Yen jumps as BoJ’s Ueda hints at rate hike

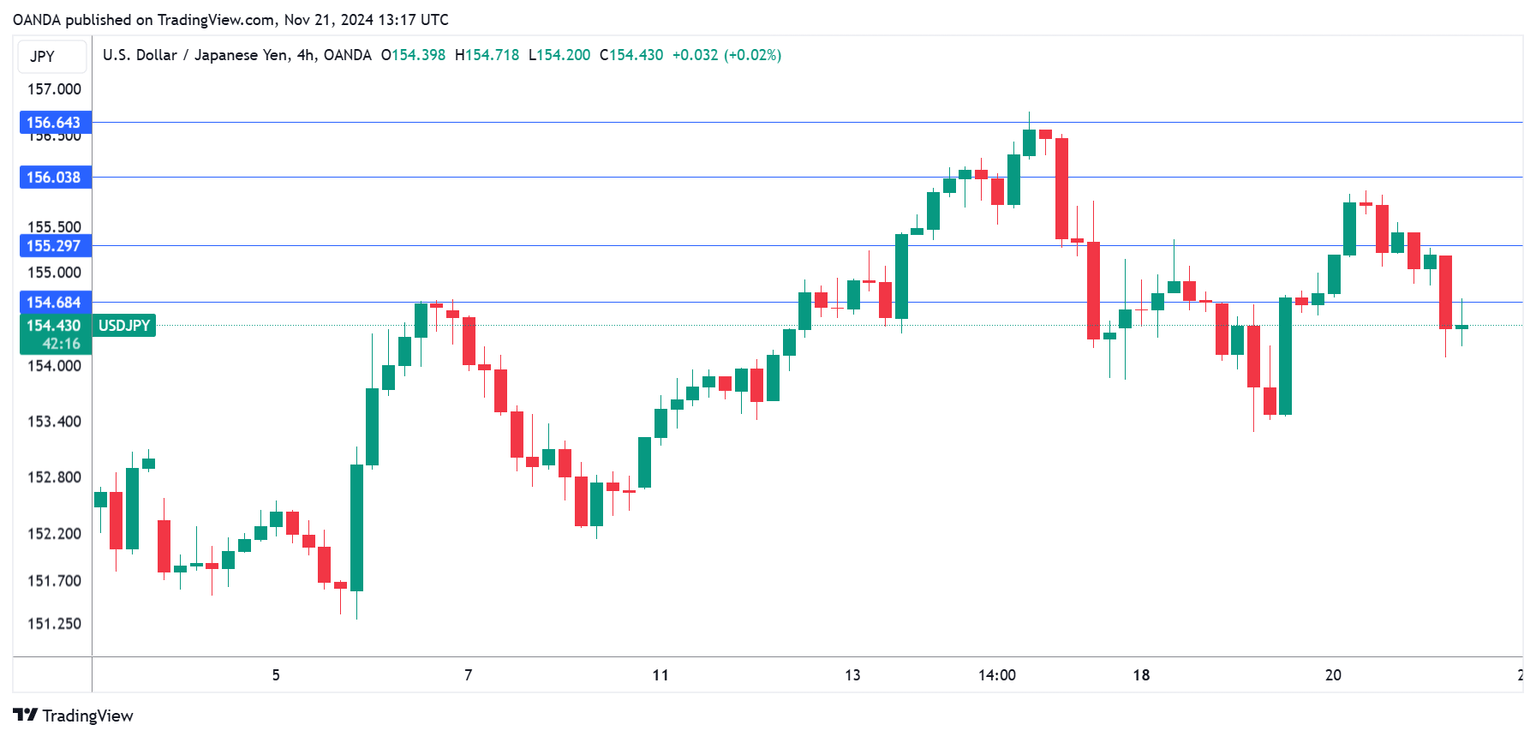

The Japanese yen has posted strong gains on Thursday. In the European session, USD/JPY is trading at 154.34, down 0.70% on the day.

Ueda says rate decision will depend on data

Bank of Japan Governor Ueda’s remarks are always closely monitored and often move the financial markets. That was the case today as the yen has posted sharp gains after Ueda’s comments at an event in Tokyo today. Ueda said that the BoJ would make its rate decisions “meeting by meeting” on the basis of the information available. Those comments certainly weren’t eye-opening, but Ueda also said that the BoJ would “seriously” review the impact of exchange rates on inflation and the economy and noted the yen’s sharp swings.

The markets viewed Ueda’s remarks as a hint of a possible rate hike at the Dec. 19 meeting. The BoJ raised rates in July, partly in response to the weak yen. The central bank has often voiced concern about sharp movement from the yen and could hike again as early as December in order to boost the wobbly Japanese currency.

The rise in inflation has hurt Japanese households and the coalition government is set to approve a massive $140 billion stimulus package to provide some relief. Prime Minister Ishiba is trying to stay in power with a fragile minority government and will need the opposition’s agreement to pass the bill. The spending bill will raise the already huge government debt and an interest rate hike would raise the cost of servicing the debt.

USD/JPY Technical

-

USD/JPY has pushed below support at 155.28 and is testing support at 154.68.

-

1.5604 and 1.5664 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.