WTI Oil settles higher again, but will it break the range? [Video]

![WTI Oil settles higher again, but will it break the range? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-flows-out-of-barrel-20436219_XtraLarge.jpg)

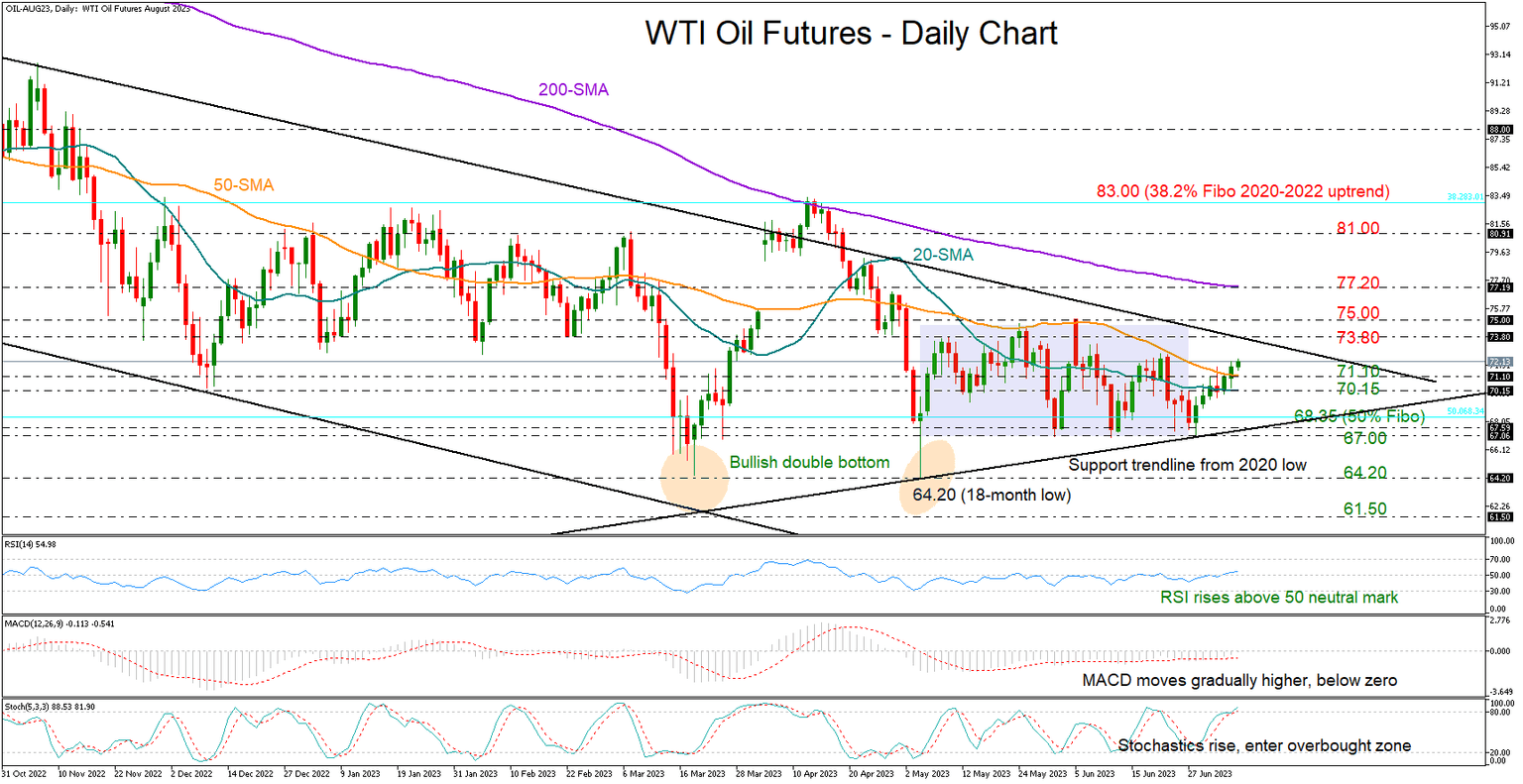

WTI oil futures are again targeting the upper boundary of the almost one-year-old bearish channel seen at 73.80, having pivoted for the fifth time around the 67.00 floor last week.

Previous attempts were unsuccessful, and another failure cannot be ruled out as the stochastic oscillator is entering the overbought territory and the MACD remains subdued around its zero and signal lines. That said, the odds for a bullish breakout seem to be higher now as the RSI is marking new higher highs above its 50 neutral mark and the price itself has closed slightly above its 50-day simple moving average (SMA) for the first time since the end of April.

The 73.80-75.00 zone is currently under the spotlight. If the bulls knock down that border, the 200-day SMA could be the next threat at 77.20. A break above that line is required to brighten the short-term outlook and bolster buying appetite towards the tough 81.00-83.00 resistance region. Another victory there would upgrade the medium-term picture, likely lifting the price straight to 88.00.

In the event the price slides below its 20-day SM at 70.00, the focus will again turn to the 68.35-67.00 region. The 50% Fibonacci retracement of the 2020-2021 uptrend and the support trendline from the 2020 lows make this area important to watch. Hence, a correction lower could intensify selling forces, pressing the price towards its spring lows around 64.20. If the bears breach the 62.00-61.50 floor from 2021 too, then the door will open for the 57.50 handle.

All in all, WTI oil futures retain a neutral short-term outlook, with traders waiting for a close above 73.80-75.00 or below 67.00 to direct the market accordingly.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.