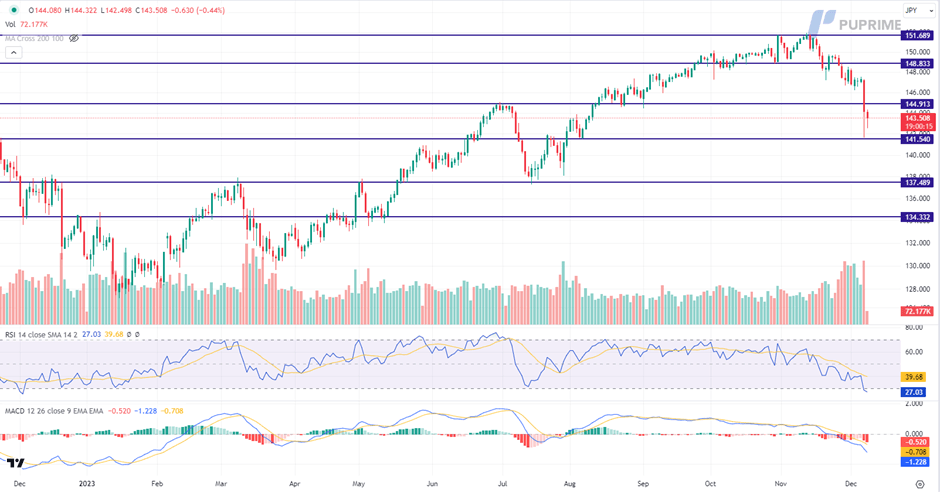

Yen rallies on BoJ hawkish comment

The Japanese Yen staged a robust rally in the previous session, leading to a substantial 2% drop in the USD/JPY pair overnight. This surge in the Yen's value was significantly influenced by statements from BoJ Governor Kazuo Ueda following discussions with the Japanese Prime Minister. Governor Ueda remarked on the exploration of diverse options to navigate the country out of its negative interest rate regime. Economists are increasingly anticipating the BoJ to achieve its inflation target in the near term, speculating a potential end to the ultra-loose monetary policy as early as April next year. Meanwhile, investors are maintaining a vigilant stance as they await the release of the U.S. Nonfarm Payroll data later today. The outcome of this economic indicator will serve as crucial evidence regarding the labour market status, shaping expectations for the Federal Reserve's policy meeting scheduled for next week.

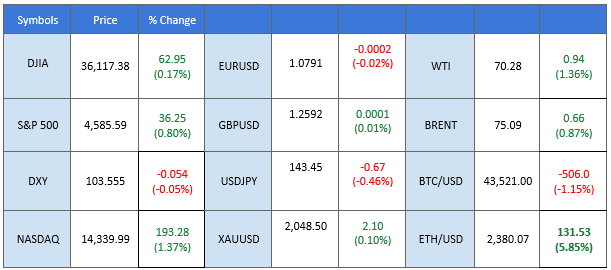

Market overview

Prices as of 03:00 EET

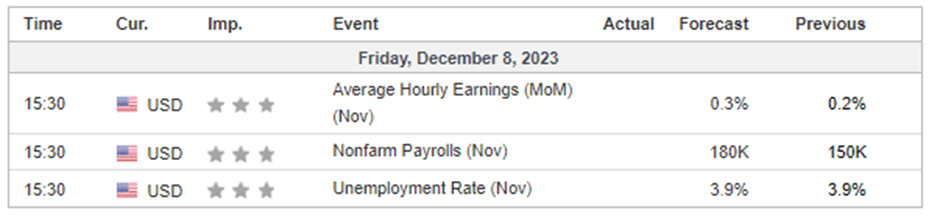

Economic calendar

(MT4 System Time)

