Aptos eyes over 10% gain, Franklin OnChain US Government Money Fund now represented on-chain

- Aptos announces Franklin OnChain US Government Money Fund is represented on the blockchain.

- FOBXX surges past $20 million in subscriptions, signaling a major breakthrough in institutional crypto adoption.

- APT eyes over 10% gains, holds steady above 10-day EMA.

Aptos (APT), a proof-of-stake blockchain network, is gaining on Wednesday amidst new developments in its blockchain ecosystem. Aptos announced the launch of Franklin OnChain US Government Money Fund (FOBXX) represented by the BENJI token.

APT trades at $7.78, eyeing double-digit gains.

Aptos gears up for double-digit price rally

Franklin Templeton has launched the OnChain US Government Money Fund (FOBXX) represented by the BENJI token on Aptos blockchain. The fund is regulated under the 1940 Act and invests at least 99.5% of total assets in government securities, cash and repurchase agreements.

FOBXX surged past $20 million in subscriptions, and Aptos blockchain considers this a sign of rising blockchain adoption among institutional investors.

⚡ Aptos Newsroom, Special Edition ⚡@FTI_DA has launched its Franklin OnChain U.S. Government Money Fund (FOBXX) represented by the BENJI token on Aptos!

— Aptos (@Aptos) October 2, 2024

FOBXX has surged past $20M in subscriptions, signaling a major breakthrough in institutional blockchain adoption. https://t.co/L7CgthT6a0 pic.twitter.com/pgLHfjZN4V

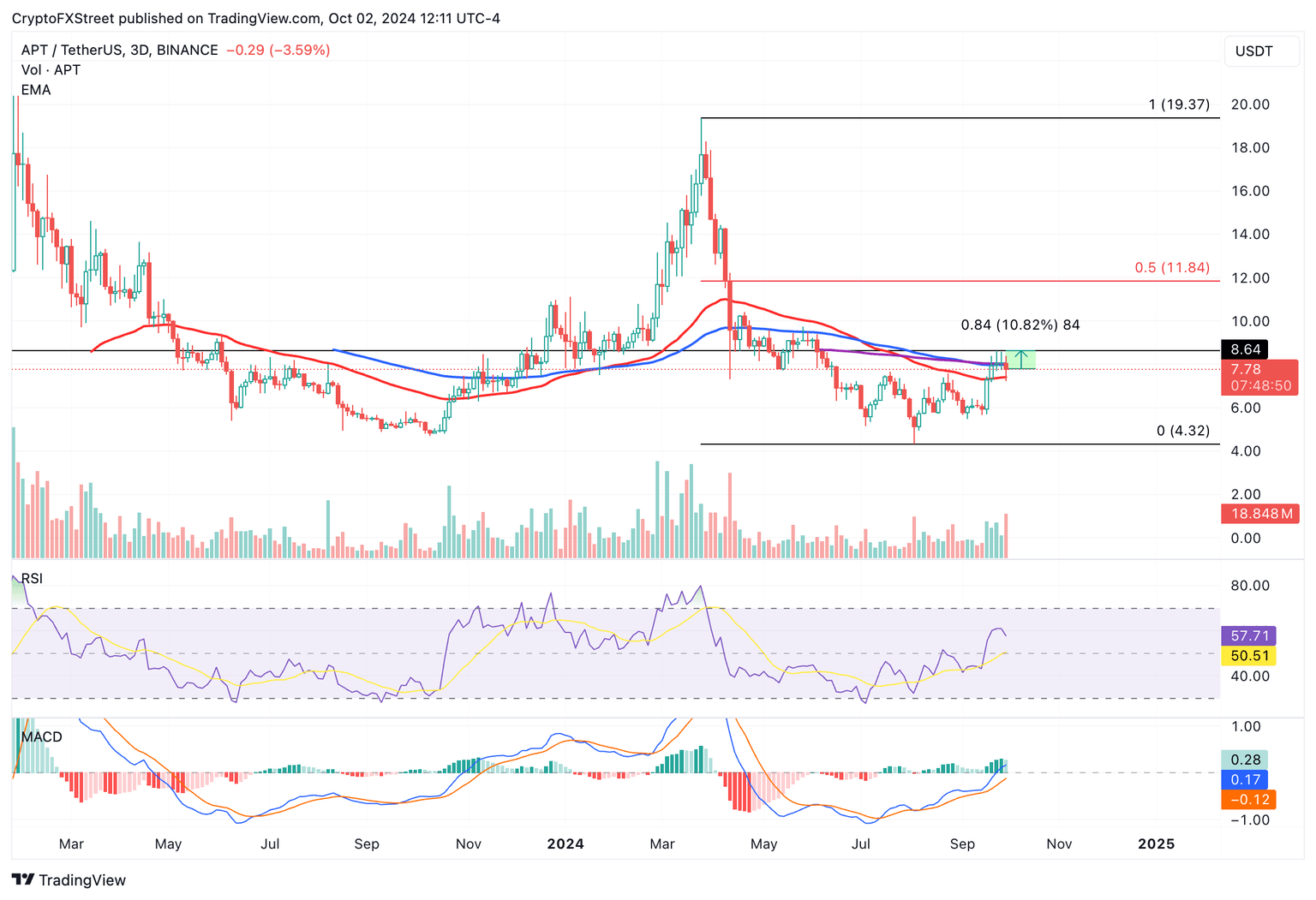

APT could extend its gains by 10.8% and rally toward $8.64, the September 24 peak for the asset. The Moving Average Convergence Divergence (MACD) , a momentum indicator, shows green histogram bars above the neutral line, meaning there is positive underlying momentum in the APT price trend.

The asset could find support at the 10-day Exponential Moving Average (EMA) at $7.41. The asset faces resistance at $11.84, the 50% Fibonacci retracement of the decline from the March 25 top of $19.37 to the August 4 low of $4.32.

APT/USDT daily chart

A daily candlestick close under the 10-day EMA at $7.41 could invalidate the bullish thesis and send APT to collect liquidity at the September 18 low of $5.70.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.