach, Binance sidestepped regulatory hurdles while dominating the information flow to Indonesian users.

As a result, Tokocrypto’s blog and social media now serve as hybrid news-and-promotion channels, blurring education with exchange marketing. It’s a model of “acquisition-integration”: a global exchange acquires a local player and immediately inherits its media footprint to push its own agenda.

Mediascape and KOLs

Outside of Tokocrypto’s influence, Indonesia’s crypto media scene features a mix of small independent blogs and international crypto media franchises.

Global brands such as BeInCrypto and Cointelegraph have Indonesian-language editions (run by local teams under license). These outlets produce localized news and participate in affiliate partnerships (e.g., referral links for exchanges or token sales) to monetize their content. Purely independent Indonesian crypto news sites are few, partly due to the relatively later uptake of crypto in the country and limited advertising revenues.

Instead, influencers (KOLs) and community forums on Telegram/Facebook have been key in spreading information, albeit in a less organized way. Indonesian crypto communities rely heavily on social media for news, which has led to a lower emphasis on dedicated news websites.

In fact, one survey respondent observed that web traffic to Indonesian crypto articles is notably low because users are “no longer clicking on articles,” they get their info from YouTube, X, or messaging apps without visiting news sites. This could be symptomatic of the broader zero-click trend driven by algorithmic feeds and AI (more on that in the Macroanalysis section).

Regulatory and cultural factors

Indonesia’s regulatory environment for crypto has been relatively open (until recently, when stricter exchange rules were announced), which allowed international players such as Binance to enter via acquisition.

However, local journalism has not caught up in scale. There are no legacy Indonesian media conglomerates focusing on crypto, and mainstream outlets cover it sporadically. The vacuum is filled by exchange campaigns and influencer-driven hype cycles, which can skew the information landscape.

For instance, when a major token or NFT trend hits Indonesia, it is amplified by exchange promotions and KOL social blasts rather than investigative reporting. This makes the media ecosystem feel more marketing-heavy.

Still, as the market matures and with upcoming regulations classifying crypto as regulated commodities, there are early signs of more independent journalism emerging to demand accountability. For now, though, Indonesia exemplifies an exchange-centric media model akin to China’s, but with even less in-country journalistic infrastructure.

Macroanalysis: Patterns and trends across Asia

Convergence vs. fragmentation

Comparing these markets reveals a pattern: Asia's crypto media has not evolved uniformly but is instead divided into three separate ecosystem models:

- Vietnam represents a consolidated Media–Venture model

- China/HK and Indonesia are exchange-dominated

- South Korea/Japan are fragmented independent landscapes

The divergence can be traced to several underlying factors.

Regulatory environment

Regulation (or lack thereof) is a primary driver of media structure. In China’s banned market, crypto media relocated into exchange/fintech ecosystems as a survival mechanism. Exchanges effectively became publishers, since traditional news outlets couldn’t openly cover crypto.

In Vietnam’s unregulated space, by contrast, a few savvy players (Coin68, IVY) seized the opportunity to build influential platforms without facing compliance barriers. This paradoxically enabled higher-quality content dominance in the absence of regulation, as one respondent noted: “Vietnam has no clear crypto regulations yet, but we follow journalistic ethics….”, allowing a credible group to lead without the cost of compliance that might deter entrants.

Meanwhile, South Korea and Japan’s strict regulatory frameworks forced the media to professionalize and remain independent. Only those outlets meeting standards (e.g., licensing, fact-checking, avoiding market manipulation) survive, which has kept the field narrower and relatively trustworthy.

In short, heavy regulation tends to prevent overt exchange-media collusion but also raises the bar for consolidation. Light regulation can invite either chaotic fragmentation or the rise of a dominant private sector group.

Language and culture

Every country shows a strong preference for local language content, but the reasons vary.

In Vietnam and much of Southeast Asia, respondents said global media “report news quite late, with few insights beneficial to investors”. Speed and actionable info (via community rumor or insider tips) are valued over polished analysis.

In Korea and Japan, even though machine translation is available, readers complain that translated content misses cultural nuances and context. Thus, they stick to native outlets that understand local sentiment and honor domestic journalistic norms.

So, the entrenched localization means global English crypto news has limited direct influence. Instead, global news gets filtered and reinterpreted by local media or influencers before reaching the audience. It also means a project or exchange entering multiple Asian markets must navigate a patchwork of media channels. There is no single gateway.

Market maturity

Markets that have been in crypto longer and have larger retail bases (e.g., Korea, Japan) show more stable media structures. They have legacy crypto news sites from the 2017 era that have either endured or evolved. Newer markets or phases (e.g., Indonesia’s recent boom, Vietnam’s DeFi wave) saw rapid proliferation of media and KOL projects, many of which were short-lived.