Source: MQL5

Market movements

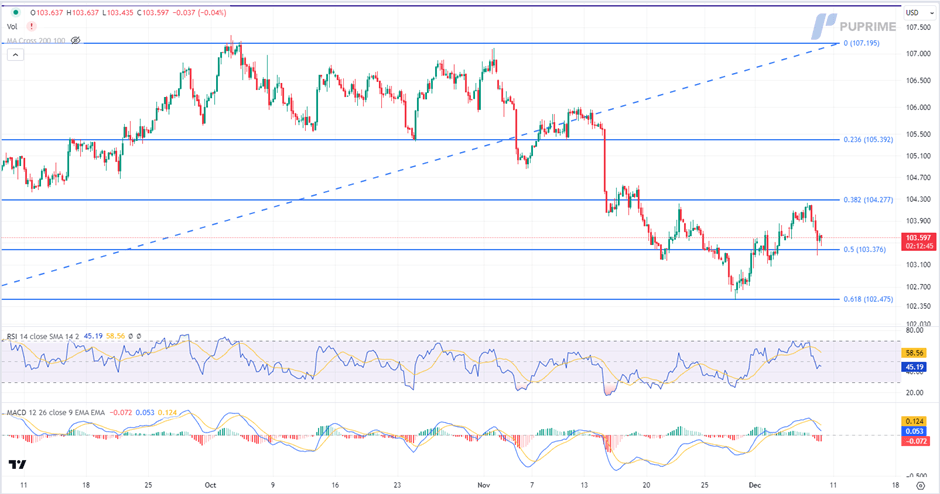

Dollar_Index, H4

The US Dollar continues its decline, influenced by a series of disappointing employment reports that cast a shadow on the upcoming Nonfarm Payroll and Unemployment rate data. Early-week data, including JOLTs Job Openings and ADP Nonfarm Employment Change for November, falls short of market expectations. The string of bearish reports adds uncertainty to the market ahead of the highly anticipated Nonfarm Payrolls release later in the week.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 104.25, 105.40.

Support level: 103.40, 102.50.

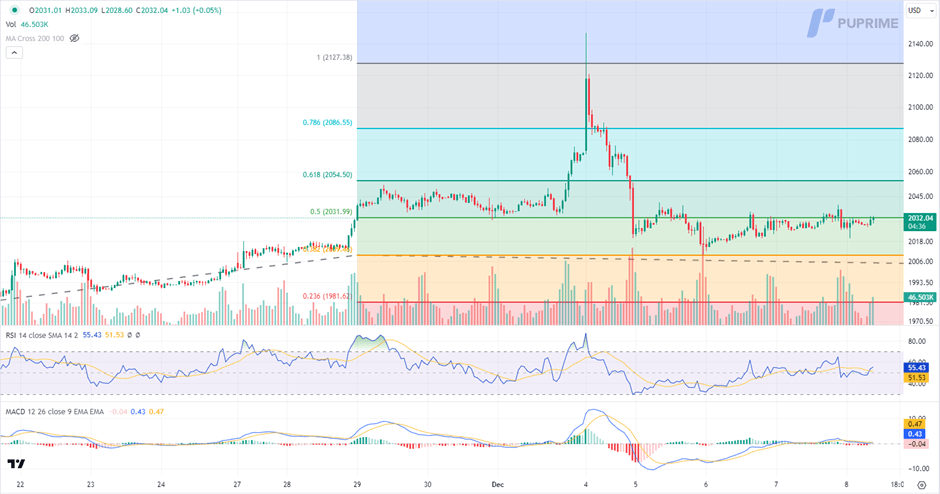

XAU/USD, H4

Gold prices exhibit a modest increase as a pessimistic economic outlook in the US prompts heightened demand for the safe-haven asset. Despite remaining relatively flat, gold sees a modest uptick, reflecting investor concerns over the economic uncertainties emanating from the region. Investors are advised to continue monitoring the crucial US jobs report, which is due to release later today to gauge the likelihood movement for the gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 55, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 2030.00, 2050.00.

Support level: 2010.00, 1980.00.

