XAU/USD Outlook: Gold accelerates higher on fresh risk aversion

GOLD

Spot gold advanced 0.7% in Asia/Europe on Tuesday and holding at session high at $1475 (the highest since 20 Nov) in early US session.

The yellow metal rallies on weaker dollar after downbeat US manufacturing data and fresh uncertainty over US/China trade conflict.

President Trump said today that there is no deadline and final deal could be delayed until US presidential election in Nov 2020 that prompted traders into safe havens.

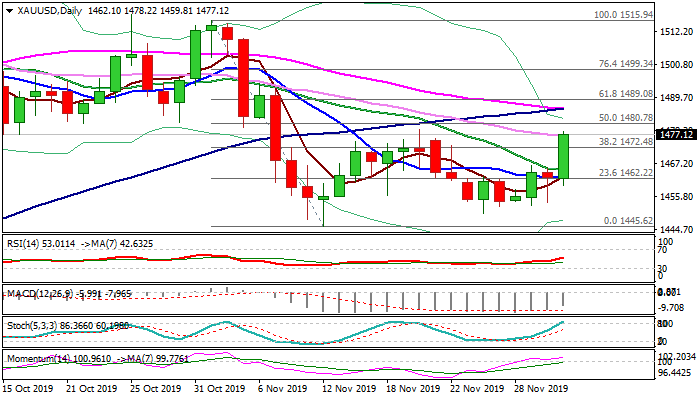

Today's rally broke above important Fibo barrier at $1472 (38.2% of $1515/$1445 descend and pressures pivotal resistances at $1478/80 (20 Nov high/daily Kijun-sen), break of which is needed to confirm reversal. Rising bullish momentum and RSI add to positive tone on improved sentiment for further advance, but bulls may face headwinds on overbought stochastic. Adjustment may interrupt bulls and offer better levels to re-enter bullish market while holding above broken Fibo barrier at $1472.

Extension and close above $1480 would focus $1489 (Fibo 61.8% of $1515/$1445) and unmask daily cloud base ($1498).

Res: 1478; 1480; 1485; 1489

Sup: 1472; 1468; 1465; 1462

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.