A list of things that need to happen for Bitcoin price to reach $25,000

- Bitcoin price is retracing after a rejection off the 200-week SMA at $22,486.

- Investors can expect this pullback for BTC to bounce off the $20,726 to $19,284 demand zone.

- A daily candlestick close below $18,608 will invalidate the bullish thesis.

Bitcoin price shows an interesting outlook that could help swing traders and long-term investors make crucial decisions. A retracement followed by a bounce off a significant area could trigger a bullish move for BTC.

Bitcoin price and the impossible

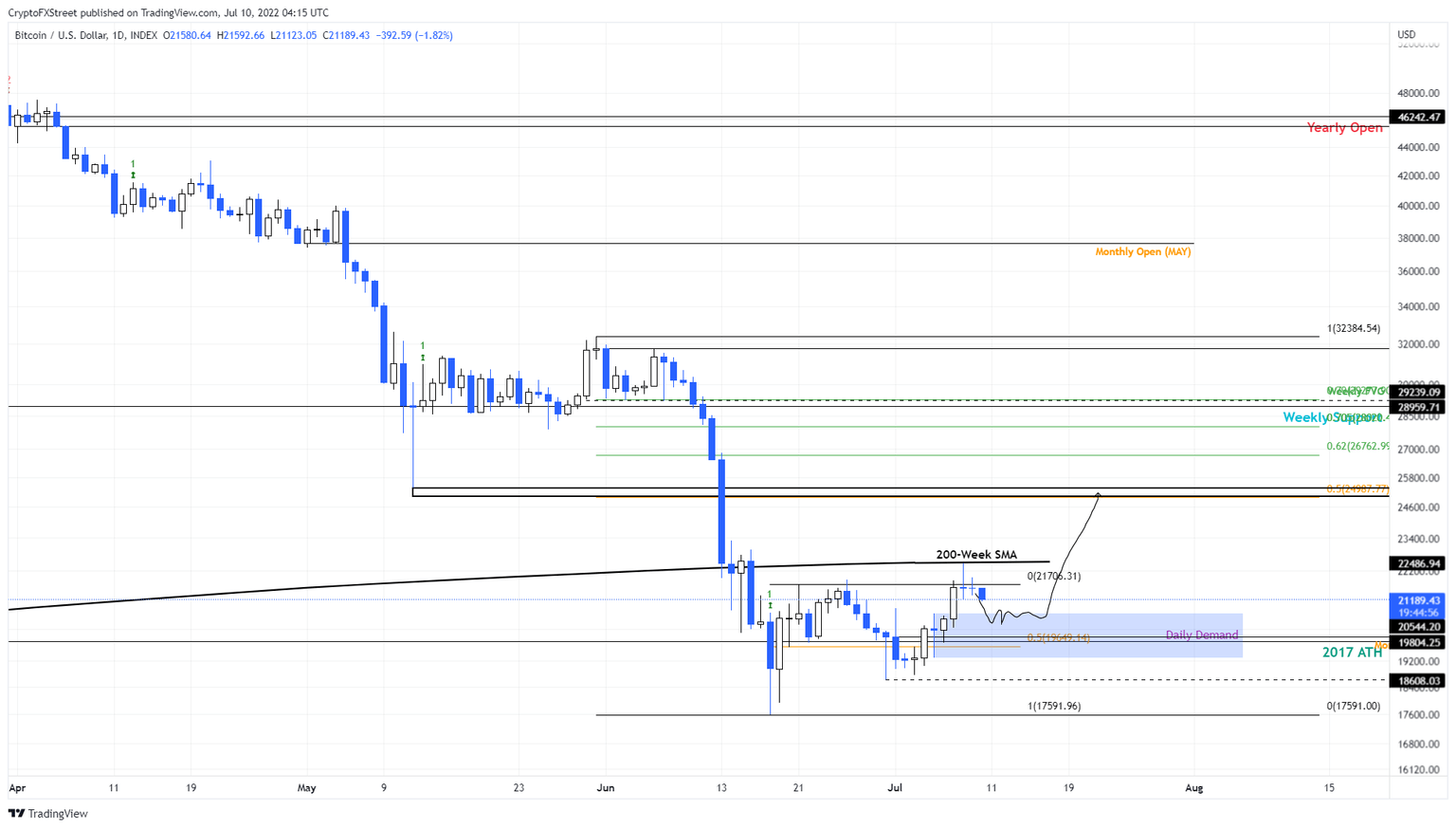

Bitcoin price retested the 200-week Simple Moving Average (SMA) on July 08, making it the first time since the initial flip below it on June 16. The rejection is likely to knock the big crypto down to the $20,726 to $19,284 daily demand zone.

This area was key in pushing the Bitcoin price above the range high at $21,706. Hence, a retest of this demand zone could trigger another leg-up, but this time, it could breach the 200-week SMA.

Assuming BTC bulls manage to overcome this hurdle and flip it into a support level, it will allow the Bitcoin price to swiftly rally toward the $24,987 barrier. This level is the midpoint of the range, extending from $32,384 to $17,591 and is likely where the upside is capped.

In total, this move would constitute a 20% ascent for Bitcoin price from its current position at $20,726.

BTC/USDT 1-day chart

While the move to $25,000 makes sense from a technical perspective, investors need to note that Bitcoin price has to respect the $20,726 to $19,284 demand zone. Moreover, BTC needs to overcome the 200-week SMA at $22,486.

Rejection at any of these levels that knock Bitcoin price down to produce a daily candlestick close below $18,608 will create a lower low and invalidate the bullish thesis. If BTC takes this one step further and produces a weekly candlestick close below $17,591, it will likely trigger a crash to $15,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.