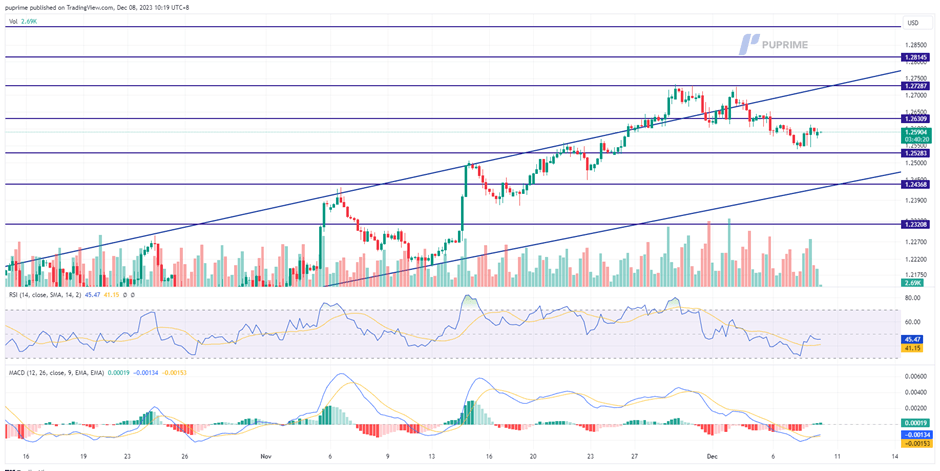

GBP/USD, H4

The British Pound saw a modest uptick against the U.S. dollar in anticipation of the upcoming Nonfarm Payroll data, scheduled for release later today. Traders are strategically positioning themselves, eagerly awaiting additional evidence that supports the notion of a cooling labour market in the U.S., fueling speculation that the Federal Reserve might initiate rate cuts in the coming year. Concurrently, traders in the Cable market are exercising patience as they look forward to the Bank of England's (BoE) interest rate decision next week, recognizing the significance of both domestic and international factors shaping the currency's trajectory.

The Cable is poised above its near support level at 1.2530 ahead of the crucial economic event later today. The RSI continued to flow at the lower region while the MACD maintained below the zero line, suggesting that the bearish momentum remains.

Resistance level: 1.2631 1.2729.

Support level: 1.2530, 1.2437.

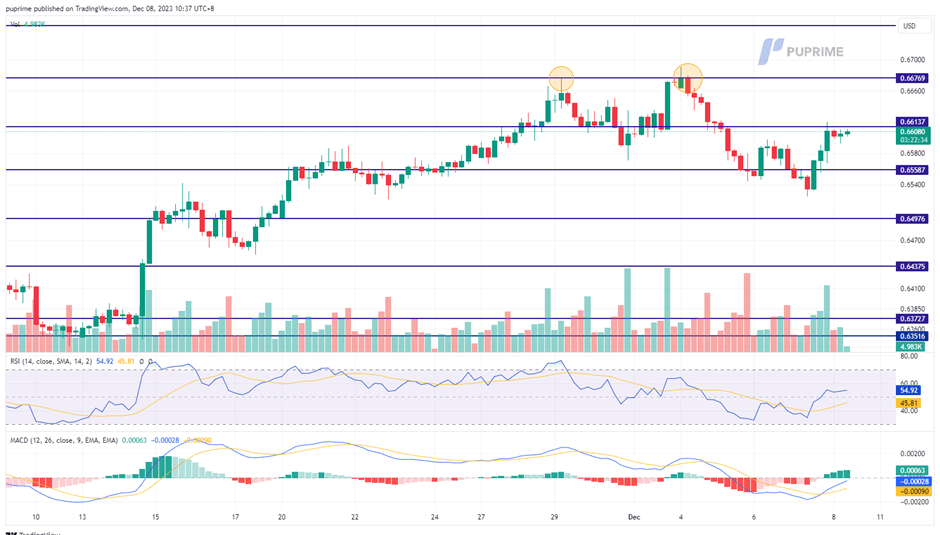

AUD/USD, H4

The AUD/USD experienced a rally in the previous session, propelled by a weakening U.S. dollar in the lead-up to the pivotal job data release. Market participants are eagerly anticipating further evidence that would substantiate the notion of a cooling U.S. labour market, potentially paving the way for Federal Reserve considerations of rate cuts in the upcoming year. Additionally, the Australian dollar found support in better-than-expected trade data from China, indicating a positive trajectory for the Chinese economy and contributing to the strength of the Aussie dollar.

