Alameda ex-CEO, FTX co-founder plead guilty to fraud charges following extradition of Sam Bankman-Fried

- FTX co-founder Gary Wang, has been alleged to create an option in the exchange platform allowing Alameda an unlimited line of credit.

- Alameda former head, Caroline Ellison, has also been charged with manipulating the price of FTX's native token, FTT.

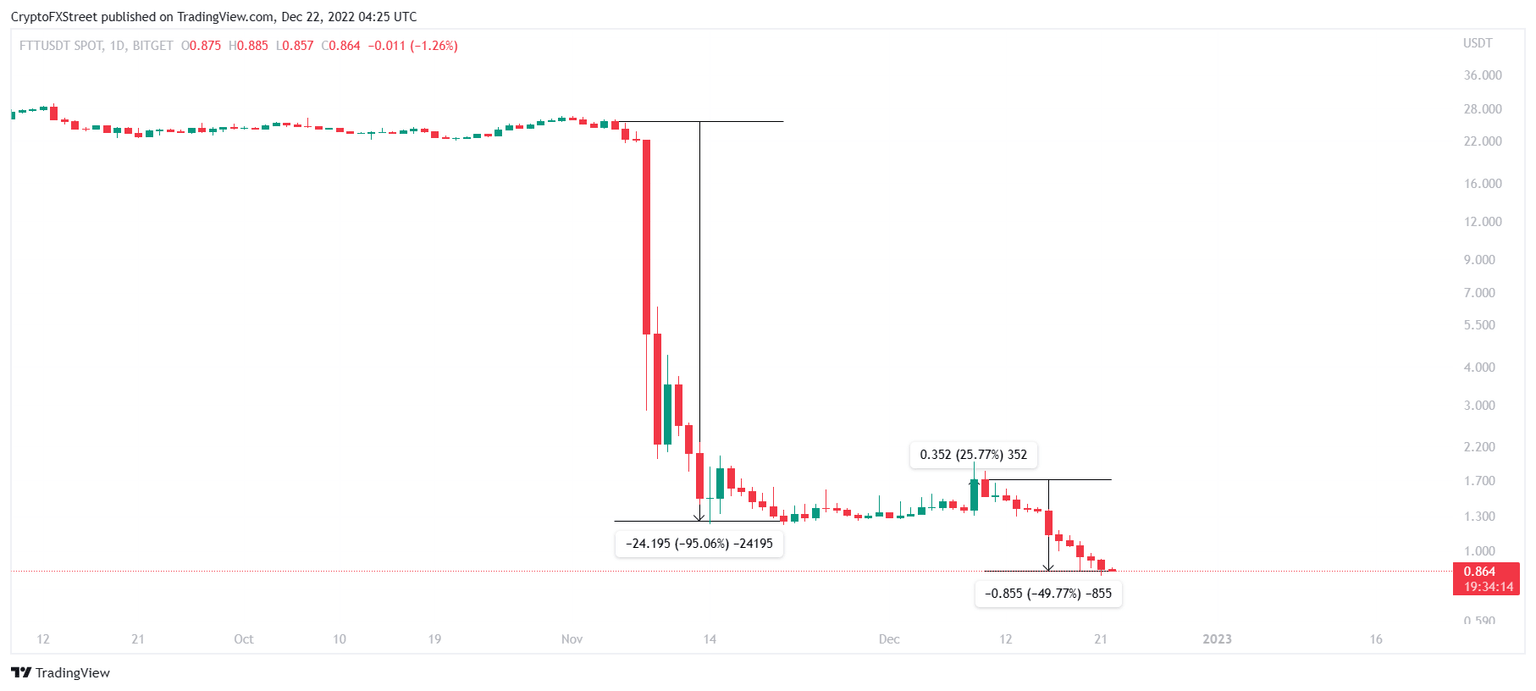

- FTT price continues to establish new all-time lows after losing more than 50% of its value in the last two weeks.

FTX collapse had a huge contribution from Alameda Research, the exchange's sister company. The use of FTX's customers' funds by the company triggered widespread panic, leading to the liquidity crunch, which eventually resulted in the exchange's bankruptcy. Thus taking the onus of the companies' downfall, both Alameda and FTX executives submitted to law enforcement on December 21.

FTX saga comes closer to its end

FTX co-founder Gary Wang, and Alameda Research's former Chief Executive Officer, Caroline Ellison, pleaded guilty on Wednesday night. Both executives had multiple charges to their name pertaining to fraud, which was accepted by Wang and Ellison.

According to US attorney Damian Williams, both executives are cooperating, although specific charges against both of them were not revealed. According to the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), both Ellison and Wang were engaging in fraudulent schemes.

Gary Wang has been alleged to create features in the code of the FTX trading platform. This enabled Alameda to maintain an unlimited line of credit on the exchange. On the other hand, Caroline Ellison was alleged to have manipulated the price of FTX's native token, FTT, in addition to fraud.

Although further details are yet to surface, Attorney Williams was noted saying that this is not the end yet. The investigation is ongoing, and the public can expect more announcements from law enforcement.

The admittance of Wang and Ellison came days after FTX founder Sam Bankman-Fried was arrested by Bahamian authorities. After considerable back and forth, Bankman-Fried has finally been placed in the custody of the Federal Bureau of Investigation (FBI) and is being extradited back to the United States.

FTT price paints new lows

FTX's ongoing debacle has resulted in a further decline in the value of FTT price as the token slumped to trade below the $1 mark. Currently changing hands at $0.864, FTT fell by almost another 50% this week.

FTT/USD 1-day chart

This marked a new all-time low for the cryptocurrency, and as the investigation against FTX and Alameda executives develop further, FTT should keep establishing new lows. The broader market cues are not going to be of any help either since the crypto market is currently noting bearish developments.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.