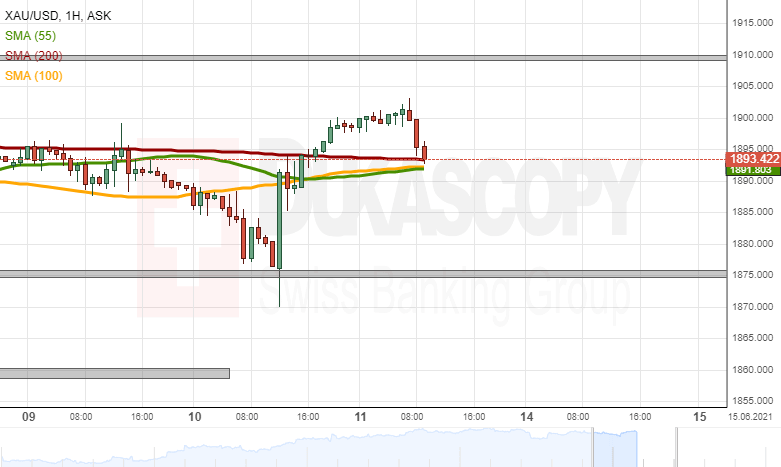

XAU/USD analysis: Potential target at 1915.00

XAU/USD

The XAU/USD exchange rate bounced off a support level at 1875.00 on Thursday. As a result, the yellow metal surged by more than 245 pips or 1.31% against the US Dollar during yesterday's trading session.

By and large, the commodity could continue to edge higher during the following trading session. Bullish traders might drive the price towards the 1915.00 level.

However, buyers are likely to encounter resistance at the 1905.00 area within the following trading session.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.