WTI Oil futures pick up negative vibes [Video]

![WTI Oil futures pick up negative vibes [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-flows-out-of-barrel-20436219_XtraLarge.jpg)

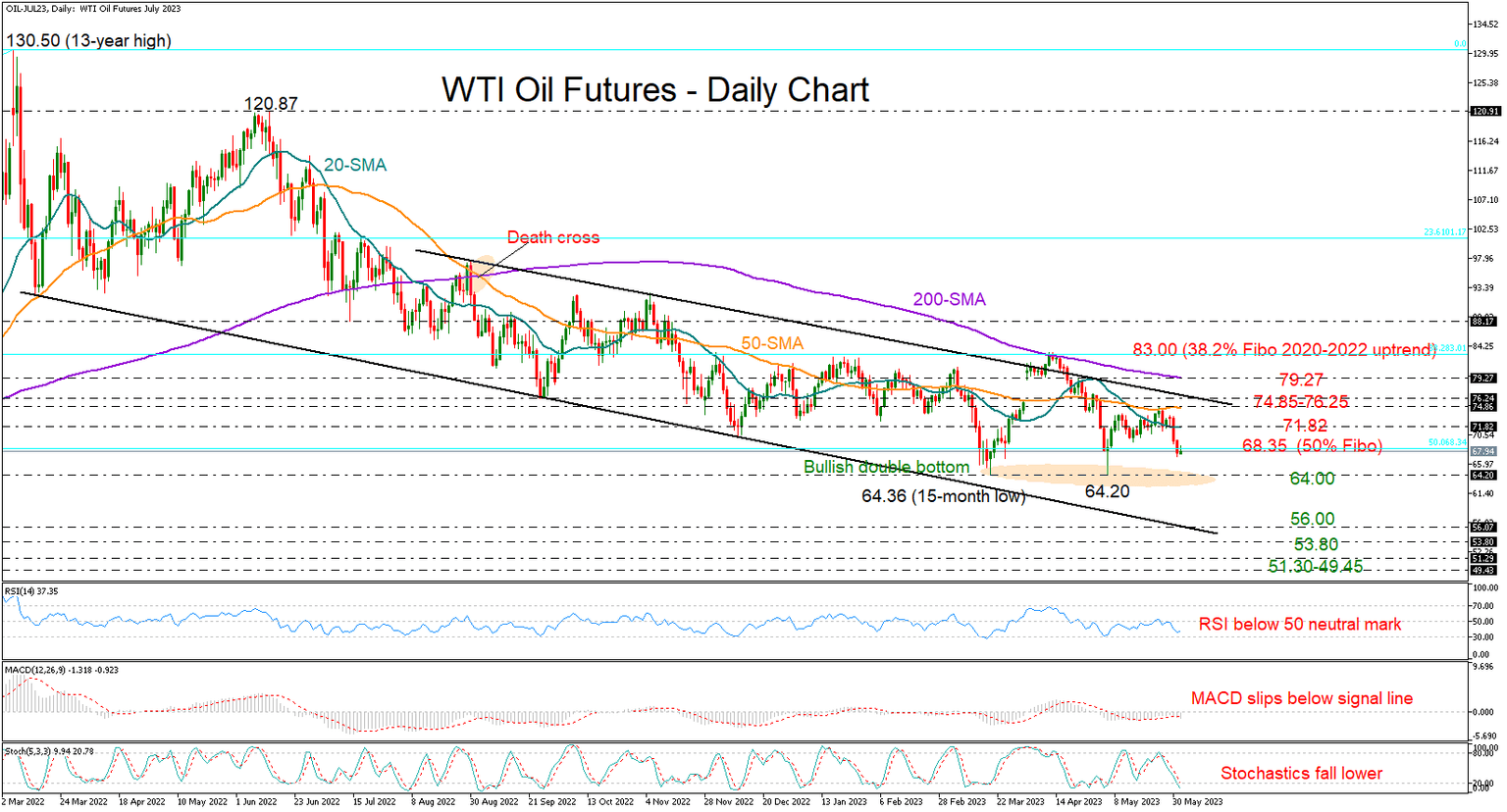

WTI oil futures registered their largest monthly decline since November 2021 in May, closing marginally below the 68.35 base, which had been acting as a buffer to downside movements since mid-March.

The price is currently struggling to climb back above that threshold of 68.35, with the technical indicators reducing the odds for a significant bullish breakout. The RSI has resumed its negative momentum, falling back into the bearish zone. Likewise, the MACD has slipped below its red signal line and the stochastic oscillator has extended its decline, warning of a resumption of selling appetite.

Nevertheless, hopes for an upward trend reversal will not fade away if the price manages to create a triple bottom pattern around the March-April base of 64.00. Should that floor collapse, the bears could aggressively drive towards the channel’s lower boundary, seen around 56.00. The former resistance zone of 53.80 may next attract interest, while the 51.30 area has been a strong support and resistance zone for more than a decade and could be an important area to watch ahead of the 49.45 level.

On the upside, the bulls will need to rally decisively above the channel and the 200-day simple moving average (SMA) in order to eliminate downside risks and create optimism for an upside trend reversal. A continuation above the 38.2% Fibonacci of 83.00, where the price peaked in April, could activate fresh buying orders, likely up to 88.00.

In brief, WTI oil futures are picking up some bearish vibes as the price is facing resistance around 68.35. Failure to overcome that bar could see a plunge towards the 2023 floor.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.