The AUD/USD pair found support at near 0.6535 level and is currently hindered by its near resistance level at 0.6615 level. The RSI has surged while the MACD is approaching the zero line from below, suggesting that the bearish momentum is drastically drained.

Resistance level: 0.6615, 0.6677.

Support level: 0.6560, 0.6500.

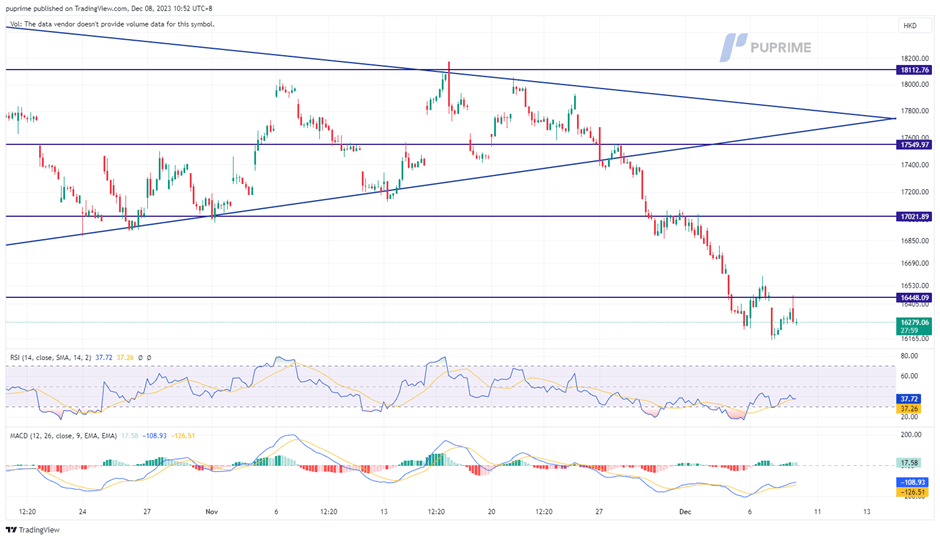

HK50, H1

The China index faced significant headwinds due to the lacklustre economy, and market sentiment soured further following Moody's credit rating cut for China earlier this week. The Hang Seng Index, in particular, could not maintain its critical psychological support level at 17,000 and is currently grappling at its one-year low. Traders are now in a wait-and-see mode, anticipating China's Consumer Price Index (CPI) reading scheduled for the weekend. This key economic indicator is expected to provide valuable insights into the current economic status in China, guiding market participants as they navigate the challenges posed by recent developments.

The Hang Seng index is trading in a strong bearish momentum and is strongly suppressed below its psychological level at 17000. The RSI has been flowing near the oversold zone, while the MACD flowing flat below the zero line suggests that the bearish momentum remains strong.

Resistance level: 17020.00, 17550.00.

Support level: 15880.00, 15290.00.

USD/JPY, H4

The Japanese yen sees a substantial boost, reaching a three-month high against the US Dollar, as Bank of Japan Governor Kazuo Ueda and a deputy signal a potential end to the negative interest rate regime. The hawkish tone prompts a significant move in Japanese bond yields, with market participants swiftly pricing in expectations for a policy shift this month.

USD/JPY is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 27, suggesting the pair might enter oversold territory.

Resistance level: 144.90, 148.85.

Support level: 141.55, 137.50.

