ApeCoin price ready to sink to $4.2 as bears take control

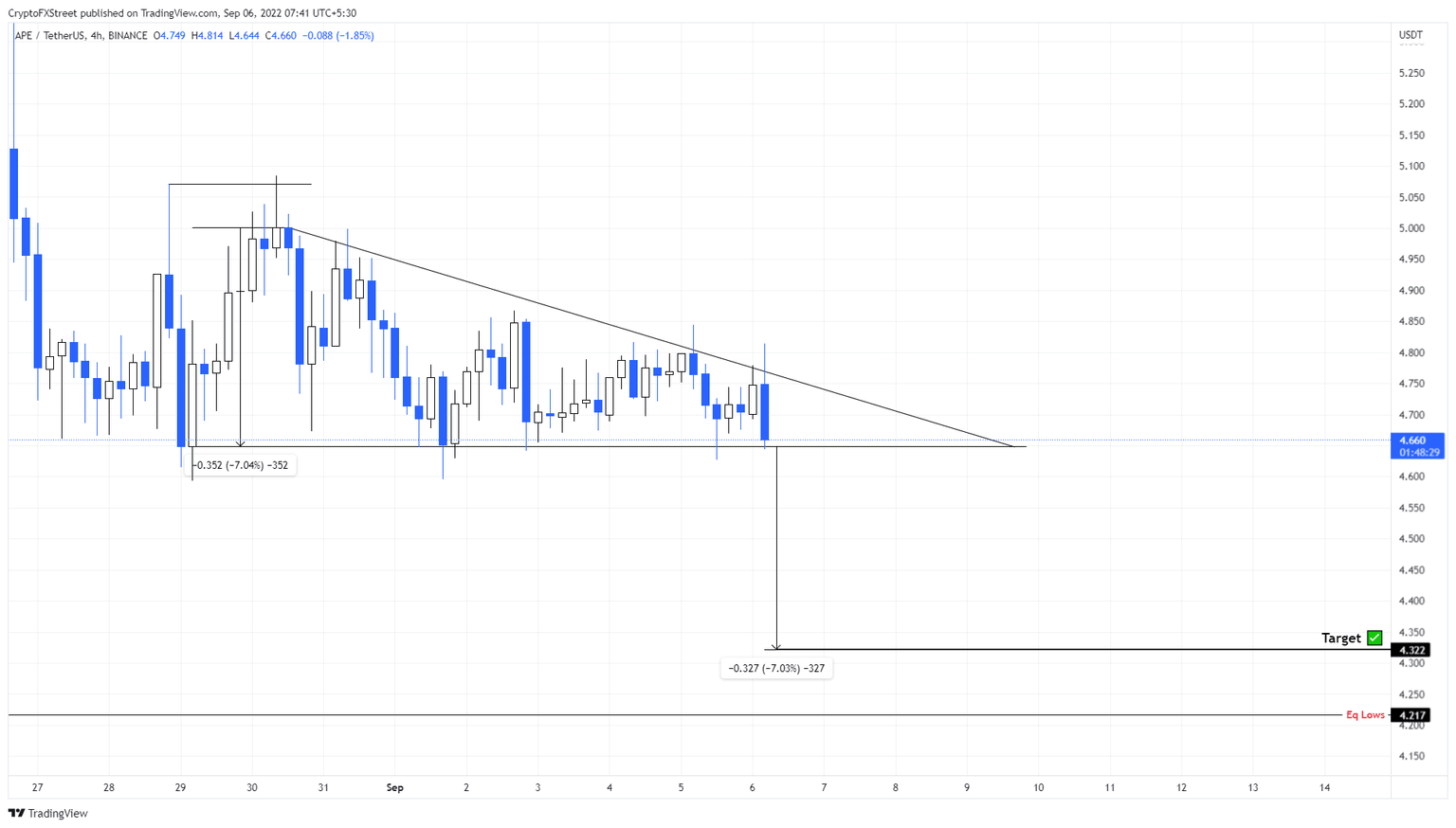

- ApeCoin price reveals a descending triangle formation on the four-hour chart.

- The pattern forecasts a 7% drop to $4.32 but could extend as low as $4.21.

- A daily candlestick close above $4.81 will invalidate the bearish thesis for APE.

ApeCoin price shows that the recent consolidation will likely yield a bearish breakout. The incoming crash will collect the liquidity resting to the downside before triggering a larger uptrend.

ApeCoin price prepares for its next leg

ApeCoin price has formed four lower highs and four equal lows since August 29. Connecting these swing points using trend lines reveals a descending triangle formation. This technical formation has a bearish bias and forecasts a 7% downswing, obtained by measuring the distance between the first swing high and swing low to the breakout point.

The target for ApeCoin price is $4.32, but if bears are active, the move could extend lower to sweep the equal lows at $4.21. This development would bring the total drop to 9.3%.

Interested investors can wait for a four-hour candlestick close below the horizontal support level at $4.64 to enter a short position. Once the breakout is confirmed, ApeCoin price will start its descent to $4.32 and $4.21, respectively.

APE/USDT 1-day chart

On the other hand, if ApeCoin price bounces off the $4.64 support floor and produces a higher high above the September 6 swing high at $4.81, it will denote a bullish breakout and invalidate the bearish outlook.

Such a development could see ApeCoin price revisit the $5 psychological level.

Note:

A major move in Bitcoin price could affect altcoins, including ApeCoin. Therefore, investors can look at this video explaining the path BTC might take over the next few days.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.