Arizona passes bill to create crypto reserve using public Treasury funds

- Arizona has passed a bill proposing a state-managed cryptocurrency reserve including Bitcoin, stablecoins and NFTs.

- The bill authorizes the state treasurer to lend digital assets and invest through state-registered crypto products to generate returns.

- The governor’s veto threat over unrelated budget issues clouds the bill’s future, despite bipartisan momentum for Arizona’s crypto legislation.

- Annual digital asset investments are expected to be limited to 10% of the state treasury and routed via qualified crypto custodians.

Arizona is moving closer to creating a crypto-backed reserve as the state's Strategic Digital Assets Reserve Bill (SB 1373) advances, despite veto threats from the Governor over unrelated funding disputes.

Arizona State passes first Digital Reserve Bill

Arizona took a bold step toward integrating crypto into public finance as the Strategic Digital Assets Reserve Bill passed a legislative hearing.

Following the House Committee of the Whole, the bill remains one vote away from the governor’s desk, before final approval.

If signed into law, it would make Arizona one of the first states to hold digital assets like Bitcoin, NFTs, and stablecoins in a strategic reserve managed by the state treasurer.

Arizona state passes SB 1373 Digital Asset Reserve Bill | April 2025

According to official documents, the bill allows Arizona to invest public funds through qualified digital custodians and crypto exchange-traded products registered in the state.

Annual investments are capped at 10% of the total fund, while digital lending is permitted to generate additional yield.

The reserve itself would be funded by legislative appropriations and assets seized by law enforcement, creating a self-sustaining, crypto-native fund with diverse inflows.

With institutional interest in Bitcoin and stablecoins accelerating, Arizona is positioning itself ahead of states like Texas and New Hampshire, which have only recently started dabbling in blockchain policy.

Following the approval of Bitcoin and Ethereum ETFs last year, US President Donald Trump’s executive order creating a crypto strategic reserve has sparked a crypto adoption push among states.

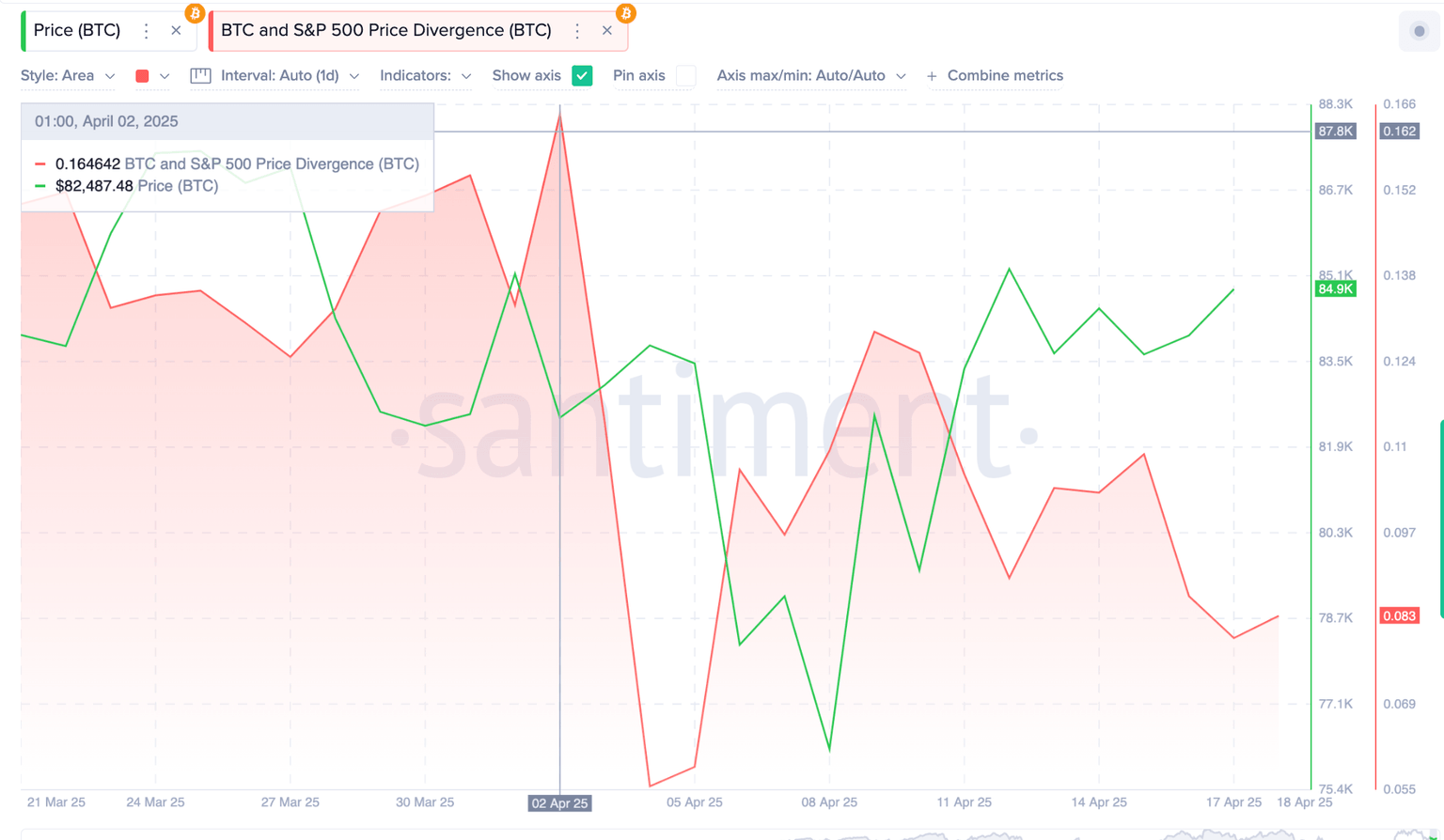

Bitcoin vs S&P 500 Divergence, April 2025| Santiment

More so, Bitcoin has consistently outperformed the S&P 500 in recent months, which has spurred States to allocate treasury funds towards crypto.

Political stand-off between Arizona Governor and the House threatens final approval

Despite bipartisan momentum behind SB 1373 and its sister bill SB 1025 (Arizona Strategic Bitcoin Reserve Act), political friction could derail the effort.

Governor Katie Hobbs has pledged to veto all legislation until lawmakers reach consensus on a separate funding package for disability services.

While the digital reserve bill saw broad legislative support, it is now caught in the crossfire of the budget standoff. If the governor follows through on his veto, SB 1373 could end up as collateral damage in a fight unrelated to its merits.

Still, as states begin to explore new fiscal instruments to adopt blockchain technology, Arizona’s early push effectively sets a working precedent for similar legislative moves in other states.

For now, all eyes are on the final House vote—and what comes next from the governor’s office.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.