Arbitrum captures lion share of derivatives transaction volume, ARB price likely to revisit 2024 peak

- Arbitrum accounts for nearly 36% of the transaction volume of multi-chain derivatives protocol.

- Arbitrum dominates the top 20 derivatives protocols, setting a historical weekly high between February 11 and 17.

- ARB price yielded nearly 3% gains in the past week and nearly 2% gains on the day.

Arbitrum has captured a large volume of the derivatives transaction volume, according to data from DeFi intelligence tracker DeFiLlama. In the past week, Arbitrum dominated other derivatives protocols with $15.44 billion in trade volume.

Also read: Fetch.AI breaks into massive rally alongside AI tokens, FET price hits two-year high

Arbitrum dominates DeFi transaction volume, likely to catalyze ARB gains

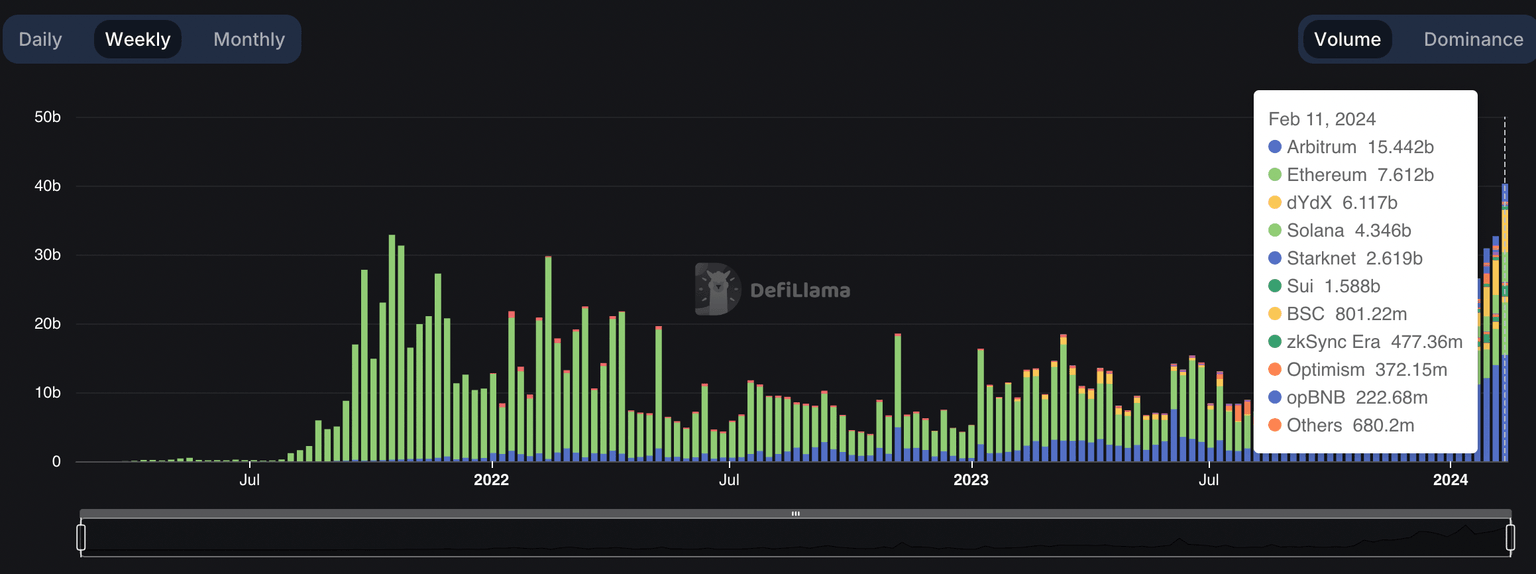

Data from DeFiLlama shows that Arbitrum has captured the largest share of the $40.9 billion transaction volume of multi-chain derivatives protocols. While competitors Ethereum, dYdX and Solana accounted for 24.04%, 17.30% and 8.73% respectively.

The rise in Ethereum’s share was largely driven by Aevo, a derivatives trading platform. Arbitrum accounted for $15.44 billion in derivatives trading volume in the week of February 11 and 17.

