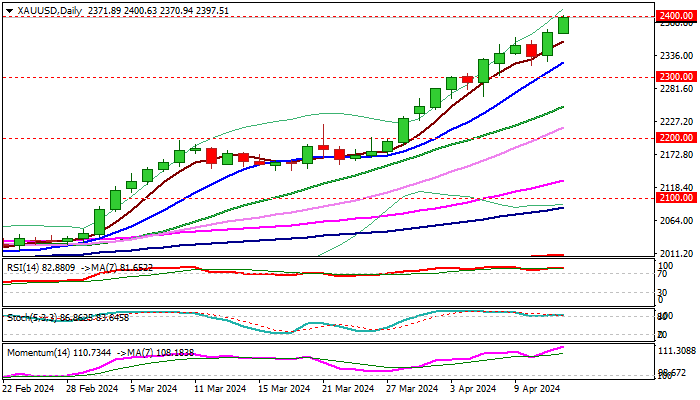

XAU/USD outlook: Gold hits new record high

XAU/USD

Gold climbed to new all-time high on Friday and cracked psychological barrier at $2400, remaining at a high speed and again taking just few days for a trip from one to another round-figure barrier.

Growing geopolitical tensions continue to fuel safe haven demand, particularly purchases by the central banks and lift metal’s price, offsetting negative influence from solid US economic data and stronger dollar on colling expectations for Fed’s first rate cut in June.

The yellow metal is on track for the fourth straight weekly gain and holding in a steep ascend for the second month, advancing by impressive 16% since the beginning of the year.

Technical picture remains bullish, as strong positive signal has been generated after the metal’s price broke above larger range (2020/2024), indicating continuation of broader uptrend.

Bulls are expected to keep control in coming months in favorable conditions for safe haven bullion, with next significant target at $2500, coming in focus.

Dips, under current circumstances, should be limited and provide better buying levels

Res: 2400; 2411; 2428; 2440.

Sup: 2370; 2358; 1324; 2300.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.