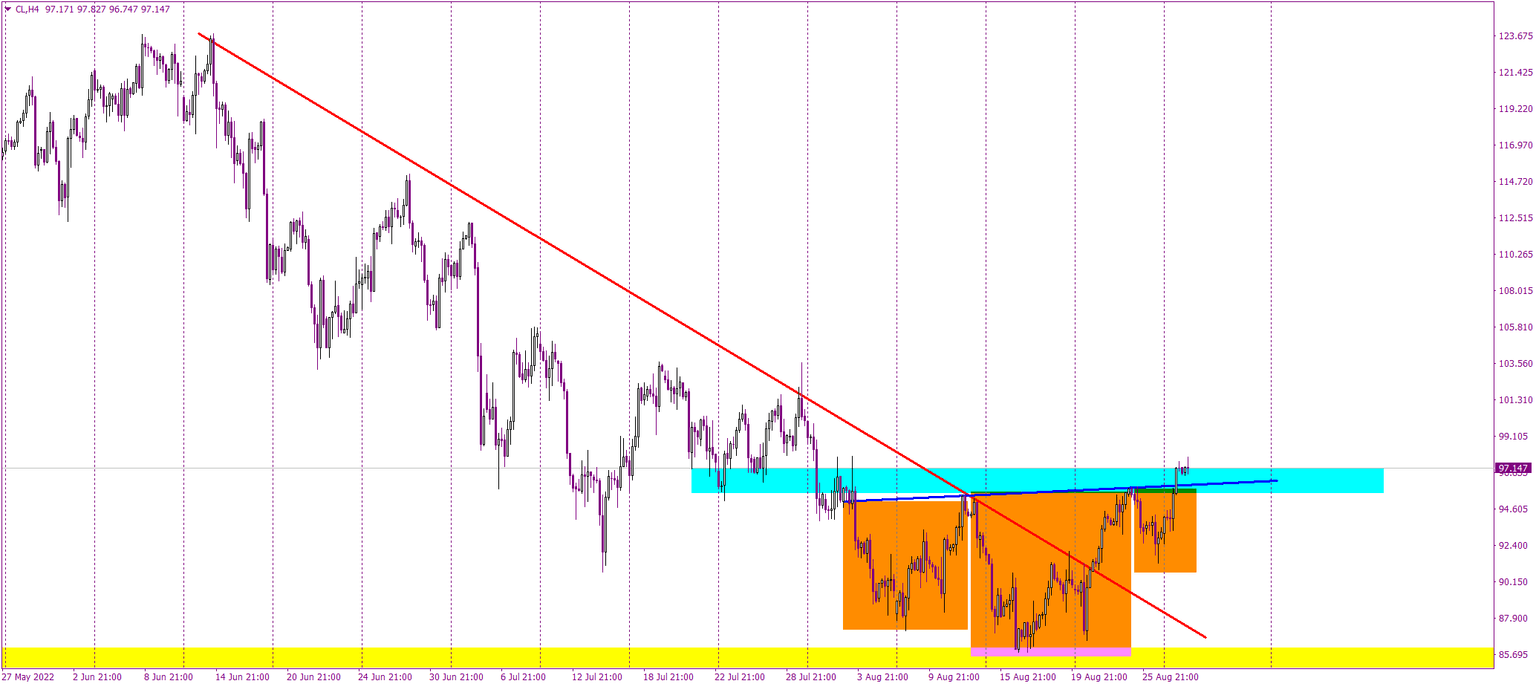

WTI climbs higher after breaking the neckline of the inverted head and shoulders formation

Oil is on the run and the upswing is heavily supported by an excellent bullish technical situation on the chart. The buy signal is still fresh as it comes from yesterday, so there’s still a lot of room for buyers to extend the rise.

In the middle of August, WTI bounced off the support on the 86 USD/bbl, which was a local top in October and November last year. The bounce was not random as the price created and inverse head and shoulders pattern (orange), which is a very reliable price action formation. Oil broke the neckline of the pattern (blue) yesterday and that technically, gives us a proper buy signal. A few days before, on the 22nd of August, buyers managed to break the down trendline (red), which should also be considered as a positive factor.

Today, after the breakout of the neckline, the price is continuing to climb higher, targeting August highs. In my opinion, a buy signal is fully ON as long as the price stays above the neckline of the inverted head and shoulders pattern.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.