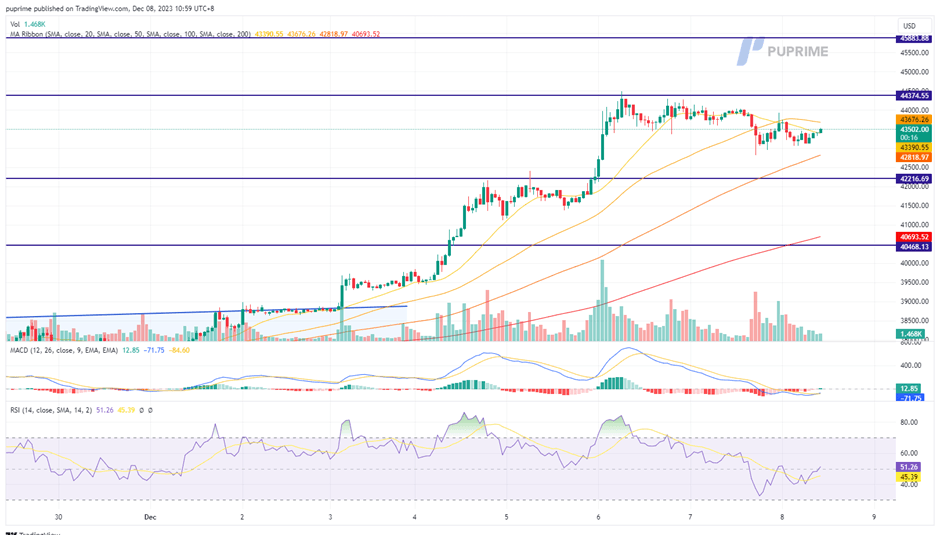

BTC/USD, H4

Bitcoin options open interest surged to a remarkable $20.5 billion in the first week of December, setting a new record and signalling substantial involvement from institutional investors in trading activities. With the looming deadline for the SEC to make a decision on a Bitcoin Exchange-Traded Fund (ETF), participants in the crypto market are strategically positioning themselves ahead of this crucial regulatory event.

The BTC prices have traded sideways since Wednesday and are awaiting for a catalyst to continue its bullish run. The RSI has declined to near the oversold zone while the MACD has broken below the zero line, suggesting the bullish momentum has drastically diminished.

Resistance level: 44370, 45880.

Support level: 42210, 40460.

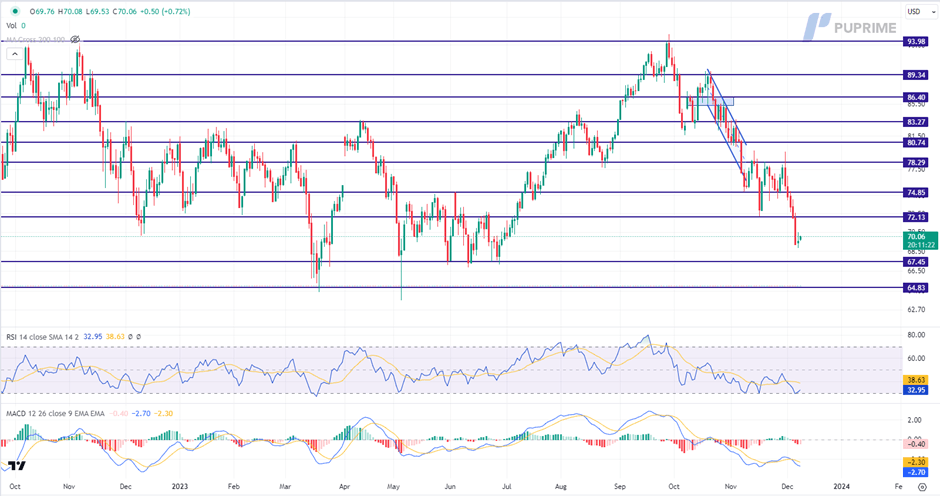

CL Oil, H4

Oil prices face downward pressure, hitting a six-month low amid mounting uncertainties in the global economic landscape. A persistent lack of confidence, exacerbated by concerns over China's economic slowdown, has curtailed any upward momentum from prior OPEC production cuts. Despite attempts to balance the market, the relentless surge in US oil output, maintaining levels over 13 million barrels per day, intensifies the bearish sentiment.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the commodity might enter oversold territory.

Resistance level: 72.15, 74.85.

Support level: 67.45, 64.85.

Author

PU Prime team

PU Prime

PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities, Indices, Share CFDs and Bonds.