Algorand releases technical roadmap for 2024 but fails to catalyze recovery for Algorand price

- Algorand price has been treading upward slowly but to no avail as bearish cues remain dominant.

- Algorand Foundation stated that the network will go through five major upgrades this year.

- The first upgrade, which went into effect today, is set to increase network performance but did not impact the price in any way.

This year is expected to be huge for the crypto market, considering the spot Bitcoin ETF approval, potential spot Ethereum ETFs, and the Bitcoin halving. But beyond the major tokens, other L1s, such as Algorand, are also set to witness crucial upgrades coming their way.

Algorand has a five-step plan

Algorand Foundation took to X, formerly Twitter, to announce the technical roadmap for 2024, which is comprised of five major upgrades. These upgrades will be deployed throughout the year, with the first two set to go live before Q2 and the other three between Q2 and Q4.

The first of these upgrades - Dynamic Round Times - came into effect on January 17, and the primary focus of the upgrade was increasing network performance, which translates to higher throughput and lower block times.

As noted by the Algorand Foundation, block times will now average less than three seconds.

♟️Checkmate. We open 2024 with The Algorand Gambit, our technical roadmap for the year.

— Algorand Foundation (@AlgoFoundation) January 17, 2024

2024 marks a pivotal moment for Algorand—committed to permissionless blockchain infrastructure while setting new standards in performance and usability.

Read the full roadmap:… pic.twitter.com/DD0svU7ZlS

Further updates will focus on a host of issues and improvements. This includes bringing Python to Algokit 2.0 to ease the development of protocols on the chain. Additionally, the updates will make the network greener and more efficient and significantly reduce operational costs.

A major focus of the 2024 roadmap also seems to be on decentralization. To make this happen, Algorand will be shifting from a relay structure to a P2P Gossip Network akin to Bitcoin and other major chains.

Algorand price will need all the help it can get

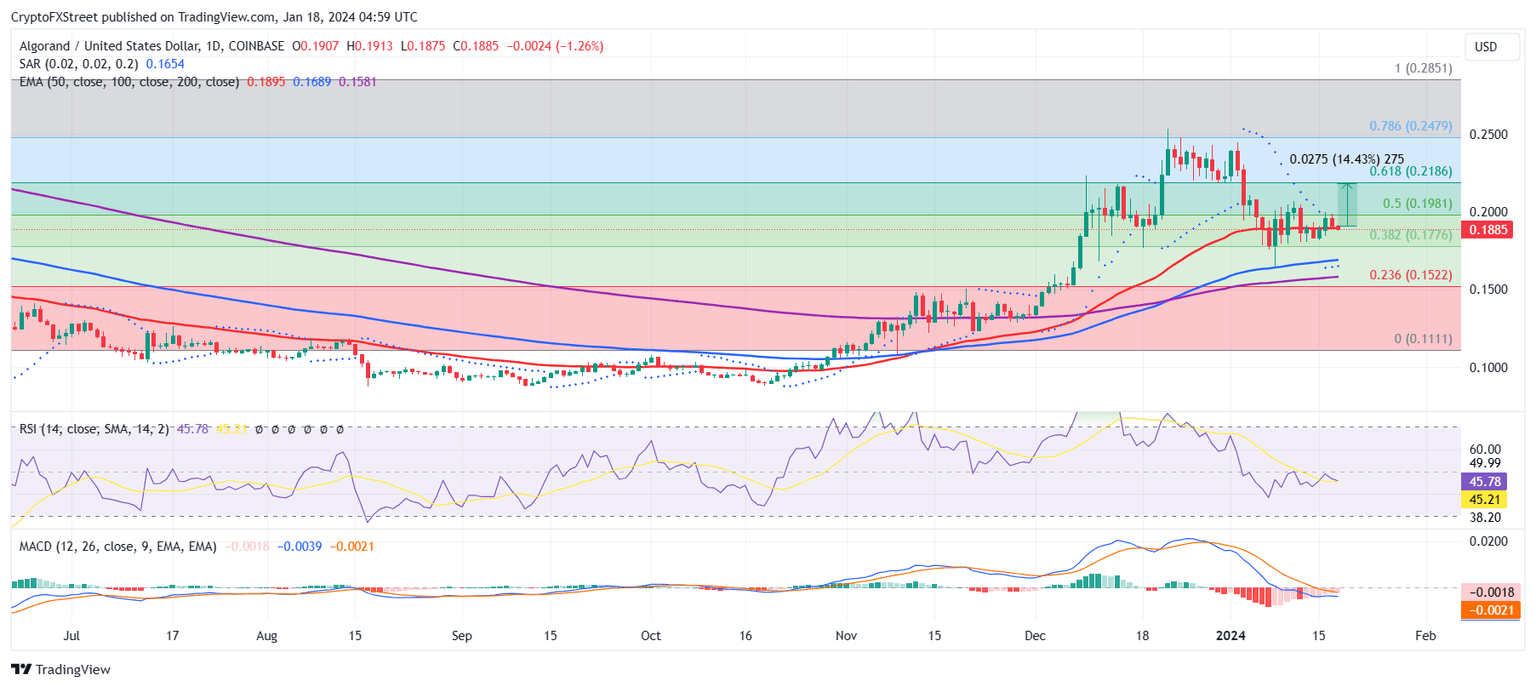

Algorand price is trading at $0.1885 at the time of writing, moving around the 50-day Exponential Moving Average. The launch of the roadmap was expected to be a bullish event for Algorand, but the price action failed to relay the sentiment as ALGO continued its sideways movement.

In its favor, the 50-day Exponential Moving Average (EMA) is still acting as a support line, but the chances of losing it are likely. This is because the price indicators Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are hinting at a potential bearish outcome, given the former is below the neutral line of 50.0, and the latter is far from a bullish crossover.

Thus, if the market continues to exhibit a lack of interest, a decline below $0.1880 is likely, and the altcoin could also slip to $0.1690.

ALGO/USD 1-day chart

However, the 100 and 200-day EMA are both acting as support at the moment, so even a decline would mean that a bounce back from these levels is likely. Reclaiming the 50-day EMA as support would initiate a recovery rally by invalidating the bearish thesis, moving Algorand price towards a potential 14% recovery towards $0.2186.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.