DeFi trading volume. Source: DeFiLlama

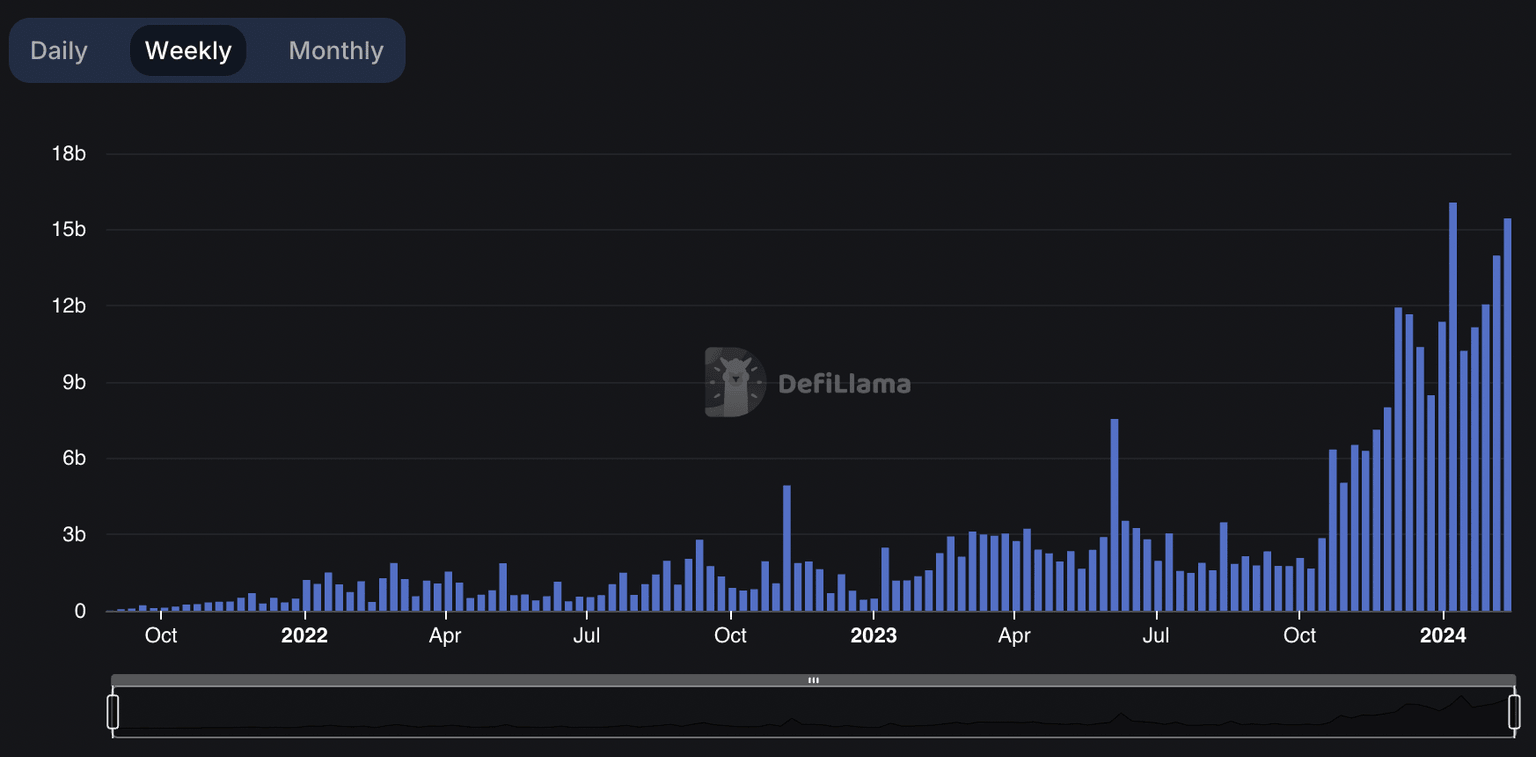

Arbitrum’s derivatives trade volume has climbed consistently throughout 2024, as seen in the chart below.

Derivatives trading volume on Arbitrum

ARB price climbed is $2 on Sunday. The token is likely to rally to its 2024 peak of $2.42. ARB yielded nearly 3% gains to holders in the past week. If ARB price continues its uptrend, it could hit its 2024 peak and target the $3 level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.