Over time, however, even these are maturing.

For instance, Indonesia’s early blogger scene gave way to more organized outlets and partnerships in 2023–2025 as audiences demanded better quality. A common theme in interviews is that audience trust and attention are consolidating around a few leaders in each market as the hype cycles normalize. Our Asia Q2 2025 study noted that 18 top outlets captured over 80% of Asia’s crypto media traffic, while dozens of small blogs struggled for the remainder. The era of countless small crypto blogs is waning. Sustainable growth now favors platforms that can either align with larger ecosystems (exchanges, networks) or carve out a credible niche.

KOL influence vs. media trust

Across Asia, there is a delicate balance, and sometimes tension, between KOL-driven influence and institutional media trust. Many Asian crypto participants rely on charismatic individuals for timely tips and a sense of community. These KOLs (whether YouTube educators, X pundits, or Telegram group admins) build trust by being transparent about their own investments and engaging directly with followers.

As noted earlier, “in Asia’s crypto scene, trust is personal, deposited in ‘OG’ figures who have survived multiple bear markets”. The personalized trust contrasts with the West, where brand reputation (e.g., Wall Street Journal, Bloomberg) carries more weight.

However, the KOL-centric model has its pitfalls: the same audiences that chase influencer advice also harbor an undercurrent of skepticism, aware that some KOLs may be shilling for profit. This has led to what one might call the trust paradox. Users oscillate between independent influencers for “alpha” and established media for verification.

In response, professional outlets in Asia are increasingly overlaying human identity onto their content. Rather than anonymous newsroom pieces, we see named analysts, op-ed styles, and reporters cultivating public personas. The goal is to blend credibility with relatability, to show that behind the publication is a human (ideally an expert or insider) who can be as trusted as any freelance KOL. This approach attempts to marry the “community trust” model with the “editorial integrity” model, creating a new hybrid of crypto journalism that resonates with Asian readers.

AI-driven disruption

An important macro trend affecting all markets is the impact of generative AI on content discovery and consumption. Publishers across Asia report an alarming rise in the zero-click phenomenon. Users ask a question to ChatGPT (or other AI assistant) and get a direct answer, bypassing any article that news outlets have written.

For example, instead of clicking a how-to article on buying Bitcoin in Indonesia, a user might get a step-by-step answer from an AI that scraped various sites. This threatens the ad-based revenue model and erodes site traffic.

In our survey, multiple editors observed their “SEO traffic declining as readers turn to AI-driven aggregators and summaries”. In response, the media in Asia are pivoting strategies.

One tactic is the human-centric pivot, which doubles down on content that AI cannot easily replicate, such as personality-driven commentary, exclusive interviews, and opinion pieces that convey a distinct voice or local insight. Outlets argue that while AI can efficiently summarize facts, it lacks the “attitude, emotion, and insider perspective” of a human analyst.

Indeed, the resurgence of the writer-influencer model (journalists with their own following) is partly to give audiences a reason to read the article rather than an AI summary.

Another emerging tactic is focusing on “Entity Authority,” ensuring the outlet’s brand becomes a recognized authority in knowledge graphs and AI training data. By doing so, the media hope that when AI platforms provide answers, they will attribute or rely on the content of those authoritative outlets. For example, some sites are structuring content in QA formats and pursuing schema markup so that AI assistants reference them as the source.

In short, the AI disruption is forcing Asian crypto media to innovate: either become the source that machines trust or double down on human elements that machines can’t replace.

Global media’s limited role

A final pattern to note is the relatively limited influence of global crypto media brands within Asia’s local ecosystems. With few exceptions (such as Cointelegraph’s local franchises or the occasional translation of major English scoops), the likes of CoinDesk, Decrypt, and The Block play mostly a background role.

Asian audiences view global news as a baseline for macro-level trends but not a primary source for local developments. As one Southeast Asian respondent put it, “International media aren’t popular locally. Community channels and native news platforms deliver updates faster and in the right language.”

A simple truth becomes obvious at that point: crypto information needs to be hyper-localized to be actionable.

Global media may set the agenda on issues like U.S. regulations or Bitcoin halvings, but when it comes to exchange listings, local project dramas, or government rumors in a specific country, local sources (including informal ones) dominate the narrative. Thus, global media in Asia end up partnering with or aggregating from local outlets to stay relevant, rather than the other way around.

How to use these findings in practice

For global brands, funds, and exchanges, the main lesson is simple. Plan media work in the Asia market by market, not region by region. Each of the three models rewards a different approach.

- In venture-media markets like Vietnam:

Work with the full stack. A launch that only uses “neutral press” and ignores venture-linked media and their KOL networks will not reach the core audience. Build relationships with the media-venture complexes early, before funding or listing news goes live.

- In exchange-anchored markets like China, Hong Kong, and Indonesia:

Narrative control sits close to trading venues. Exchange-owned or exchange-funded outlets have outsized power to shape perception. Outreach plans should treat exchange content, research reports, and branded education as part of the media mix rather than as a separate channel.

- In independent media markets like Japan and South Korea:

Compliance and credibility matter more than speed. Editors look for clean documentation, clear risk language, and local relevance. Strong coverage in one or two trusted outlets brings more value than a scattershot press release blast.

Across all markets, AI introduces a shared constraint. Articles do not compete only with other articles. Articles now compete with chatbots and social feeds that answer questions without a click. Teams that invest in expert voices, consistent quality, and structured content stand a better chance of becoming the sources that both humans and AI systems treat as authorities.

We at Outset PR plan to keep tracking how these ecosystems move over time. Future waves of the survey will show whether venture-media complexes, exchange ownership, or independent models gain ground, and how that shift changes the best way to communicate with Asian crypto audiences.

Conclusion

From the foregoing analysis, it’s evident that Asia’s crypto mediascape defies any one-size-fits-all description. Instead, it reflects a tapestry of cause-and-effect relationships unique to each locale:

- In Vietnam, a lack of traditional media coverage and regulatory void enabled crypto-native entrepreneurs to form a venture-plus-media complex. The Coin68–Kyros model arose because a hungry retail market demanded both information and investment opportunities. By fusing those, they created an all-in-one ecosystem that reinforces their dominance. The formation of media groups here is a market-driven response to high demand for “alpha” content in a trusted package.

- In China, strict bans on crypto trading ironically strengthened the exchange-media alliance. Exchanges like Bitget, needing alternative channels to reach users, invested in media and venture arms (e.g., Foresight News and Ventures). Media platforms, unable to rely on open advertising or Google (blocked in China), aligned with these deep-pocketed patrons. The result is quasi-holding companies where the exchange’s interests, the VC’s investments, and the media’s stories all intertwine. Media groups form as a necessity to operate under the regulatory radar and leverage the only entities (exchanges) that have both capital and captive audiences.

- Hong Kong, serving as China’s proxy, shows how a relatively freer market can still orbit around a larger ecosystem’s gravity. The absence of indigenous crypto media conglomerates in Hong Kong is largely because mainland-linked networks fill that role, and global companies (like Binance, OKX) set up shop to influence the region via events and sponsorship rather than formal media acquisitions.

- In South Korea, we see the opposite scenario: a robust regulatory framework and presence of strong domestic exchanges (Upbit, Bithumb) did not translate into exchange-run media. Advertising limits and a history of protecting investors led to the media remaining independent. No single entity had both the ability and the incentive to consolidate media. Domestic exchanges were busy with compliance, and external players faced barriers. Thus, media groups did not form. Instead, a handful of independent outlets coexist, and their competition is healthy enough that none has overtaken the rest. Essentially, Korea’s case shows that where regulation enforces a clear separation between financial services and media, classic market competition prevails among news providers.

- In Japan, cultural and regulatory causes also prevented crypto media consolidation. Traditional finance stepped in (e.g., SBI’s stake in CoinPost) not to create a media monopoly, but to ensure the narrative aligns with institutional adoption. The fact that no sprawling crypto media empire exists in Japan is a function of high trust in established brands and a smaller pool of speculative retail players. There was simply less pressure to form a hype-driven media network. Each outlet finds a stable niche, and collaboration with TradFi is more about legitimacy than controlling the news. Media groups, as seen in Vietnam or China, didn’t arise because mainstream institutions pre-empted that role in a measured way.

In summary, the formation (or non-formation) of crypto media conglomerates in Asia boils down to market needs and trust structures.

Where audiences crave quick gains and insider tips, influencer-driven networks flourish (coalescing into informal groups). Where regulatory or economic forces constrain advertising, exchanges and investors step in to bankroll information channels. And where audiences prioritize reliability and regulators keep watch, independent journalism, or even traditional finance-backed media, holds sway.

One overarching insight is that trust in Asia’s crypto media is human-centric. Even as AI and globalization reshape how news is delivered, Asian readers gravitate toward ecosystems where they feel a sense of community or credible authority.

As a recent analysis aptly noted, “In Asia, do not look for the ‘New York Times of Crypto.’ Look for the ecosystem.”

The news one reads is likely part of a broader venture, exchange, or community apparatus. For industry strategists and crypto projects, this means success in Asia is not just about what story is told, but who carries it and how it connects to the pulse of the local community. The crypto mediascape here will continue to evolve, but its future will be shaped by the same forces evident today, a triad of localization, integration, and human trust driving how information powers the next phase of crypto growth in Asia.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.